XM, an online broker, offers a wide variety of trading options. CFDs for currencies, precious metals and energies are all available through the platform. CFDs on stocks and exchange traded funds are also available. With over a million users, XM is one of the world's most popular brokers.

XM is a European registered broker. It is licensed by the International Financial Services Commission (IFC) and the Cyprus Securities and Exchange Commission (CySEC). XM also has a subsidiary, XM Global Limited. This subsidiary is licensed by Australian Securities and Investments Commission. XM has a presence in more than 190 countries worldwide.

XM offers a variety accounts to suit different trading needs. These accounts include Standard and Micro accounts. These types have both low minimum deposit amounts as well as leverage. In addition, XM provides a demo account. XM also provides a free virtual server service that can be accessed anywhere in the world.

Traders can withdraw money using MasterCard or Visa, Skrill and Neteller from their XM bank account. XM also accepts Payoneer. For XM to open an Account, you will need to provide accurate and current information. This includes proof that you are a person and your address. XM's websites offer multi-factor authentication to safeguard customer data.

XM offers a wide range of educational resources on its website. Users can watch webinars on various topics. XM also provides daily market analysis as well as trading signals. Several tutorials are available to learn more about the broker's platforms. XM also has a manual trading signals tool. This includes information on some of the most common tradable instruments.

Spreads for XM brokers are lower than other brokers in their industry. For example, the average spread for the major currency pairs is 0.1 pips. However, the spreads vary by account. Floating spreads enable clients to avoid high spreads and ensure that they receive the lowest prices.

Unlike many brokers, XM does have a zero commission policy. A deposit fee may be charged by a broker who is more competitive. Keep in mind, however, that broker fees will vary depending upon how you pay. Ultimately, the amount you are charged for transferring money to a broker will have to be weighed against the overall cost.

XM provides a micro account that requires a minimal deposit of $5. The micro account allows for trades of up to 300 simultaneously and leverages up to 1 to888. XM also provides protection for negative balances.

XM is a global broker with over 1.5 million clients coming from 190 nations. As a result, it has a large network of financial markets around the world. XM also offers its services in multiple languages. XM's website can also be downloaded on Android and Apple phones.

XM is a very popular broker with traders in the United States, Japan, Canada, and other nations. Anyone who resides in these countries should consult the relevant regulations before opening an Account. Some countries require proof of identification to open an account.

FAQ

Which is more difficult, forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

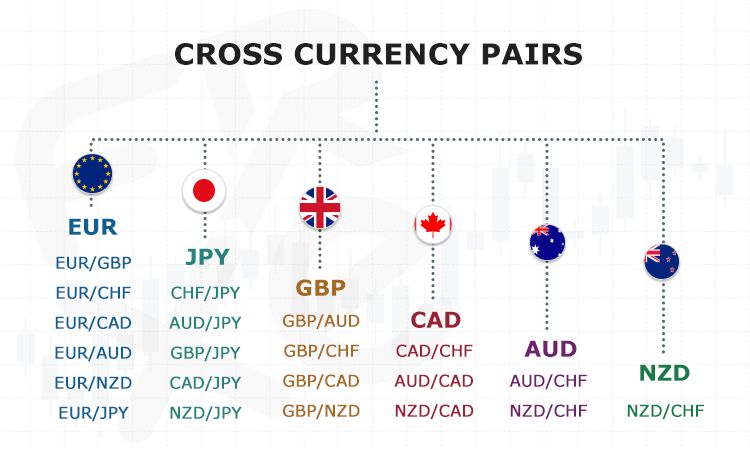

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Is Cryptocurrency a Good Investing Option?

It's complicated. It is complicated. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which trading platform is the best for beginners?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which forex trading platform or crypto trading platform is the best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

Both cases require that you do extensive research before investing. Any type of trading can be managed by diversifying your assets.

Understanding the various trading strategies for different types of trading is important. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it is important that you understand the risks as well as the rewards.

What are the pros and cons of investing online?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

Online investing is a risky venture. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

You must be mindful of who your investment platform or app is dealing with. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Research the background of any companies or individuals you work with before transferring funds or providing any personal data.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

It is important to ensure that only trustworthy people have financial access to your accounts. Make sure you delete old bank apps from all devices, and change passwords every few weeks if necessary. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. You should also use different passwords to protect each account from being compromised. Last but not least, make sure to use VPNs when investing online. They're often free and easy!