NVIDIA, a technology company, manufactures and sells graphics processor units (GPUs). These high-performance processors are used to create realistic looking graphics. These processors are well-known for their ability to handle complex tasks such as machine learning. The company is also an expert in artificial intelligence and cloud computing. Santa Clara is the headquarters.

Since it was founded, NVIDIA has become a leading provider of high-end graphics processing units. It sells GPUs to gaming and other industries as well as the general public. Although initially it was a maker of video cards it has since expanded its offerings into high-performance computing and artificial intelligence. Its primary business is making graphics cards for consumers. The company has also made key acquisitions to increase its product range.

NVIDIA competed against Matrox, ATI Technologies, as well as other computer chip companies, for market share of the GPU market in the 1990s. NVIDIA acquired 3dfx Interactive's assets in 2000. NVIDIA was developing the RIVA, GeForce and GeForce series graphic processors. The GeForce 256 GPU became a leading graphics chip, gaining a reputation of being the best. The GeForce 256 was superior in performance due to its 3D graphics capabilities.

NVIDIA's focus in the early 2000s was on the increasing demand for GPUs that are used in AI. The company invented the CUDA programming languages, which allow programmers to use the GPUs' processing power through direct programming. This allows developers and programmers to develop massive parallel programs that run high-performance floating points processes. NVIDIA GPUs are being used by many computer scientists and researchers for machine learning.

In addition to its core line of GPUs, NVIDIA also has a line of supercomputers, called DGX. These machines come with GPU hardware and deep learning. In 2016, the company launched its first DGX series.

It has made numerous investments in AI and cloud computing. Its products are also used by the automotive, professional visualization, gaming, and other markets. The company also offers mobile processors and tablets for smartphones and tablets.

While the company is focused primarily on graphics processing unit, it recently began to expand into mobile-specific CPUs. Earlier this year, NVIDIA announced a plan to buy UK chip designer ARM for $40 billion in September 2020.

The company has faced many challenges over the years, including the rise in Intel and AMD. NVIDIA's supply chain has also been affected by disruptions. But the company has found a way to overcome these challenges. It recently diverted ninety per cent of its waste from landfills during a major construction project.

NVIDIA released a number of data center technologies in addition to its GPUs. Nvidia Spectrum, one of these technologies, is among them. The Spectrum, which is designed to support the next-generation Ethernet platform and contains a ConnectX-7 SmartNIC (data center infrastructure software) and DOCA (data center automation software). These products provide data center security that is highly effective.

FAQ

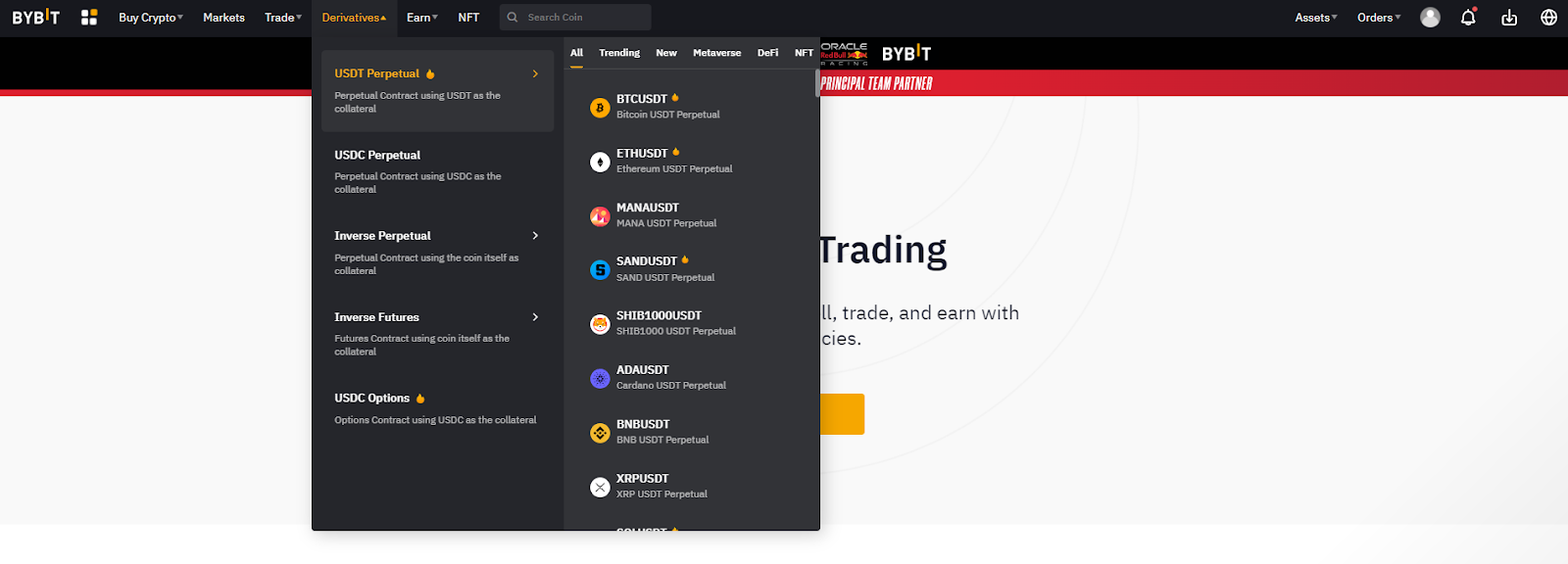

Which trading platform is the best?

Choosing the best trading platform can be a daunting task for many traders. With so many different platforms to choose from, it can be hard to know which one is right for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down your search to find the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which is more difficult, forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which trading site for beginners is the best?

It all depends on your level of comfort with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Where can I find ways to earn daily, and invest?

It can be a great method to make money but it's important you understand all your options. There are many other investment options available.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Frequently Asked questions

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

While money can be confusing, the decision to where it should be stored can be just as complex. There are many options to protect your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?