After hours trading is a trading option that happens outside of normal trading hours. It is open both to institutional and retail investors. However, there are fewer participants than usual during regular market hours. It is therefore more volatile and less liquid. In addition, the spreads tend to be wider. Traders need to use a limit or order when placing a trade.

Even though trading after hours can have risks, there may be some opportunities to profit from this market. This market may offer opportunities that you would not otherwise have access to if you're an experienced trader. When a new product is released or new legislation impacts the company, stocks can be bought or sold. These events can have a major effect on the stock price when the market opens the next day.

Another benefit of trading after-hours is the ability to analyze stocks in depth prior to the market closes. A period of consolidation may be identified before the earnings report is available. You can therefore sell your shares at higher prices than in the regular market. There are no buyers or sellers in the market so you won't necessarily be able to fulfill your order. To limit your cash balance, you can use limit order.

You need to be aware of the risks involved in trading after hours, regardless of the method you use. Investing in stocks is a time-sensitive endeavor, and it is important to be able to react to changes in the market. In the event of liquidity problems, you might not be able to close your positions at a profit. Also, your limit order might be canceled if you don't have the money to fill it by the deadline.

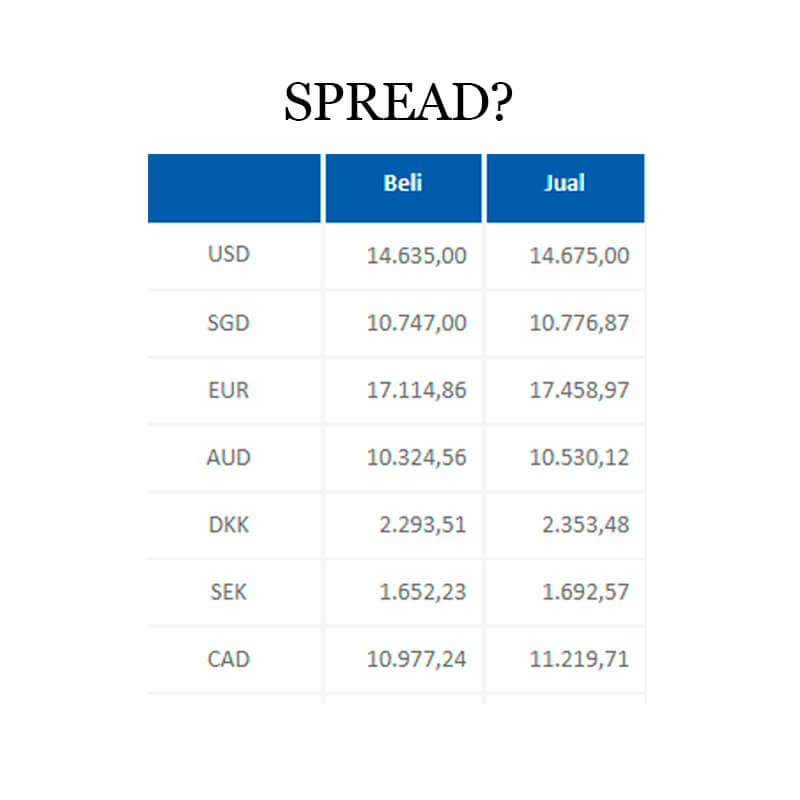

After-hours trading is more risky than regular market. You can only lose a certain amount. It can be more difficult to find a price that suits your needs because the bid-ask spreads are wider than in regular markets. Traders with long positions might be willing to settle for a price that is too low to close out at a loss. Short sellers might not want to pay for a price too high to close their trade.

The possibility of fewer traders trading during the night is another risk. Although there is less volatility due to fewer sellers and buyers, it can make it more difficult to find a price that meets your needs. Even if you are able to find a great price, there is no guarantee you will get it.

You should pay attention to live charts, news, and charting when trading after hours. This will help you spot breakouts and previous performance. Stocks can move more strongly after earnings announcements. This means that you will see greater price fluctuations.

FAQ

Can forex traders make any money?

Forex traders can make a lot of money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Frequently Asked Questions

What are the different types of investing you can do?

Investing can be a great way to build your finances and earn long-term income. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into preferred and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

How Can I Invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. To get started, you only need to have the right knowledge and tools.

You need to be aware that there are many investment options. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. Keep an eye on market developments and news to stay current with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which is more difficult forex or crypto currency?

Both forex and crypto have their own levels of complexity and difficulty. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Trading forex or Cryptocurrencies can make you rich.

You can make a fortune trading forex and crypto if you take a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What precautions can I take to avoid investment scams online?

Protecting yourself starts with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Do not answer unsolicited emails and phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Lastly, always remember "Scammers will try anything to get your personal information". You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

Also, it is important to invest online using secure platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.