There are many good reasons to invest in crypto currencies. They are very affordable to buy. These can be extremely profitable long-term. You can find the best crypto for you by focusing on your investment goals.

The Best Cryptocurrency for Investing in 2021

Some of the best cheap cryptocurrencies to buy are those that can increase in value over time. There are many factors that influence the value of cryptocurrencies, including their technology, team or community, hype, and how they are perceived by others.

1. Dogecoin

DOGE, despite being satirical in origins, has been one of the most sought-after cryptocurrencies and penny tokens. This is due to DOGE's large following, support by influential personalities, as well as the potential for expanding its uses, which were recently announced.

2. Monero

Monero has a large user base and a high market capital. This makes it an attractive choice for investors who are looking for a cheap crypto with privacy features. It is also a great choice for people who want to diversify portfolios.

3. Uniswap

UNI is the local token of Uniswap. It is the largest decentralised exchange in the world. UNI was launched originally as part of the DeFi sector. It is fast and allows for cheap transactions. It has also been designed to support smart contracts, so it is ideal for developers looking to build dApps.

4. Solana

Solana is a decentralized application platform, also known as DApps. Its underlying blockchain is highly scalable and robust, and it has a strong development team.

5. MEMAG

MEMAG, which is selling its tokens at presale prices, is currently the best play to earn cryptocurrency. This makes it a great crypto investment, and its presale will likely sell out quickly.

6. C+Charge

C+Charge can be your penny crypto investment choice. Its upcoming CEX listing is expected to make it one of the fastest-growing cryptocurrencies in the space.

7. THETA

This project has also been successful over the years. It's a good addition to our list of cheap cryptocurrencies that you can purchase in 2021. Its underlying blockchain was specifically designed to provide end-to-end solutions for video streaming, delivery and storage.

8. Ether (ETH).

Ethereum is second in cryptocurrency market capitalization and has had a lot of success in recent years. Because Ethereum was the first cryptocurrency to offer smart contract, it allows developers to create dApps.

9. Basic Attention Tokens, BAT

BAT is a cryptocurrency that will increase in value over time. Its underlying technology is a combination of blockchain and DLT, making it a perfect fit for those who are looking to invest in a future-proof platform. Its ICO has already begun, so now is the best time to grab this opportunity.

FAQ

Which trading platform is the best for beginners?

It all depends on how comfortable you are with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many offer interactive tools to help you understand how trades work.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Can you make it big trading Forex or Cryptocurrencies?

Yes, you can get rich trading crypto and forex if you use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. It is important to trade only with money you can afford to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

How do forex traders make their money?

Yes, forex traders are able to make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which is the best trading platform?

Many traders can find choosing the best trading platform difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. Understanding these factors will help narrow down your search for the best trading platform for your needs.

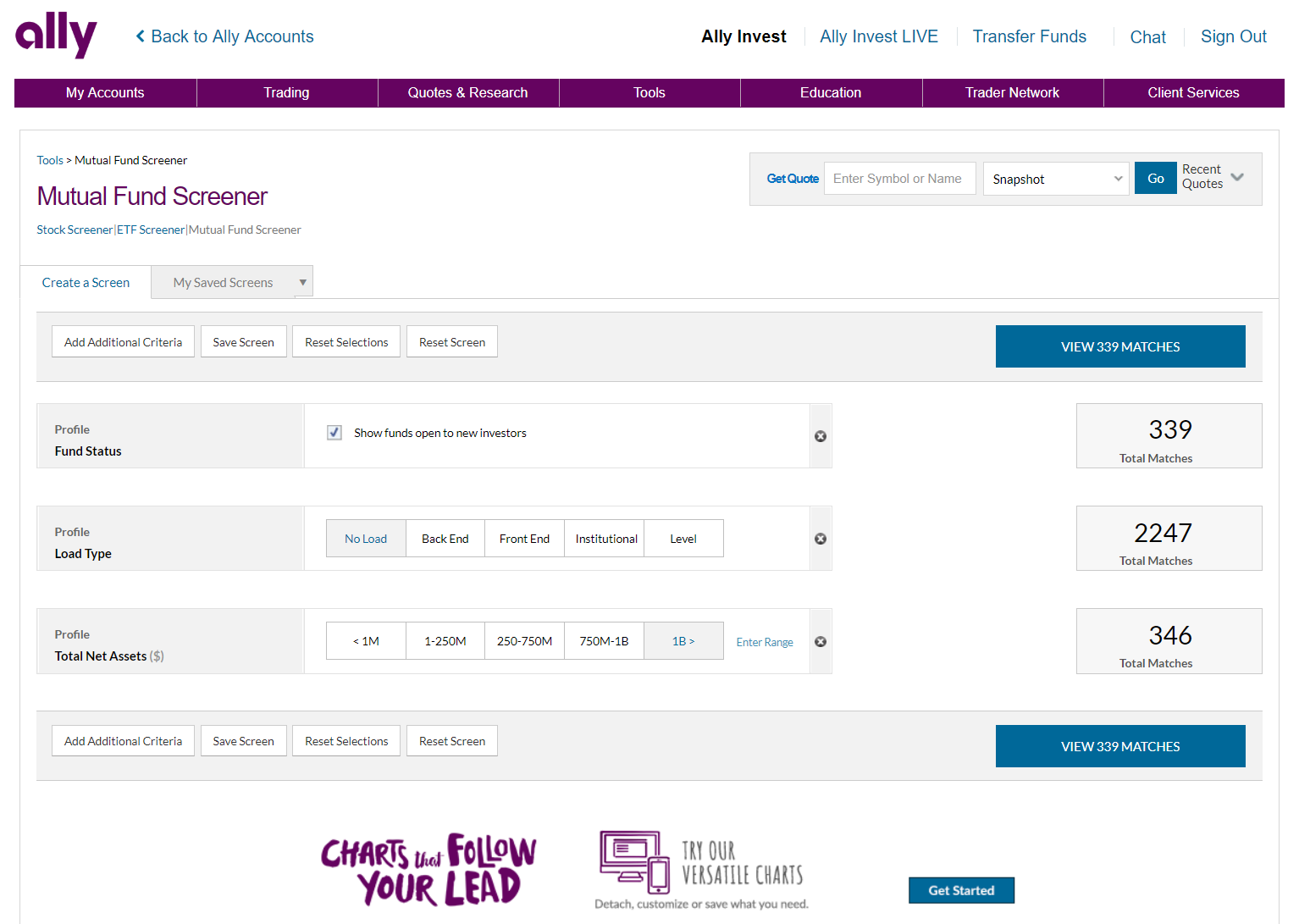

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Where can I earn daily and invest my money?

Investing can be a great way to make some money, but it's important to know what your options are. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to invest in real property. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Frequently Asked Fragen

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protection starts with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Never respond to unsolicited phone calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Never forget that scammers will try any means to steal your personal data. Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

It's also important to use secure online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.