A new digital asset market is emerging are non-fungible tokens, or NFTs. These digital artifacts are created with distributed ledger technology. A non-fungible token is only worth what another person will pay. Many have made millions trading NFTs. However, the industry remains young and subject of volatility. Before you invest, it is important to be familiar with the basics of NFT trading.

First, you will need to have a crypto wallet. To store your NFTs you can use MetaMask or another popular wallet. This will make it possible to send and collect your tokens. It is convenient for token storage, but you will need to pay a conversion fee.

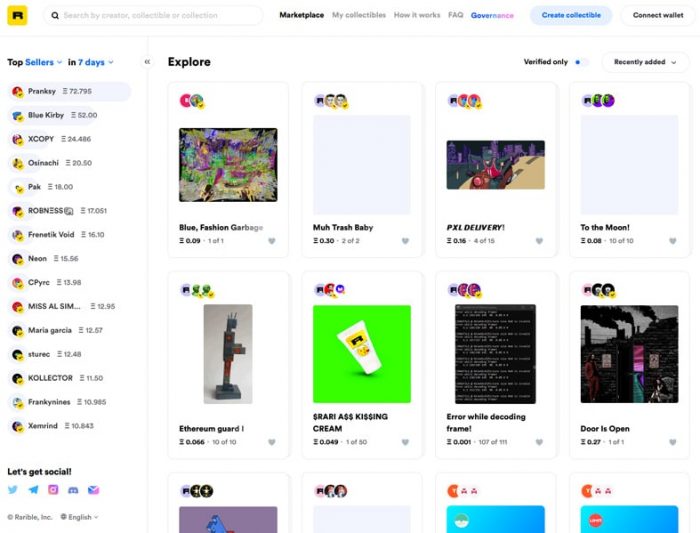

Once you have a crypto wallet, it is time to search for a trusted NFT marketplace. NFT marketplaces may be peer-to–peer exchanges or auctions. Auctions are similar to eBay listings. However, the auction lasts for a certain time. The highest bidder wins the auction.

You can also sell and buy NFTs on a primary marketplace. Primary markets are often the best for buying NFTs as they tend to have the lowest prices. If you don't know where to look, it's helpful to use a research tool. A research tool will allow you to assess the value of a specific NFT collection. They can also give you information about its latest news and updates.

OpenSea is the most popular NFT marketplace. This platform hosts hundreds upon hundreds of NFTs. Most of them are based on the Ethereum blockchain. For example, the Lucky Block NFT is available for $1,500 on the primary market.

NFTTrader is another well-known NFT marketplace. This site offers a wide selection of tokens, and is also compatible with MetaMask. You will need to deposit some ETH via MoonPay, or by bank wire in order to purchase or sell NFTs. The transaction will be approved by you after that. A 1% commission is charged when you sell an NFT.

Binance is another NFT exchange. This service allows you to trade NFTs directly with other users. You can choose from a variety of NFTs and pay a 1% commission when purchasing an NFT. They also offer mystery boxes that are a unique way to purchase rare NFTs.

NFT Launchpad will be a marketplace for NFT professionals. It carries a wide variety of sports-related NFTs. These tokens are extremely rare and competitively bid. This platform is newer than the other. But it is expected to become a major player in the NFT market.

A notable NFT trade was a 32ETH transaction for the Bored Ape Yacht Club Collection. The original price was less than $200. However, it sold for $1 million per token several months later. Several celebrities have paid six and seven figures for the NFTs.

Other notable NFT trades include the Bubble Gum Witty Weasel Veefriends trade. This was a significant win for NFT creators. They resold the tokens to make a profit.

FAQ

What are the benefits and drawbacks of investing online?

The main advantage of online investing is convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing has its limitations. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which trading site is best for beginners?

Your level of experience with online trading will determine your ability to trade. You can start by going through an experienced broker with advisors if this is your first time.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Investing property can bring steady returns as well as long-term appreciation. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is better forex trading or crypto trading.

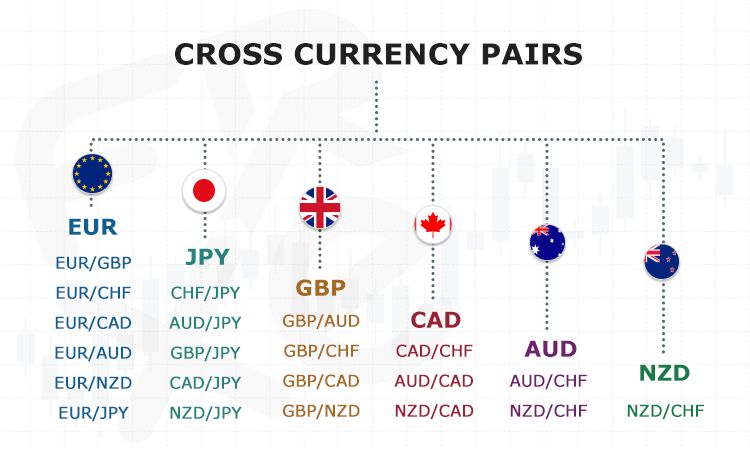

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading is easier than investing in foreign currencies upfront.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

It is important to research both sides of the coin before you make any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

Understanding the various trading strategies for different types of trading is important. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Cryptocurrency: Is it a good investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

Money can be complex but so can the decisions about how to store it. There are many options to protect your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?