Market chameleon provides an online trading platform with a range of tools that can be used by both stock and option traders. The tool can be used by traders to create watchlists and set up alerts for specific stocks or options.

Option traders can use the unusual options volume scanner to help them improve their strategies. This scanner detects stocks in which options are being traded at an unusually high rate. This could indicate potential catalysts and a trading opportunity which could yield profit.

Market Chameleon's Earnings Calendar is another unique feature. This calendar shows stock prices prior to, during, and following earnings releases. This makes it easy to stay on top of trends and market movements to make informed decisions and get the most out of your investing.

This also allows traders the ability to view order imbalances. These imbalances are caused by large fund traders placing orders at the close of a trading session based on closing price. This gives investors insight into institutional money market sentiment.

Financial analysts often use historical data to evaluate stock performance and stock movements. This is why it is so important to have reliable access to historical data over many years.

Market Chameleon provides a free trial account so you can get this information. This will let you test the service and determine whether the price is worthwhile.

The company offers a range of plan options that can be tailored to your specific needs and budget. The free plan includes basic access and a variety of tools. While the paid plans are more comprehensive, they offer more options.

Free 7-day trials are available to get an idea of how the system works. You can cancel your subscription at any time if you aren’t happy with the service.

Market Chameleon provides a range of features to traders with different levels of experience. Its stock screeners are flexible and simple, allowing you to filter through thousands of trade alternatives with ease. You can also create custom watchlist filters that will help you narrow down stocks that match your investment strategy.

Market Chameleon also has a flexible order flow screener. It allows you to monitor the market's bullish and bearish activities over time, or zero in only stocks on your watchlist. This screener displays top bearish and bullish stocks based upon recent options activity.

The options strategy screener in Market Chameleon is designed to help investors define their strategies and trading rules based on extensive data. This screener is particularly useful for options traders who are just starting out. It allows users to backtest their strategies and see how they perform in a real-life environment before making any decisions about buying or selling the underlying security.

FAQ

Is it possible to make a lot of money trading forex and cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Which trading platform is the best?

Many traders can find choosing the best trading platform difficult. It can be overwhelming to pick the right platform for you when there are so many options.

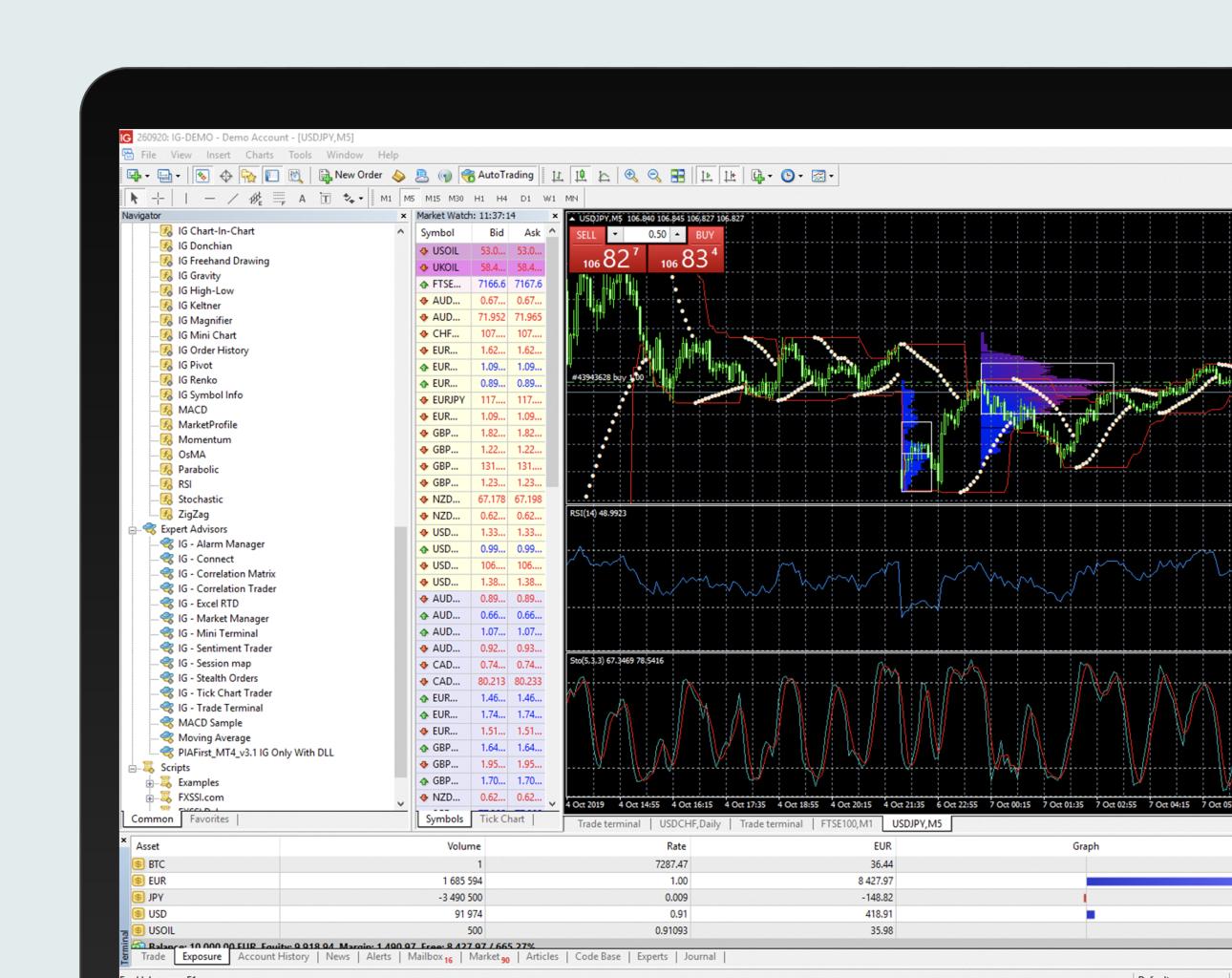

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down the search for the right platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Which forex trading platform or crypto trading platform is the best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading is easier than investing in foreign currencies upfront.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both instances, it is crucial to do your research prior to making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Which trading platform is the best for beginners?

It all depends on how comfortable you are with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is safe crypto or forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Do forex traders make money?

Yes, forex traders can make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

It is important to do your research before investing online. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

You should understand the investment risk profile and be familiar with the terms. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.