Interactive Brokers provides a low-cost and low-risk trading platform that is highly secure. It provides a wide range of products that can be used by investors from novice traders to experienced traders. There are also many tools and features designed to enhance the user experience.

Interactive Brokers gives investors access to many markets, including futures and stocks. Interactive Brokers has global reach and can provide investors with the opportunity to invest in currencies, stocks, bonds, or bonds in more 150 countries. In addition to the US, investors can access markets in Europe, South Korea, Japan, Australia, and India.

Investors have the option of choosing between IBKR's app or desktop. Although the app is easier than the desktop, the functionality is virtually the same. With the app, you can monitor your portfolio, receive impact scores, and use ESG data from third-party vendors.

IBKR provides a wide range of trading tools including the PortfolioAnalyst tool that tracks portfolios and helps you identify undervalued companies. You can trade ETFs, buy and sell stock, or exchange cash for shares. Market research is also available on the platform, including UBS Live Desk market analysis and Dow Jones market headlines. Market News International is another option.

Investors also have the opportunity to access a range of educational resources. Interactive Brokers has partnered with Coursera to offer courses in finance and trading. These classes feature quizzes and progress tracking. You can subscribe to premium news subscriptions for clients. You can also use the IBKR SmartRouter to automatically route your trades to lowest cost market makers.

Traders also have the option to access IBKR's online learning centre, IBKRcampus. Interactive Brokers offers educational content both free and paid. There are courses offered by in-house staff and third-party instructors. The Traders Academy portal covers the wider financial markets and is available to traders. Interactive brokers also offer a robo advisor service that can be used by investors to make trades. This robo advisor service is based upon a set of investment criteria.

IBKR has been a member of the Securities and Exchange Commission and National Futures Association. Through the Securities Investor Protection Corporation, customers can get coverage for their account assets and securities. Customers with more assets than $1 million have the option to get a digital card.

Interactive Brokers could seem intimidating to new investors. This low-cost brokerage provider does have many advantages, especially for active traders. You can trade options, stocks, bonds and other assets with no transaction charges. You can also buy mutual funds with no transaction fees. Interactive Brokers provides a variety of trading and analytical tools making it a great choice for more experienced investors.

Interactive Brokers is a member with the Financial Industry Regulatory Authority. This guarantees security. It also has memberships in the Securities and Exchange Commission(SEC), Chicago Mercantex Exchange and Commodity Futures Trading Commission and New York Stock Exchange.

FAQ

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which is better forex trading or crypto trading.

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

It is important to research both sides of the coin before you make any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important that you understand the different trading strategies available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it's important to understand both the risks and the benefits.

Is Cryptocurrency a Good Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which is the best trading platform?

For many traders, choosing the best platform to trade on can be difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This information will help you narrow down your search and find the best trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

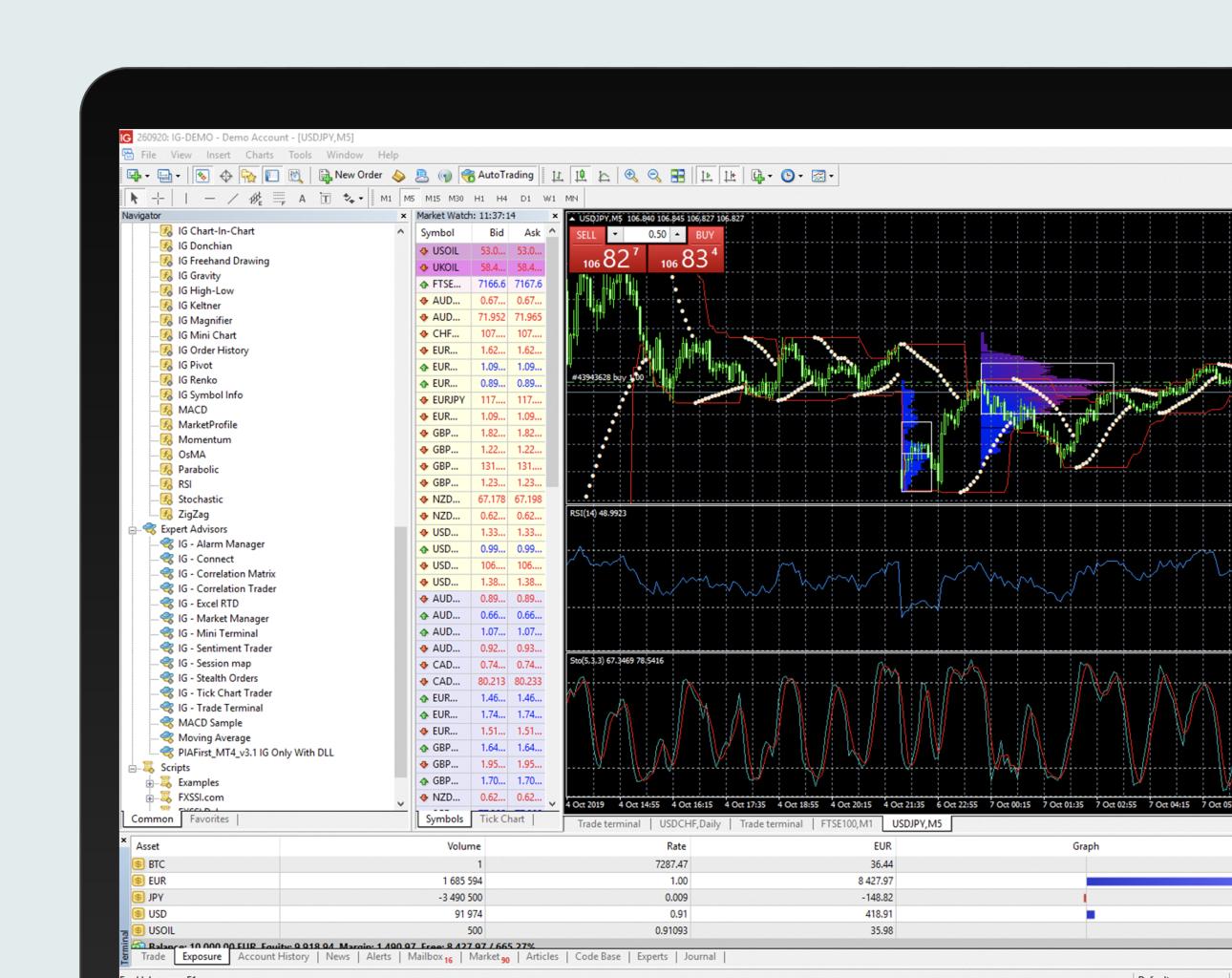

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which trading website is best for beginners

It all depends on your level of comfort with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

You can also trade independently if your knowledge is good enough. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

What are the pros and cons of investing online?

Online investing has one major advantage: convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing comes with its own set of disadvantages. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Security is essential when investing online. Protecting your financial and personal information online is essential.

You must be mindful of who your investment platform or app is dealing with. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. Also, you should use different passwords on each account to ensure that any breach in one doesn't cause others to be compromised. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!