Candlestick patterns are used by price action traders to analyze and trade markets. They may choose to focus on three or four patterns. These patterns will give information about market direction. For maximum impact, you can combine several strategies with the price action strategy. To reduce the chance of error and trial, it is important to adhere to the trading rules.

Successful price action trading requires that you identify a trending market. You need to identify if the market's trend is uptrending or downtrend. It's also important to define key support and resistance levels.

To make this process easier, you can download a free app called the Pin Bar Indicator from the MQL5 Community. The indicator will notify you when the bar chart shows a pattern by observing it.

Bollinger bands, moving mean, and Relative Strength index are some of the most common indicators. However, these indicators may not always provide accurate signals. Be sure to filter out fake signals. Also, these instruments don't allow you to know when to enter or exit a particular trade.

Fibonacci levels are one example of another tool that can be used for identifying early trends. However, you should do a multi-timeframe analysis before using these tools. Multi-timeframe analyses require you to choose the right combination of charts and timeframes to identify price patterns.

You must first mark high levels on your chart. If the EUR/JPY prices are making higher lows, then you should set a stoploss level that is just below the next strong level.

Rectangles are another type of chart pattern you can recognize. This indicates that the trend is likely to continue. A pullback that fails to reach below a given level can be used as an opportunity to enter a position long.

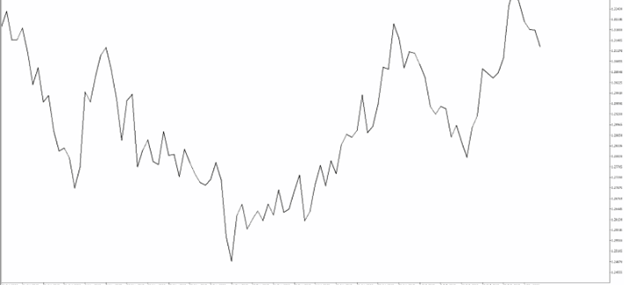

Elliott wave is a very popular strategy for price movement. This technical pattern is inspired by Ralph Elliot. He spent years studying financial charts and found five impulse wave patterns in bull markets. When the wave is complete, it's followed up by a corrective one.

These patterns can be spotted in any market. The EUR/JPY exchange rate made a series o higher lows, starting in April. Profitable trading can be achieved if you spot this pattern in the right moment.

A tester is a great way to start price action trading. A strategy tester allows you to practice a variety of patterns with different time frames. Once you are comfortable with one technique, you can move on.

Remember that price action is subjective. Different traders have different views on the same market. It's subjective so you can't be certain when to sell or buy.

FAQ

What are the advantages and drawbacks to online investing?

Online investing has the main advantage of being convenient. You can manage your investments online, from anywhere you have an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Most Frequently Asked Questions

What are the four types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

There are two types of stock: preferred stock and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Is Cryptocurrency Good for Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

How do I invest in Bitcoin

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need is the right knowledge and tools to get started.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. You may choose one option or another depending on your goals and risk appetite.

Next, research any additional information you may need to feel confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. Keep an eye on market developments and news to stay current with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Can one get rich trading Cryptocurrencies or forex?

Trading forex and crypto can be lucrative if you are strategic. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Also, you should only trade with money that is within your means.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Online investment accounts require security. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, ensure the platform you are using is secure. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. You should also have a policy that describes how your personal information will be monitored and controlled.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

Thirdly, make sure you understand your investment platform's terms and conditions. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, make sure you do thorough research about the company before investing. You can read user reviews and ratings about the platform to see how it works and what users have said about it. You should also be aware of the tax implications when investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.