Crude oil is one of the most traded commodities in the world, with its volatility attracting both speculators and investors. Its importance is evident in our daily lives, with its products ranging from gasoline to plastics and medicines.

There are many options for trading crude oil. Options include futures contracts, stocks and ETFs. Traders have many options to trade crude oil, from futures contracts and options to stocks and ETFs.

CFDs are the most widely used method of trading crude oil. This is because they allow traders to follow price changes without actually owning the asset. CFDs also have lower spreads than futures making them ideal for scalpers or high-frequency traders.

The oil market is global. Geopolitical and economic events have an effect on its price. The price of oil can fluctuate greatly, making it difficult for new traders to decide whether they should be taking a long or a short position.

Trades in crude oil require a lot knowledge and expertise. Additionally, this market has strict regulations. Potential oil brokers must complete training classes on securities laws, disclosure and trading licenses.

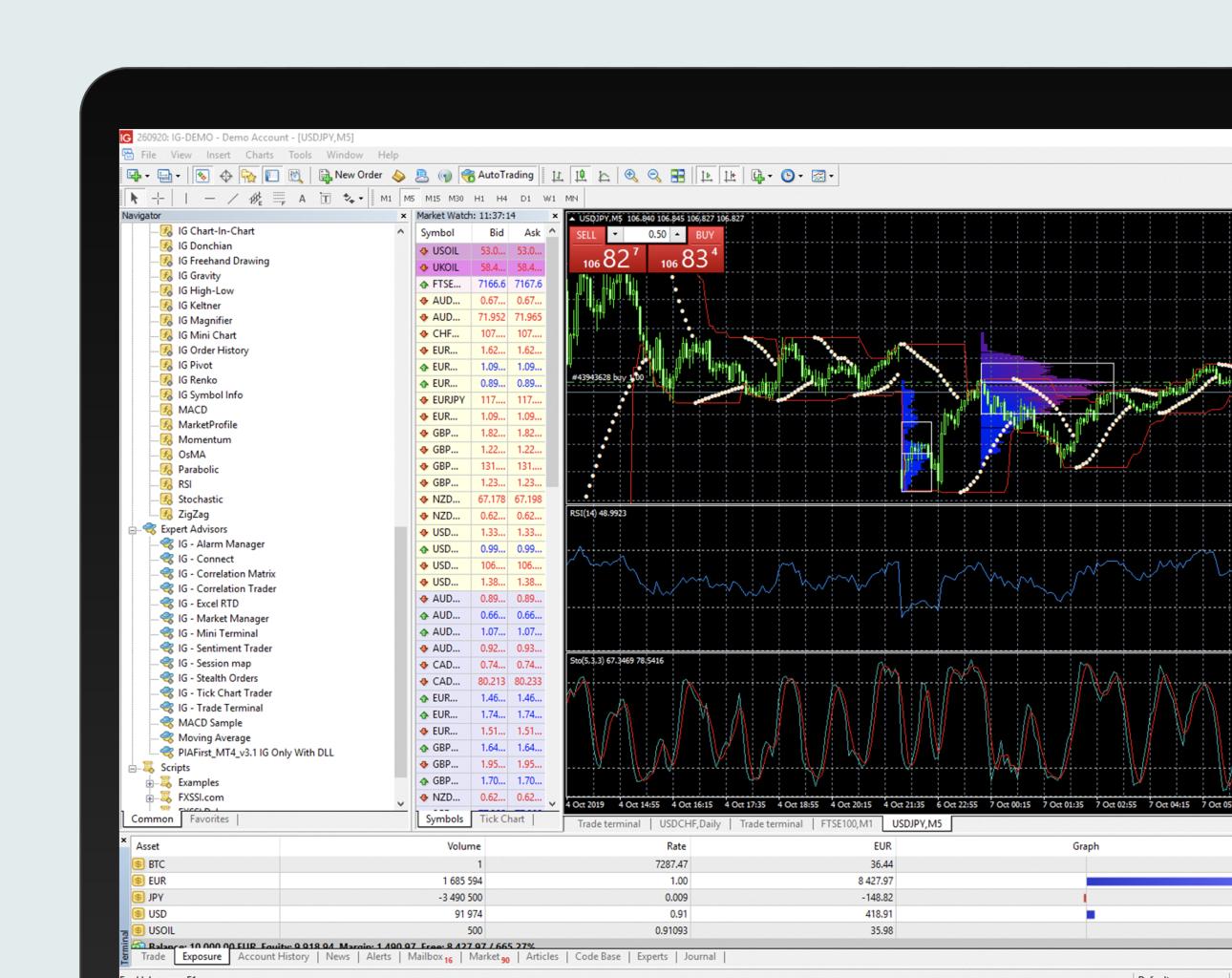

Before you can start trading, you need to find a reliable broker that offers the trading tools you need. This can be done by doing some research and comparing different options. Once you have chosen the right brokerage to work with, you can open an Account and Fund it. To test your strategy, and manage risk, you can trade from a demo trading account.

The process of trading crude oil is complicated by a range of factors. These changes can have a significant impact on oil prices, so it is crucial to keep track of all of them.

To have a realistic view on the future price oil, traders need to keep track of all these factors. The most influential factors include GDP data, political developments and supply and demand.

The trading psychology of the crowd is another factor traders need to be aware of. Understanding the behavior of oil traders can help them to make informed decisions and avoid common mistakes.

When trading oil, it is important to understand the differences between light and heavy grades. The density of light grades is lower, which means they are simpler to process and may be more affordable to produce.

A lighter oil grade is preferable for making gasoline because it requires less energy to refine.

The online oil trading platform lets you place orders to buy and sell a specific type or commodity. You can also create a safe stop-loss limit to protect your capital.

Crude oil is an extremely valuable commodity and the world needs it. Crude oil is an attractive investment option for many investors, including investors who are looking to diversify portfolios or speculators.

FAQ

Forex traders can make money

Forex traders can make a lot of money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

How do I invest in Bitcoin

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need is the right knowledge and tools to get started.

The first thing to understand is that there are different ways of investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, research any additional information you may need to feel confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Is it possible to make a lot of money trading forex and cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. You should also trade with only the money you have the ability to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Is Cryptocurrency a Good Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

There are also potential gains if one is willing to risk their investment and do some research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

What are the benefits and drawbacks of investing online?

The main advantage of online investing is convenience. You can access your investments online from any location with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many choices: stocks, bonds or mutual funds. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Some investments may also require a minimum investment or other restrictions.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can my online account be secured?

Safety is a must when it comes to online investment accounts. It's vital that you protect your data, assets and information from unwelcome intrusion.

You want to ensure that the platform you use is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

Secondly, always choose strong passwords for account access and limit your log in sessions on public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

It's also important to fully understand the terms, conditions and fees associated with your online investment platform. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, be sure to research the company where you plan on investing. Review and rate the platform and see what other users think. Make sure to understand the tax implications of investing online.

Follow these steps to ensure your online account is protected from potential threats.