Trading in energy is a great way for you to profit from the fluctuations of prices in energy commodities. This also allows you diversify your portfolio with different types and energy products.

Several factors can affect the profitability of an energy company, including interest rates, production costs, competition, and local economies. If gas prices rise, utilities may see their profits drop. Because gas is more expensive to produce, this will lead to a drop in sales.

Energy commodities that are most important include crude oil, natural gas (natural gas), gasoline, coal and ethanol. These commodities are available for trade using options, futures contract, ETFs and ETNS, CFDs and shares in energy companies.

Crude oil is the most popular commodity for trading in the energy markets and it is an essential part of the global economy. It is used in the production of everything, from gasoline and diesel fuel to oil for heating.

The price of this commodity varies greatly due to many factors. These factors are tracked by commodity exchanges all over the globe. It is traded in intraday, day-ahead, and balancing markets.

Electricity is a product that is unique and has many of the same characteristics as commodities. But it is not a commodity because there is no physical store. It must be delivered and consumed by consumers. This involves many factors.

Renewable energy has been a major component of the global energy markets over the last decade. It is a form of energy that is renewable and can replace fossil fuel-based energy sources.

This shift is being driven by the rapid development of new technologies as well as the growing demand for energy alternatives. It is a rapidly growing area of the industry that offers exciting opportunities for traders.

The most successful traders in energy use trend or momentum-based analysis to analyze the commodities' prices. This type of trading strategy is used to take advantage of breakouts in a trend. It can also be very effective when paired up with a volatility based trailing stop.

In the last few years, crude oil and natural gas have experienced massive swings in their prices. These swings can sometimes be difficult to predict. They can also lead to big losses.

These swings may be an opportunity to get into a long trade, but they can also present a risky situation as they could lead to a sharp change in price. It's therefore crucial to take the time to evaluate all factors that can impact the price for these commodities.

This can be done by making your trades online (OTC). This is an alternative market to a formal market, and it can be more customizable.

It can also be less volatile than trading on an exchange. OTC transactions carry a high level of counterparty risks and are not as convenient or fast as exchange-based transactions.

Trading energy can be a lucrative investment but also a risky one. It is important that you understand all factors that could impact the price for an energy commodity. These factors can include global politics, weather, travel trends, and prevailing data and forecasts.

FAQ

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Forex and Cryptocurrencies are great investments.

Trading forex and crypto can be lucrative if you are strategic. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. You should also trade with only the money you have the ability to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. There are many other investment options available.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you are comfortable with the risk, you can trade online using day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. It can be overwhelming to pick the right platform for you when there are so many options.

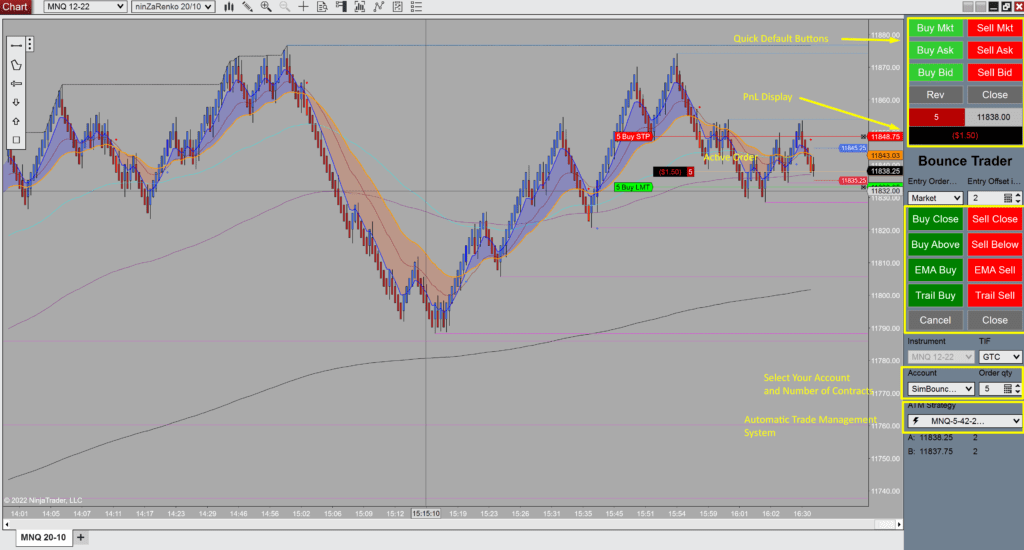

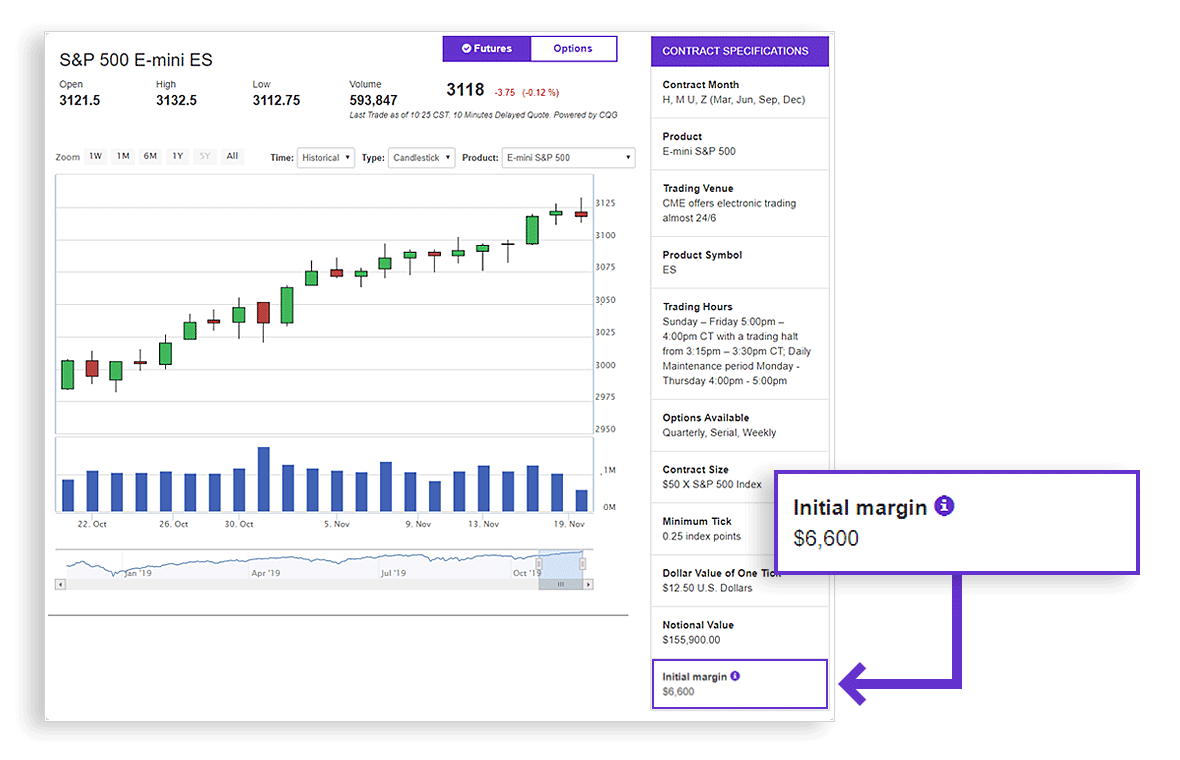

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

First, you need to know that there are many ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. To stay on top of crypto trends, keep an eye out for market developments and news.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Which is harder forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

It is easy to lose your money, but it can also be difficult to decide where to keep it. You have many options for protecting your valuable assets.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.