Forex fundamental analysis involves analyzing currency pairs on the basis of several factors that determine their relative worth. These factors include the country’s economic outlook, interest rate, inflation reports, or any other data that can impact the currencies' prices.

Fundamental analysis is complex and time-consuming, but can give forex traders valuable information about the economy and potential profit. It is a valuable tool that can be used by any trader, regardless of experience level or trading style.

Forex Fundamental Analysis: When Should You Use It?

Fundamental analysis can help you determine where a currency will go next, regardless of whether you are looking at short-term fluctuations or long term positions. It can also give you a head start when it comes to taking advantage of windows that are likely to be characterized by higher volatility, allowing you to capitalize on them and get in early.

How to use fundamental analysis

An approach to Forex fundamental analysis that considers all the factors that affect the currency pair's price is the best. If you want to improve your trading skills and be more profitable, it's a good idea to become familiar with all the major economic indicators that are important for the health of a specific currency.

A country's unemployment rate falling or its economy improving will lead to a stronger currency. This is because foreign investors and businesses are more likely to invest in that country.

It is also important to note that central banks can reduce interest rates which can cause more money to flow out of an economy. This can create bubbles in the economy and increase market volatility. This could be a very dangerous situation for traders. But it's important to not ignore.

Forex Technical Analysis

Forex traders tend to focus on technical analysis when making trading decisions. This type of analysis analyzes the charts to study the trend of a specific currency.

Forex traders tend to focus on the most current news in order make their trading decisions. The forex market will react quickly to new data, which means it will be volatile.

If you're not a skilled forex trader or don't have a good understanding of the markets, this could be dangerous. In forex trading, it is recommended that traders use both technical analysis and fundamental analyses.

When to Use Forex Trading Mobile

Mobile forex trading offers traders the chance to make money regardless of where they are. A smartphone or tablet can allow you to view market news and economic reports in real time, making it easier to make informed trading decisions.

When to use Forex Analysis

Fundamental analysis is a highly complex area of research that can prove difficult to grasp and master. But, fundamental analysis can be a powerful tool to improve your forex trading results. It can also help you avoid common mistakes made by newcomers to forex trading.

FAQ

How do I invest in Bitcoin

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. You only need the right information and tools to get started.

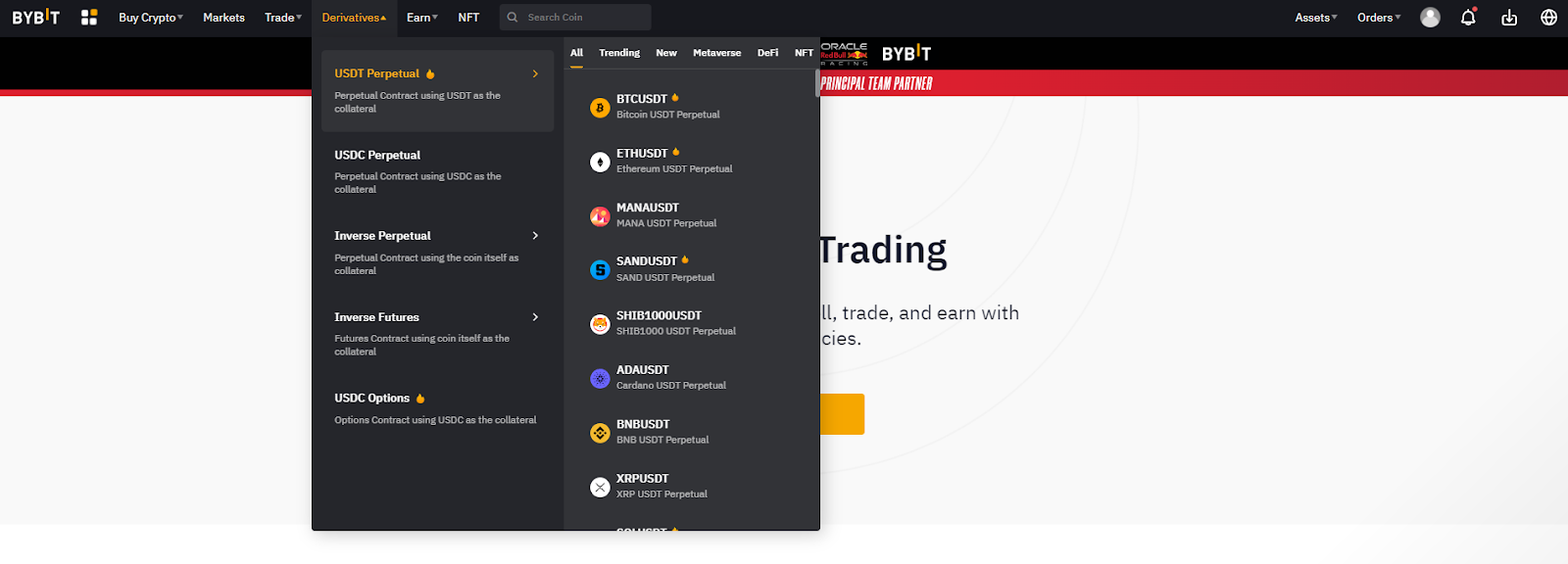

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, gather any additional information to help you feel confident about your investment decision. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Can one get rich trading Cryptocurrencies or forex?

Trading forex and crypto can be lucrative if you are strategic. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Knowing how to spot price patterns can help you predict where the market will go. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Which trading site for beginners is the best?

It all depends on your level of comfort with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is more difficult forex or crypto currency?

Both forex and crypto have their own levels of complexity and difficulty. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

It is important to research both sides of the coin before you make any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it is important that you understand the risks as well as the rewards.

Frequently Asked questions

Which are the 4 types that you should invest in?

Investing can help you grow your wealth and make money long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

Online investing requires research. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Know the risks associated with your investment and the terms and conditions. Before opening an account, confirm the exact fees and commissions on which you might be taxed. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.