A currency pairing is a combination between two currencies that are traded together. Pairs can be USD/JPY, EUR/GBP, or any combination thereof. The paired currency's worth is then compared to the base currency. These pairs can be scalped by traders looking to capitalize on fluctuations in their base currency.

Forex traders often look at various indicators to determine what currency to trade. Depending on your pair, you might see lots of trading activity. You should consider a risk management strategy regardless of which pair you want to trade. This will make trading pairs much more straightforward.

The most common type of forex trading is deciding whether you want to go long or small. You can do this using many tools such as charts and economic announcements. There are many factors that can affect currency prices. These include economic and political status, future hopes for the country and current positions of its residents. A trading plan, historical information and other factors should be considered.

There are four main currencies that have been most popular historically. These include the US dollar, the Japanese yen, the Canadian dollar, and the euro. While these are the most commonly traded pairs, they are not the only major currencies in the world. Other major pairs include: the Australian dollar; the Chinese yuan; the Hong Kong Dollar, New Zealand Dollar and the South African rand.

Exotic pairs are another type of currency pair. The exotic currency pair is more volatile than other types. They can be described as a combination of several currencies from different market sources. Some of these exotic pairs have higher spreads and are more risky. However, you may have a better chance of making a profit from these pairs.

Exotic currency pairs are more attractive, but they can also be more difficult to trade. Before you venture into exotic markets, it is crucial to understand your market.

Major currency pairs offer some potential profits, but are generally more stable and less volatile than major currency pairs. They also have more liquidity and are easier to trade. They are also more volatile because of the consensus among traders.

Traders will often choose to invest in the safest and liquidest currency pair during times when there is turmoil or tumult. The US dollar, which is very stable, is widely considered a "safe haven". You might consider investing in a minor or cross pair to diversify you investment portfolio.

Comparing the pros and cons of each pair is the best way to decide which pair you should invest in. Experienced traders will prefer the majors. However, novice traders may prefer the minors. No matter what your preference, the most important thing about a currency is its political and economic stability. You may want to consider other factors, such as the country's agricultural influence, if you are trading for a living.

FAQ

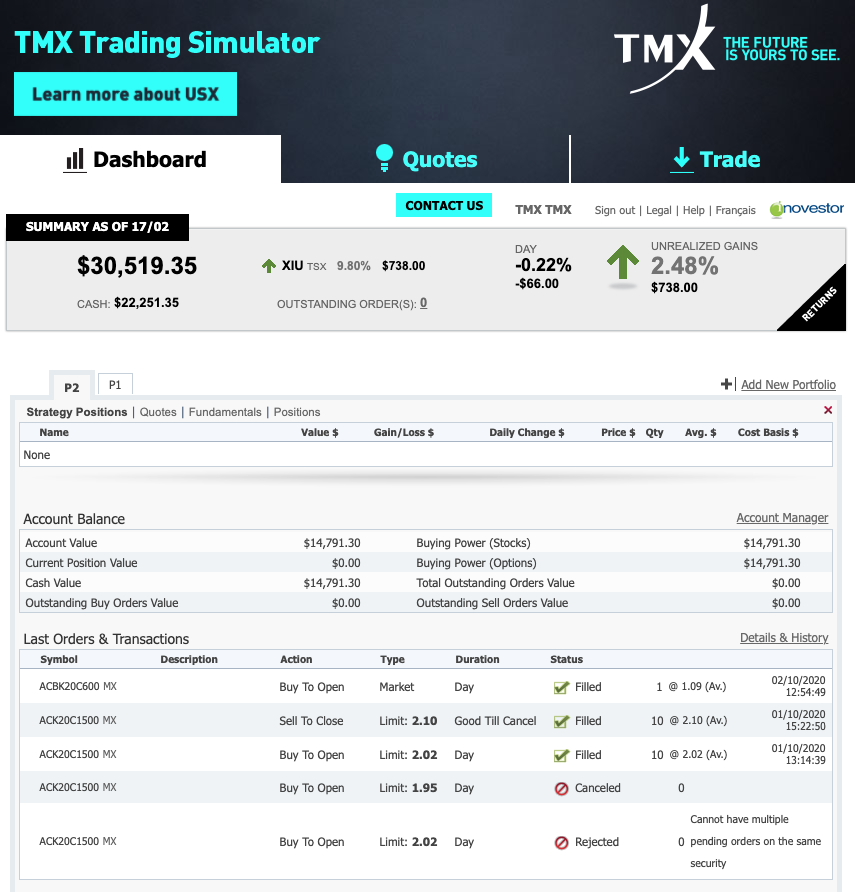

Which trading platform is the best for beginners?

It all depends on how comfortable you are with online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers provide interactive tools to show you how trades function without risking any money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Is Cryptocurrency a Good Investment?

It's complicated. It is complicated. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Forex and Cryptocurrencies are great investments.

Trading forex and crypto can be lucrative if you are strategic. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Which is harder forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which forex or crypto trading strategy is best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is also important to understand the different types of trading strategies available for each type of trading. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. It is important to understand the risks and rewards associated with each strategy before investing.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investing is a risky venture. Protecting your financial and personal information online is essential.

Be mindful of whom you are dealing with when using any investment app. You want to work with a company that has positive customer reviews and ratings. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

For all accounts, use strong passwords with two-factor authentication. You should also regularly test for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!