Trading commodities in day trades is a great way profit from the changing supply and need. However, it is also one of the most risky types of day trading. It is important to understand how to minimize your risks.

Intraday commodity trading

Day traders use a variety of strategies to buy and sell commodities. Although they may have a computer program or indicator to help them spot trends in the market, most of the work is done by day traders.

Commodity markets tend to be less volatile than stocks. This makes them great for day trading. They do experience some volatility, particularly after major news stories.

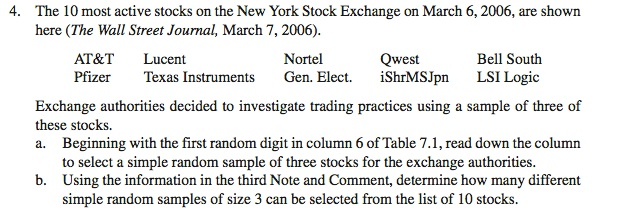

Day trading specialists should closely follow market news to identify a good entry point or exit. Additionally, they should monitor the stock's order flows. This list shows the potential orders that are available to buy or sell. It tells them when the price is likely to rise or fall.

Choose the right commodity to trade intraday

Before you make any decision about which commodity to trade, it's essential to consider several factors, including its liquidity and price history. This will help determine if the commodity is a good fit for your trading strategy.

High volume commodities with low spreads are the best for intraday trading. The more volume, the greater liquidity and the lower spread, the better, as this will increase trader interest in selling or buying.

Silver is a well-known commodity for intraday traders due to its volatility as well as tight spreads. The metal's volatility and tight spreads can cause huge swings in its prices, making it easy to make a lot from these types of transactions.

Day trading is also possible in currency markets, which offer high volume and low transaction fees. A market crash is unlikely because they are highly liquid.

Day traders don’t need to know everything about every market in which they trade. But they must have an understanding of the wider economy and how it impacts the underlying commodity. They can use this information to make more informed trading decisions and to help them avoid over-trading.

They must also be able to use the many indicators and tools available to them, including trend lines and moving averages. This will allow them to make the most of their time, and lessen the stress caused by the market's constant changes.

Remember that you must have a strategy in place for all your investments when you day trade. This will help to keep you focused and stop you making poor choices when you're losing your money.

You should also plan an exit strategy to each of your holdings. This will help ensure you don't lose any money at all and allow you to recover those losses later.

A day trader can make a large number of trades in a short period of time, as long as their strategy allows them to do so. You can benefit from a wide range of markets, including futures and exchange-traded fund markets.

FAQ

Which platform is the best for trading?

For many traders, choosing the best platform to trade on can be difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. The interface should be intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This will help you narrow your search for the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

How do forex traders make their money?

Yes, forex traders are able to make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Online trading is a great way to get real-time market data. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing has its limitations. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important for online investors to be aware of all the investment options. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Is Cryptocurrency a Good Investing Option?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is harder, forex or crypto.

Each currency and crypto are different in their difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Can one get rich trading Cryptocurrencies or forex?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investments require security. Online investments are a risky way to protect your financial and personal information.

Start by being mindful of who you're dealing with on any investment app or platform. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. To prevent a breach of one account, it's smart to have different passwords for each account. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!