The relationship between cryptocurrencies & stock markets is being given a lot of attention. Researchers have found that the research findings can have significant implications for investors. There is some debate about the degree of the relationship between the two asset classes. However, researchers have come up with several methods for evaluating this. It is crucial to determine the relative risk share between cryptocurrencies and the stock market so that portfolio managers can develop optimally balanced portfolios.

As the global economy evolves, cryptocurrency has become a more popular investment method. Many scholars have researched the relationship between cryptocurrencies & the stock markets, using Bitcoin as the main source of their research. In fact, the market for this asset is worth $200 billion, and a recent Bloomberg analyst predicted that it could reach $20,000 by 2020.

Three methods can be used to examine the relationship between cryptocurrency markets and stock markets. These include an empirical method and a statistical approach. These methods allow researchers to study the relationship between cryptocurrency and stock markets in different countries and under different market conditions. The result of this research can be used to determine the risk sharing between these assets, as well as guide strategies for risk-on and risk-off investing.

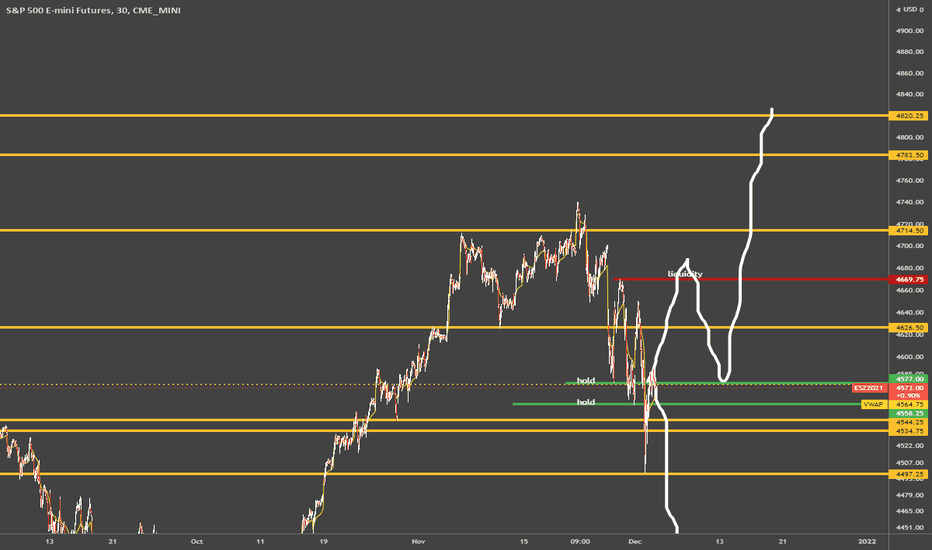

First, the empirical approach relies on a limited number of cases to examine the impact of crypto and stock markets. They used a variety of cryptocurrencies, as well their disaggregated stocks indexes, to study the correlation between returns on each investment and the stock exchange. The results showed that cryptocurrencies and stocks market depend on each other in a dynamic way. This dependencies vary with the country, market environment, and the time horizon of the study. These results suggest that the Clayton copula, which is time-varying, best represents the relationship between cryptocurrency and the stock market. But, it is not ideal when the market turns bearish or flat.

The second is the sample-based approach, which uses a more conservative approach to estimating the risk of cryptocurrencies spillover to the stock exchange. Researchers can estimate the effect of cryptocurrency on the stock market by combining multiple methods with a small sample. Although the results showed a positive relationship with the S&P 500, the researchers found that cryptocurrencies have a less prominent connection to the stock exchange than they should.

Third, the time-varying Clayton copula best fits the relationship between cryptocurrencies and the stock market when both assets experience extreme downward movements. The relationship is stronger when the markets are bullish. Despite this, authors believe that stronger downside risk spillovers are a good indicator that cryptocurrencies cannot be used to hedge the stock market.

Finally, the time-varying approach shows a positive relationship between cryptocurrencies as well as the FTSE MIB/SSE Indexes. These indices measure rapidly industrializing countries, which could indicate that investing is possible in these indices for stock investors.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Where can I find ways to earn daily, and invest?

Investing can be a great way to make some money, but it's important to know what your options are. There are many other investment options available.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. You should also trade with only the money you have the ability to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down the search for the right platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Which is harder forex or crypto?

Each currency and crypto are different in their difficulty and complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

How do I invest in Bitcoin

While it can seem daunting to invest bitcoin, it is really not that difficult. You only need the right information and tools to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

Online investing requires research. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Know the risks associated with your investment and the terms and conditions. Before opening an account, confirm the exact fees and commissions on which you might be taxed. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.