A crude oil ticker is a type futures contract that allows investors buy or sell a specific quantity of a commodity such as oil at a given date. The price is determined using a benchmark, which is the commodity's current value in dollars and the amount of a barrel. Different grades of crude oil are traded in different areas and have different sulfur and other impurities.

Crude oils futures are one of the most liquid and popular contracts. These contracts can be traded on many exchanges, with NYMEX being the most popular. NYMEX offers oil contracts, as well as gasoline and heating oil. These commodities are the most traded with an average of more than one million contracts traded per day.

Crude oil futures provide a convenient way for investors to take part in the world's most active and important commodity market. They are quoted with standard ticker-tape quotations and can be traded for a specified period of time, typically for up to nine years. Futures contracts are also used by substantial energy consumers to hedge against price fluctuations.

A variety of factors affect the price of a specific grade of oil, including the production decisions made by OPEC, manufacturing industries and transportation industries. Oil speculators make their money by buying and selling futures contracts. Some commodities are considered strong buys, but others are considered strong sellers. Each investor can decide which crude oil futures work best for them.

WTI Crude Oil Futures (WTI Crude Oil Futures) are the most active crude oil futures. Light sweet crude is preferred by refiners because of its low sulfur content and high yields of fuels. This oil is also used in the United States as Bakken crude. This contract is subject to the weekly crude oil inventories report on Wednesdays.

Every Wednesday, at 10:30 Eastern Time, the EIA publishes a report on petroleum status. Analysts predict that the oil sector in 2022 will be strong.

A crude oil futures contract is able to be purchased for up nine years and then sold. This is an inexpensive way to invest in global oil industry. Crude oil futures are used by many companies that distribute and produce fuels to hedge against fluctuations in oil price.

E-mini is one of the most sought after types of crude oil futures. These contracts are smaller in size and offer private investors greater accessibility to the market. You will need to invest a minimum amount of capital in order to trade this type of contract. Schwab offers $2.25 per contract if you are interested in getting in on the action. This is a great deal compared to other brokers.

WTI Light Sweet Crude is the most liquid type of crude oil futures. Brent and Dubai crude are the other two. Traders on the CME and the Intercontinental Exchange (ICE) use Brent as a benchmark for prices in Europe, North Africa, and the Middle East.

FAQ

Which platform is the best for trading?

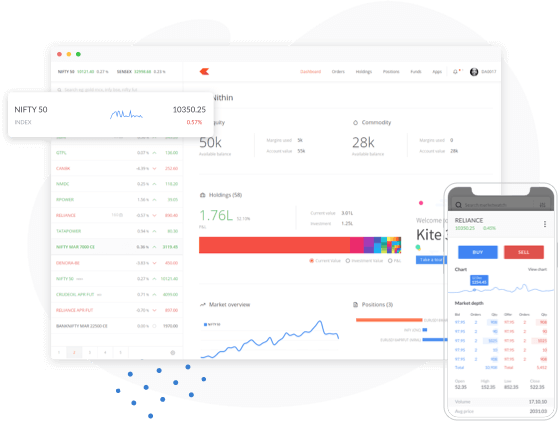

Choosing the best trading platform can be a daunting task for many traders. With so many different platforms to choose from, it can be hard to know which one is right for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down the search for the right platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Where can you invest and make daily income?

Investing can be a great way to make some money, but it's important to know what your options are. There are many options.

One option is investing in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which forex trading platform or crypto trading platform is the best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it's important to understand both the risks and the benefits.

Which is harder, forex or crypto.

Both forex and crypto have their own levels of complexity and difficulty. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex has been around since the beginning and has a solid trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

How can I invest bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. You only need the right information and tools to get started.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, research any additional information you may need to feel confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection starts with you. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Don't respond to unsolicited calls or emails. Fraudsters often use fake names, so never trust someone just based on their name alone. Before making any commitments, thoroughly research investment opportunities independently.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Remember that scammers will do anything to obtain your personal information. You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

You should also use safe online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before you make any investment, read and understand the terms of any website or app that you use.