You can choose from many online stock trading platforms, regardless of whether you're a novice investor or an experienced one. The key is to find a platform which maximizes your returns. There are many options but there are only a few that really stand out. First, find the broker that best suits your needs. In addition to finding the right platform, you'll want to select a broker with a great reputation and customer service.

TD Ameritrade offers an easy-to-use platform, competitive rates, and a host of educational tools. This stockbroker is known to be straightforward and a good place to begin investing. You can learn how to trade stocks with their education center, which includes tutorials, videos, and a webinar. The user interface is simple and easy to use, and there's even a mobile app. The platform also offers a desktop version to traders who desire more flexibility.

InteractiveBrokers, a well-respected stockbroker, specializes in international markets. They offer trading options in stocks, futures, bonds, and futures. They offer trading in more than 100 order types and have a transparent pricing structure. But they aren't the cheapest broker.

Stocktwits, one of the most popular stock-trading apps, is among them. The stock scanner, news highlights, customizable alerts, and customizable alerts are some of the features that Stocktwits offers. It can also sync with your brokerage accounts. Users can also chat with other investors on specific stocks pages. A comprehensive section on cryptocurrency is also available in the app. The app allows you to view the most popular stocks and watch live trading sessions. You can even trade paper with it.

You'll want to take the time to decide if you're interested in day trading or long-term investing. There are many low-cost options. Most brokerage firms offer zero commission trades. Some brokerage firms may offer managed options. Day traders are also interested in investing in derivatives. You can leverage your portfolio and make huge returns by investing in derivatives.

Investors Underground offers a richer experience. Nathan Michaud was the founder of this stock trading school. His track record is impeccable and there's a clear path for investment success. Their membership plan includes a live trading room, premarket broadcasts, trade recaps, and a trading floor. Their price is also very affordable. This course is unmatched in its entirety.

Udemy's portfolio offers an easy-to-use and affordable investment course. The platform offers many courses that are taught with pre-recorded videos, which demonstrate a wide range of techniques. You can also ask questions and receive free training. Plus, the majority of courses are accessible to beginners.

While you might have heard of some of these best stock trading websites online, they may not be the right one for you. Your financial situation will dictate which brokers are best for you.

FAQ

Trading forex or Cryptocurrencies can make you rich.

Trading forex and crypto can be lucrative if you are strategic. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Which is harder, forex or crypto.

Crypto and forex have their own unique levels of difficulty and complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

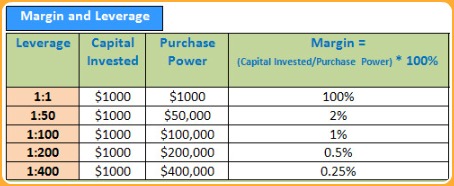

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Is Cryptocurrency a Good Investment?

It's complicated. It is complicated. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

What are the disadvantages and advantages of online investing?

The main advantage of online investing is convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing is not without its challenges. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

Where can I invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. With any type or trading, it is important to manage your risk with proper diversification.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it's important to understand both the risks and the benefits.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investing is a risky venture. Online investments are a risky way to protect your financial and personal information.

Begin by paying attention to who you are dealing on investment platforms and apps. You want to work with a company that has positive customer reviews and ratings. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

It is important to ensure that only trustworthy people have financial access to your accounts. Make sure you delete old bank apps from all devices, and change passwords every few weeks if necessary. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Last but not least, make sure to use VPNs when investing online. They're often free and easy!