Cryptocurrency is one of the hottest assets on the market right now, but it can be difficult to determine which coins are worth investing in. There are many factors you should consider before making a decision.

Best Coins to Buy Now

It is a good idea to look at other cryptos to see how they compare. This will enable to compare the risks and benefits of buying a particular token. It's also a good idea, to check for any information regarding the project that may impact its price.

Consider selling the crypto tokens or transferring them to another coin if they are experiencing prolonged price volatility. Investors who want to get the most from their investments can use this strategy.

Best Coin to Buy Right Now

Strong fundamental uses are the best reason to invest in cryptos right now. A coin's value will rise over the long term if it serves a valuable purpose. Fight Out uses its token FGHT to access its rewards program for fitness.

Additionally, some coins may offer more privacy than others. This is a great thing for investors who want their assets and private information to be protected.

The best cryptocurrency you can buy right now should have stable prices and a strong support team. This will help it continue to rise in the long run, ensuring that your investments are secure.

FAQ

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex has been around since the beginning and has a solid trading infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

What is the best forex trading system or crypto trading system?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both instances, it is crucial to do your research prior to making any investments. Diversification of assets and managing your risk will make trading easier.

It is important to be familiar with the various types of trading strategies that are available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, make sure to understand the risks associated with each strategy.

Most Frequently Asked Questions

What are the 4 types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

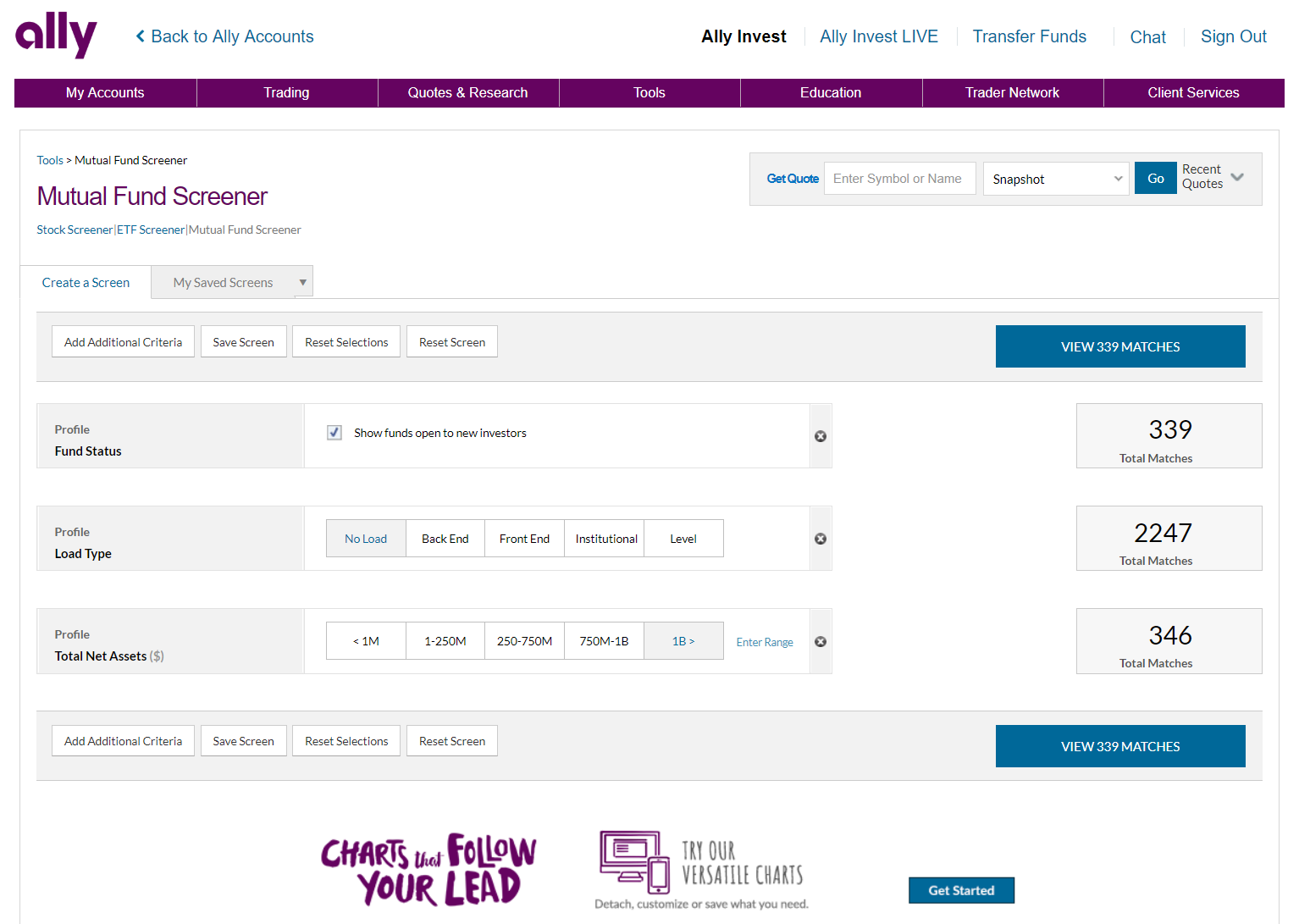

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

How can I invest Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need is the right knowledge and tools to get started.

First, you need to know that there are many ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Some options may be better suited than others depending on your risk tolerance and goals.

Next, research any additional information you may need to feel confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Forex and Cryptocurrencies are great investments.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There might be restrictions or a minimum deposit required for certain investments.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts require security. It's vital that you protect your data, assets and information from unwelcome intrusion.

First, make sure that your platform is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

It is important to be familiar with the terms and conditions of any online investment platform. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, make sure you do thorough research about the company before investing. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. You should also be aware of the tax implications when investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.