Financial options are derivatives that give investors the opportunity to buy or sell an underlying financial asset at a specified price and at a specified time. An option's value is determined by the underlying asset. This could be stocks, bonds or currencies, or even a commodity. Options can protect an equity portfolio against price falls or increase the return of investment. They can be used to speculate on financial markets and minimize the risk of losing capital. You should be aware of the potential risks involved with these investments.

Options are not for everyone but they can make a good part of a portfolio. Some investors even try options writing. For example, a corn grower may buy a put option. It is not a legal agreement, but a way to sell his crops. This allows him the opportunity to profit from favorable interest rate changes.

The price of an options fluctuates in general. While the premium paid to an option might be subject to transaction fees, the actual option value will typically exceed the original option value. Volatility in underlying markets may also have an impact on option prices.

Some examples of the most common types of financial options include call and put options. Call options are a way to sell or purchase an underlying asset at a fixed rate. Call option holders are not required to buy an asset unlike other types of options. An investor who buys a call option expects that the underlying asset will rise or fall in value, which limits his loss. Similarly, a put option gives the option holder the right to sell an underlying asset at a fixed or rising price.

A futures contract is another option. A futures contract, which is based on the price of an underlying commodity, is another type of derivative. These contracts are usually written by major financial institutions. The rate option writer will pay the difference between the cap rate and the actual rate. If the rate exceeds the cap, he is required to pay a cash sum.

Real options are a rarer type of financial instrument. Real options enable the company to make a financial decision, which is different from other types. They give management the ability to reject a decision and make an investment.

A collar is another type of option. Collared are meant to protect investment from any adverse movement. The collar purchaser has the option to purchase another, less expensive option. Leverage can increase the premium's value, but it can also lead to a significant financial loss.

Finally, spreads. Spreads enable you to buy and sell several options contracts simultaneously. Because options are not traded on open exchanges, they are considered over-the-counter. Brokerage companies must approve traders.

FAQ

Cryptocurrency: Is it a good investment?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

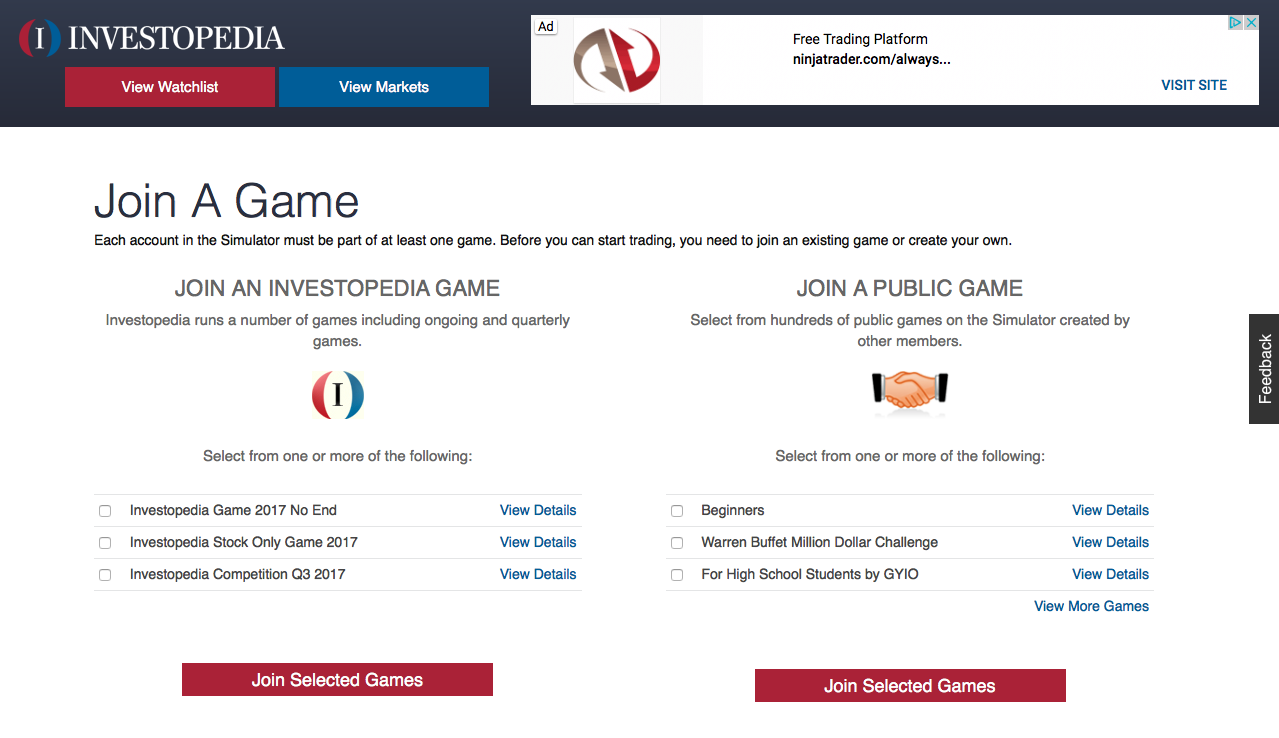

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many offer interactive tools to help you understand how trades work.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Which forex trading platform or crypto trading platform is the best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it is important that you understand the risks as well as the rewards.

Which is harder forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Knowing how to spot price patterns can help you predict where the market will go. It is important to trade only with money you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Frequently Asked questions

What are the different types of investing you can do?

Investing is a way to grow your finances while potentially earning money over the long term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into preferred and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

It is important to do your research before investing online. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.