There are many options when it comes to buying cryptocurrency. Some may be easier than other. Before buying any crypto, do your research.

A crypto-exchange is a platform where you can buy and sell crypto. There are many types of crypto exchanges. Most allow you to connect your bank account to purchase and sell. This makes it easier.

Your exchange should have strong security features. The exchange should have a reliable customer care department. You should be able to get an answer to your questions about purchasing a particular coin.

The exchange you choose should have a decent selection of cryptocurrencies. You should be able to choose between popular coins like Bitcoin and less well known altcoins. Transaction and administrative fees are common for cryptocurrency exchanges. Check with your bank before opening an account. Although they are an option, credit cards are not usually the best method to buy coins.

The exchange you choose should have slick user interfaces. A platform that is simple to navigate can help beginners. Access to a variety of payment methods should be possible. These payment methods include bank transfer and credit card. In some cases, you'll be able to buy and sell crypto with your bank's debit card.

The most important feature of a good exchange is their customer service. The exchange should be able answer your questions regarding the purchasing process and general policy. It must also be covered by private insurance. If your exchange is not insured, you may be subject to serious damages in the event of a breach of security.

There are many other factors to be aware of. You should also consider the fact that the best time to invest in crypto can differ from one area to another. A cryptocurrency isn’t backed any type of bank so your capital might be at risk. There are also tax rules that apply to trading and purchasing cryptocurrencies.

The purchase of a cryptocurrency, such as Bitcoin, is a significant decision. Therefore it's important to research the best way to go about it. You'll be pleasantly surprised at the number of options you have whether you want to buy your first bitcoin, to invest or just diversify your portfolio.

However, it is possible to do things the old-fashioned fashion. There are many options to buy and sell cryptocurrencies at banks and brokerages. Check with your bank to determine if you can deposit or withdraw the coins you are interested in. It is possible that you will have to pay an additional fee depending on which bank you use.

Another popular platform is payment apps. These platforms have crypto buying capabilities. One of these apps is Celsius. Before making a final decision, you should carefully review the fees and features of your chosen app. Most apps are simple to use, and they have the most recent information on where you can buy crypto.

FAQ

How do I invest in Bitcoin

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You only need the right information and tools to get started.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. To stay on top of crypto trends, keep an eye out for market developments and news.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Are forex traders able to make a living?

Forex traders can make good money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Is Cryptocurrency a Good Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

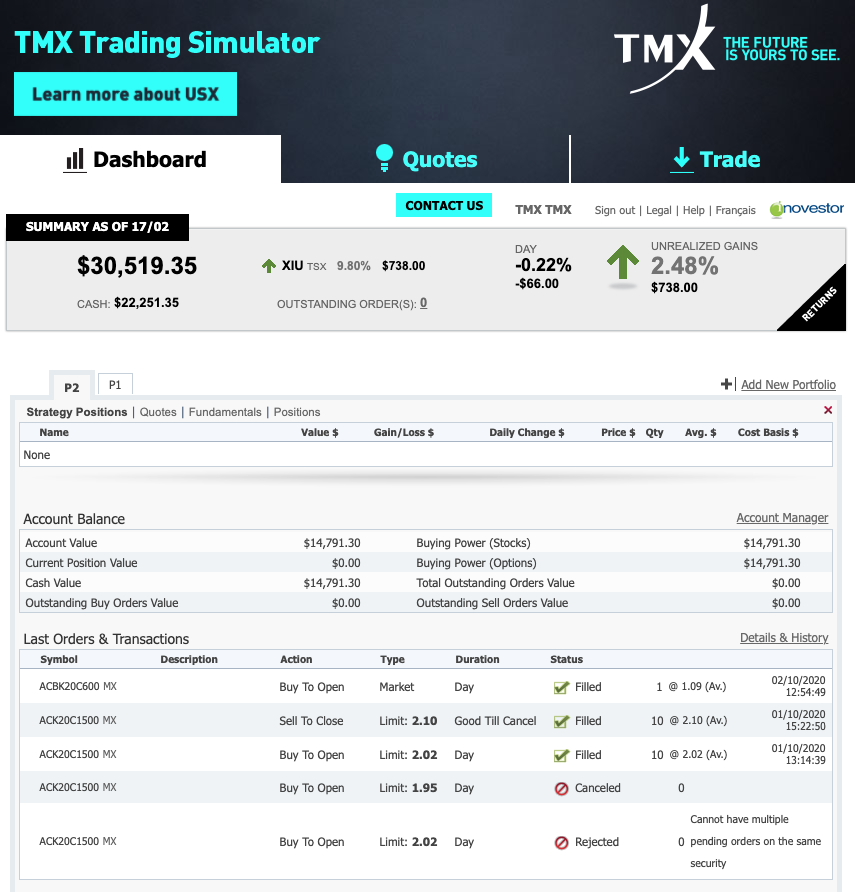

Which trading site is best suited for beginners?

It all depends on your level of comfort with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Also, you should only trade with money that is within your means.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Where can i invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

You can also invest in real estate. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you are comfortable with the risk, you can trade online using day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Online investment accounts should be safe. It is vital to secure your assets and data against any unwelcome intrusions.

First, make sure that your platform is secure. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Third, you need to know the terms of your online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, do your research on the company you're considering investing with. Make sure they have a solid track record in customer service. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. Finally, be sure to know about any tax implications that investing online can have.

These steps will ensure your online investment account is protected against any possible threats.