The Commodity Futures Trading Commission (CFTC) is a federal agency that regulates derivatives markets, such as options and futures. Since its founding in 1974, CFTC have been responsible for the supervision of derivative markets in the United States. Its mission, to protect the rights of investors in financial instruments by enforcing the rules that govern regulated markets, is to ensure their protection. There are 13 CFTC operating divisions. Each division focuses on a particular industry or market. Currently, the CFTC plans to appoint four women members of its commission.

Stability of the markets is a key aspect of the CFTC’s mission. This includes the development and implementation of rules that reflect current developments in the various industries. Commissioners serve on committees that cover different areas of risks, such as trade and global market structure. These groups meet on a regular basis to discuss issues related market structure, technology, and other topics. They have issued reports on issues related to algorithmic and high frequency trading, as well as market access, and pre-trade functionality.

During financial crisis, the CFTC grew its responsibilities. New technologies, such as machine learning and distributed ledgers, have the potential to impact the CFTC's regulations. To prepare for these changes, the agency has set up a new office to help with rule-making and other data-driven policymaking.

One of the biggest issues facing the CFTC is the emergence of cryptoassets. The agency and the Securities and Exchange Commission (SEC) are gearing up to regulate the markets. Russ Behnam (CFTC Commissioner) recently spoke to the Georgetown McDonough School of Business about the history of CFTC, and its role within the financial sector. He also discussed the Dodd-Frank Act, and outlined the new structure of the CFTC.

The CFTC also faces the problem of how to apply its statutory authority in digital assets. The agency used to have limited resources in the past to investigate violations of its regulations and enforce them. Recently, however, the agency has increased its personnel and funding to better address the problem. As such, it is likely to apply heavy scrutiny to these types of transactions. During a hearing held in February, Senator Peianne Boring, the chairwoman for the Senate Agriculture Committee demanded more guidance about the CFTC’s position regarding digital assets.

The CFTC is a vital player in regulating financial markets. The agency has been working together with foreign regulators on how the cross-border application CFTC swaps regulations would impact global markets. A CFTC Commissioner advocated the creation of an Office of Data and Technology. This would leverage the expertise of technology experts at the agency to assist the CFTC in better understanding and implementing its regulations.

Commissioner O'Malia is a pioneer in advancing the technology used to help the CFTC's mission. Among his many accomplishments, he reestablished the CFTC's Technology Advisory Committee. Through his leadership, the TAC has met several times to discuss the latest trends in technology and its impact on the markets. Recent efforts of the committee include reports on algorithmic high frequency trading and pre-trade digital asset functionality.

FAQ

Frequently Asked Questions

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into preferred and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which trading site is best for beginners?

It all depends on how comfortable you are with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

What are the advantages and drawbacks to online investing?

Online investing is convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Some investments may also require a minimum investment or other restrictions.

Where can I invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

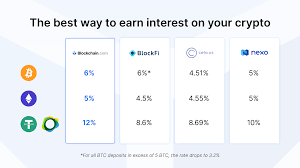

One option is to buy real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Which is best forex trading or crypto trading?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection starts with yourself. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Never respond to unsolicited phone calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Don't forget to remember that "Scammers will attempt anything to get personal information." Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

Also, it is important to invest online using secure platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.