Most active stocks are the ones that trade the most frequently during a given day. This list is also commonly referred to as a volume leader and is compiled by stock exchanges like the New York Stock Exchange (NYSE) and Nasdaq on a daily basis.

Today's Most Active Stocks

Most active stock list help investors decide which stocks to buy and sell at a specific time. These lists can easily be analyzed over weeks or months to help determine market direction.

These can be used to identify short-term trading opportunities and long-term winners. They can be triggered by news and earnings reports that cause stock prices to move in any direction.

The stocks with high average daily trading volumes (ADTV) are the most active on a daily basis. Individual investors who trade intraday often need to know this important metric.

These stocks with high volumes have a lot more liquidity which allows traders to quickly access and exit positions without significantly affecting prices. It makes it much easier for market participants in placing orders with brokers.

A wide variety of factors can influence the most active stocks, including economic data, corporate news, and policy developments. It can be a catalyst to make the stock move if a company announces an acquire or buyback.

Similar to the above, if an earnings report is coming out that is expected to increase the stock's price, it will be among the most active stocks for the day. The news can also cause the stock to drop if it is negative.

Most Active Stocks nyse

Each day, the New York Stock Exchange compiles a list with all of the most active stocks. It also includes other categories like most active by dollar volume and share. To find the best investment opportunities, you can examine these most active stocks lists on a weekly (or monthly), quarterly, or annual basis.

Most Active Stocks nyse tend to be the most traded stocks daily on NYSE and NASDAQ. They are updated each day after market close and can be accessed with a free account.

Stock volume leaders are an excellent choice for day traders or investors who want stocks with strong liquidity and momentum. They are also a great option for long-term, long-term buyers who wish to invest into the future of a particular company.

These Stocks are More Active Than Others.

Many active stocks are driven by economic news or corporate announcements that cause market pressure to purchase or sell the stock. Investors may be attracted by a dramatic price drop.

For example, if a company announces a big merger, it can create a surge in trading volume. This increase can last a few days because other investors may get caught up in the hype, and jump on the stock.

Stock volume leaders in other countries include those that announce a major event, such an earnings report. These announcements can cause the price to rise or fall in response to news that affects the company's profitability and growth potential.

FAQ

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

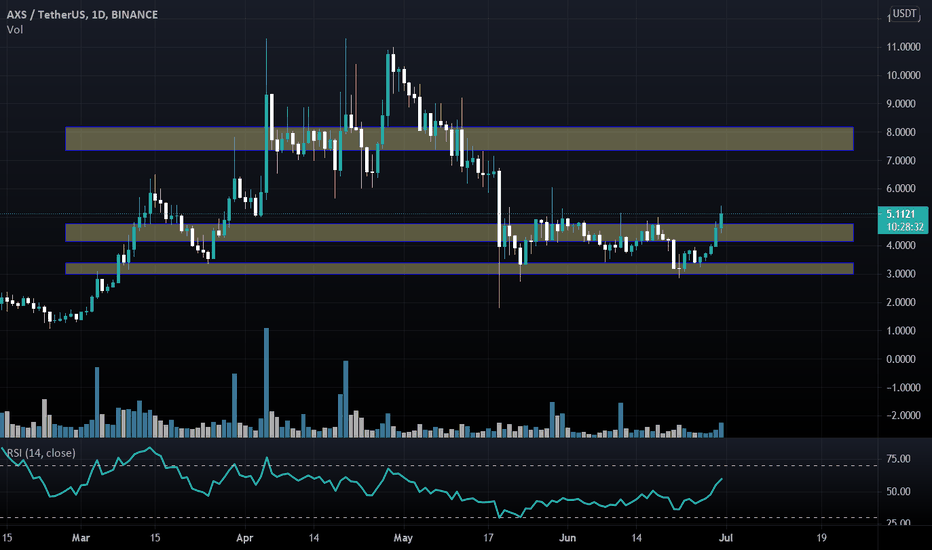

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Where can I find ways to earn daily, and invest?

It can be a great method to make money but it's important you understand all your options. There are many other investment options available.

One option is to buy real estate. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

What are the advantages and drawbacks to online investing?

Online investing has the main advantage of being convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing comes with its own set of disadvantages. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important for online investors to be aware of all the investment options. Investors have many choices: stocks, bonds or mutual funds. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There may be restrictions on investments such as minimum deposits or other requirements.

What is the best trading platform for you?

Many traders may find it challenging to choose the best trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also offer an intuitive and user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Can forex traders make any money?

Forex traders can make a lot of money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

When you invest online, it is crucial to do your homework. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Conduct due diligence checks to make sure that you're receiving what you paid for. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.