OpenSea is an open-source marketplace that lets users trade, buy, and sell non-fungible tokens. This website is the largest NFT exchange on Ethereum.

OpenSea started out as a way to mint CryptoKitties. Now, OpenSea offers an NFT Market, which provides a platform to buy and sell digital assets. OpenSea allows traders to purchase and sell NFTs using cryptocurrency. This drastically reduces transaction fees.

OpenSea's major advantage is that creators get NFT free of charge. This is significantly more than rivals like Rarible. OpenSea requires creators to pay gas costs on the Ethereum network and a 2.5% marketplace fees.

OpenSea will require you to have an Ethereum wallet and an NFT on the Polygon chain in order to use it. The Polygon Chain is a sidechain solution which uses the Ethereum blockchain to combat ethereum’s high gas prices.

First, connect your ETH wallet with the Polygon chain. After that, open the wallet for trading on Polygon. You will then need to sign a transaction in order to complete your purchase. Once you have completed this, you can begin browsing the NFTs in Polygon and then making your purchase.

After you've selected the NFT you wish to purchase, you can view its price history. You can filter NFTs according to their price, type, or other parameters to refine your search.

OpenSea's NFT buying process is simple and fast. Just select the NFT that you want to buy, select the type and then click "Buy".

The price history for the NFT that you are interested in will be displayed. You also have access the transaction history. You can also buy the NFT using your preferred payment method.

If you have a Cmorq wallet, you can also list NFTs on OpenSea. After you log in with your Cmorq account, you'll find all the NFTs in a folder called “Hidden”. The system assumed that the NFT was private. Once you are ready for the sale of the NFT, the system will allow you to remove the NFT from the hidden folder and place it on the market.

NFTs are best sold on the OpenSea market. Once you have created your profile on OpenSea you will be able sell NFTs, and you can track their activity and status.

You will need to create an NFT listing. Also, specify the price at which you would like to sell them. You can also select the sales method that you want to use and decide whether you want your NFTs visible on your profile.

FAQ

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases it's crucial to do your research before making any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it is important that you understand the risks as well as the rewards.

What are the advantages and drawbacks to online investing?

Online investing offers convenience as its main benefit. You can access your investments online from any location with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing has its limitations. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

You should also be aware of the different investment options available to you when investing online. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

Which is the best trading platform?

Many traders find it difficult to choose the right trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

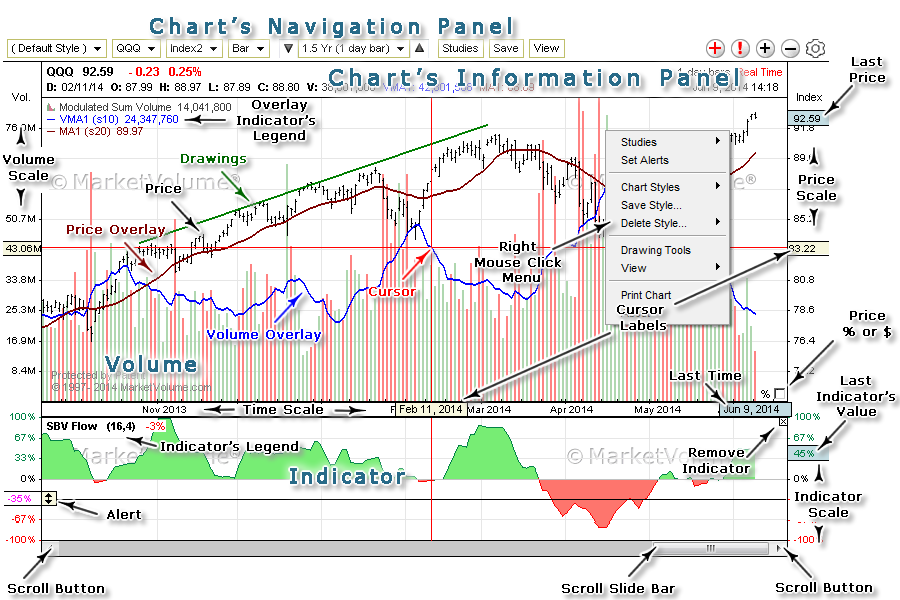

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? These factors will help you narrow down your search to find the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Most Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are many options.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Which is more difficult, forex or crypto?

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex has been around since the beginning and has a solid trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

When investing online, research is essential. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. Be skeptical of promises of substantial future returns or future results.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Conduct due diligence checks to make sure that you're receiving what you paid for. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!