ImmutableX allows you to trade NFTs with zero fees using a layer-2 scaling protocol. ImmutableX relies on a Zero-Knowledge Rollup ZK contract to validate trades. This transaction takes much less time and requires far less data. Furthermore, the contract keeps the assets associated in the transactions.

Immutable X has a large community and is gaining steam. It has over 55,000 Discord followers and 225,000 tweeters. They also raised seed funding. They have received funding from Coinbase, Galaxy Digital and Nirvana Capital.

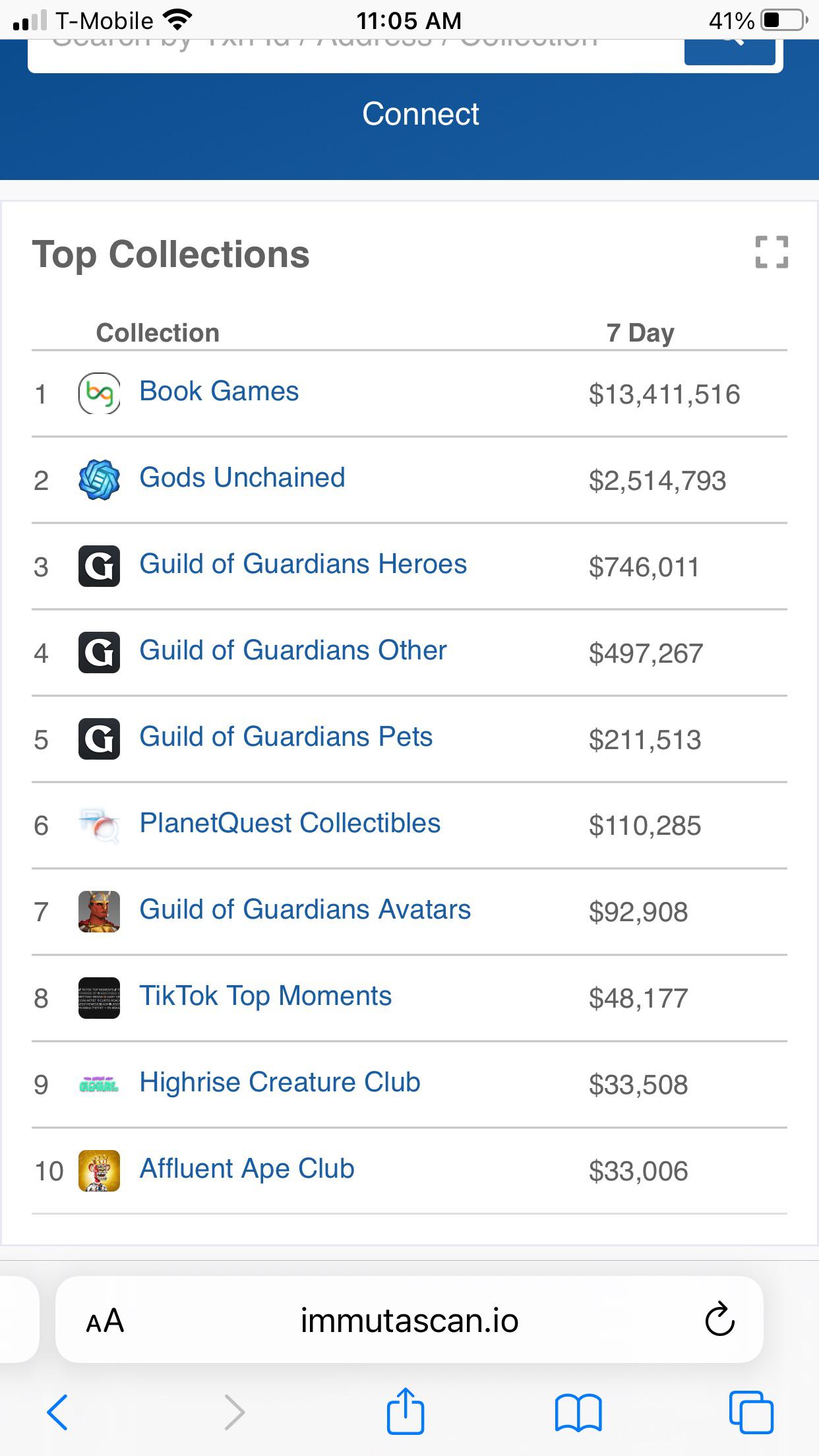

Immutable X is a collection of many digital assets. Ember Sword, Illuvium and Guild of Guardians are just a few of the available games. The titles are currently in beta. ImmutableX games are due to be released within the next months. These games will be more popular than ever.

Immutable X provides a layer-2 solution to NFTs on Ethereum. They offer developers easy access to building an NFT project on the platform. The Immutable X SDK allows users to create a NFT-project in a matter of hours. Additionally, Immutable X API makes integration easy with many commercial platforms.

You can create a dynamic and secure trading UX with the Immutable X marketplace. Users can order on one global order book or in peer-tospeer trades. Immutable X can also be carbon-neutral. The platform is partnered with Trace and Cool Effect to offset carbon emissions. Register now to join this program.

Immutable X has many tools that allow developers to create innovative features. For example, developers can develop NFTs with Immutable X through the Typescript SDK, which provides type access to the Immutable X API. By using this SDK, you can simplify the design of your NFT projects.

Immutable X offers trades on other NFT exchanges, which is one of the most attractive features. The link screen allows you to authorize each transaction. Sign in with your Layer 2 wallet to authorize transactions. Once you confirm the transaction it will be batched on the ImmutableX network and added onto the blockchain. You can also purchase IMX tokens on the open market.

As a user, you can stake IMX to receive a percentage of the revenue that the network will generate. You can use the IMX token to pay transaction fees and to vote on token-related proposals. IMX currently trades at $224 million in the overall market. The company recently announced that it plans to expand its platform. More updates can be expected soon.

Immutable X's venture fund is $500 million. In addition, the company has a staking reward pool that will receive contributions from all of the transaction fees. Every day, the staking rewards pool receives a percentage of all points earned by users.

FAQ

What are the advantages and drawbacks to online investing?

Online investing offers convenience as its main benefit. With online investing, you can manage your investments from anywhere in the world with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, online investing does have its downsides. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Some investments may also require a minimum investment or other restrictions.

Which trading site is best suited for beginners?

It all depends on how comfortable you are with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. It is important to trade only with money you can afford to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Understanding the different currency conditions is crucial.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Which is harder forex or crypto?

Forex and crypto both have unique levels of complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. A good understanding of technical indicators is essential to identify buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Cryptocurrency: Is it a good investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

There are also potential gains if one is willing to risk their investment and do some research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which is safe crypto or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protecting yourself starts with you. You can prevent yourself from being duped by learning how to spot scams, and how fraudsters work.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Never respond to unsolicited phone calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Lastly, always remember "Scammers will try anything to get your personal information". Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

Secure online investment platforms are also essential. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.