OTC stock can be used to describe a wide range of securities not listed on major stock exchanges. These investments can be risky. However, these investments have the potential to yield tremendous returns.

OTC stocks are an excellent way to diversify you portfolio. OTC stocks can be an excellent way to acquire a stake in a company that is growing quickly at a low cost. But they have their limitations. They are vulnerable to fraud and scams because they are not properly regulated. These companies are more difficult to buy or sell because they are less liquid.

Investors love penny stocks because you can buy large quantities of shares at a low price. This can be especially true for investors who want to earn a quick profit, but it can also lead to big losses if a company goes bust. You need to research penny stocks and understand the risks involved in order to avoid losing your money.

Some companies trade on OTC to avoid having to pay the high listing fees of larger exchanges. This means that some companies might not be able to meet the listing requirements for larger exchanges. It is possible that companies do not have the capital required to meet the volume or float requirements of larger exchanges. OTC markets offer lower entry barriers that can be attractive to firms that do not meet the strict requirements for mainstream exchanges.

There are several OTC stocks to choose from, including penny stock, mid-tier, and midsize companies, as well cryptocurrencies. Each type of OTC stock has its own risks and benefits. For instance, a mid-tier stock is a great option for young, growing companies in the US. To ensure that you invest in a long-term, reliable company, it is helpful to understand the terminology and classifications of OTC stock.

There are many types of OTC stock, however they are less well-known. One such type is the gray marketplace, which is an OTC-only market, but can be used to invest in smaller businesses. Another is the pink sheet, which is a unique way to sell stock. These are more risky than other OTC options, even though they aren't regulated.

OTC stocks usually have wider bid/ask spreads, which is a departure from traditional stocks. The market size and the number of stocks that are available to trade affect the bid-ask spreads. When fewer stocks are available for trading, it's easier to manipulate the prices. It is possible to order stock at any price, but you may have to wait longer before it arrives.

OTC markets are not as liquid and accessible as major exchanges but they can still be a viable option for investors. It can provide a great way for you to diversify your portfolio while also making a profit, despite the risks.

FAQ

Frequently Asked questions

What are the four types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into preferred and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

What are the pros and cons of investing online?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, there are some drawbacks to online investing. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important for online investors to be aware of all the investment options. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Which trading website is best for beginners

All depends on your comfort level with online trades. You can start by going through an experienced broker with advisors if this is your first time.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

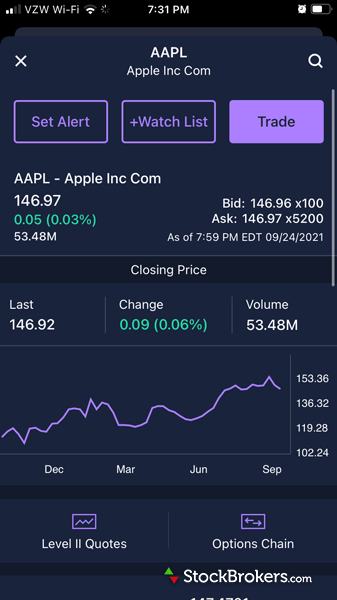

If you are more confident and have some knowledge, you can trade your investments independently on many websites. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which platform is the best for trading?

Many traders can find choosing the best trading platform difficult. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down your search to find the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Forex traders can make money

Forex traders can make a lot of money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Security is essential when investing online. Online investments pose risks to your financial and personal data. Take steps to reduce them.

Be mindful of whom you are dealing with when using any investment app. Reputable companies have good customer ratings and reviews. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. To prevent a breach of one account, it's smart to have different passwords for each account. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!