You can use a brokerage account to purchase and sell securities, including stocks and bonds, through a licensed brokerage company. Brokerage companies will execute your orders. They offer lower fees, more user-friendly interfaces, and better analytical capabilities to make trading easy. The brokerage firms offer many account types that suit different investor types.

For do-it-yourself investors, an online trading account may be the best option. These brokers offer stock trading services at no additional cost and a secure interface for placing trades. It is important to know how to choose a brokerage company.

Full-service brokers may offer more investment guidance but will charge higher fees. Online brokerages are more flexible and have lower fees. It is important to choose the best brokerage firm for you. A brokerage firm should meet your investment goals, short and long-term goals, investing style, and investment style. In addition, you should discuss your compensation model with your financial advisors.

Some brokerages offer inexpensive custodial account options for teens. This account allows children below the age of 18 years to trade stocks. They also have a low minimum balance, making them a good option for beginner investors. Parents should be cautious with allowing their children access to online trading.

If you think about opening an account online for your child to trade, educate them about the risks involved and how to safely manage their money. Make sure they know what to do when they turn 18. They should be able to trade in the evenings and have limited access to online investments. Avoid trading low-volume stocks.

A minimum deposit of $100 is required to open an E*TRADE bank account. E*TRADE Bank is a free online banking service that allows you to transfer funds directly to the account. You can also access their mobile application to make purchases and track your balance. Withdrawals can be made tax-free. An E*TRADE broker can also offer you a wide range of retirement and savings plans.

Before you open an online trading account, it is important to decide whether you prefer a full-service brokerage or an online brokerage. They will all have similar trading platforms but will have different fees and costs. Some brokerages also offer more services.

Look at the account's size and level of support before you sign up for a brokerage. Some firms will require you to sign an online agreement before they'll allow you to trade. Some companies will require that you sign an online agreement in order to be able to use the service. You should be prepared for questions about your trading goals, regardless of the firm you choose.

For those who want to get started in the stock market, it's best to get a firm that offers commission-free stock trades. Ally Invest is an example of one such company. Fidelity or Charles Schwab may also be available. These brokers provide commission-free stock trading and are regulated under the Securities and Exchange Commission.

FAQ

Which trading platform is the best?

Many traders may find it challenging to choose the best trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Which is better, safe crypto or Forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

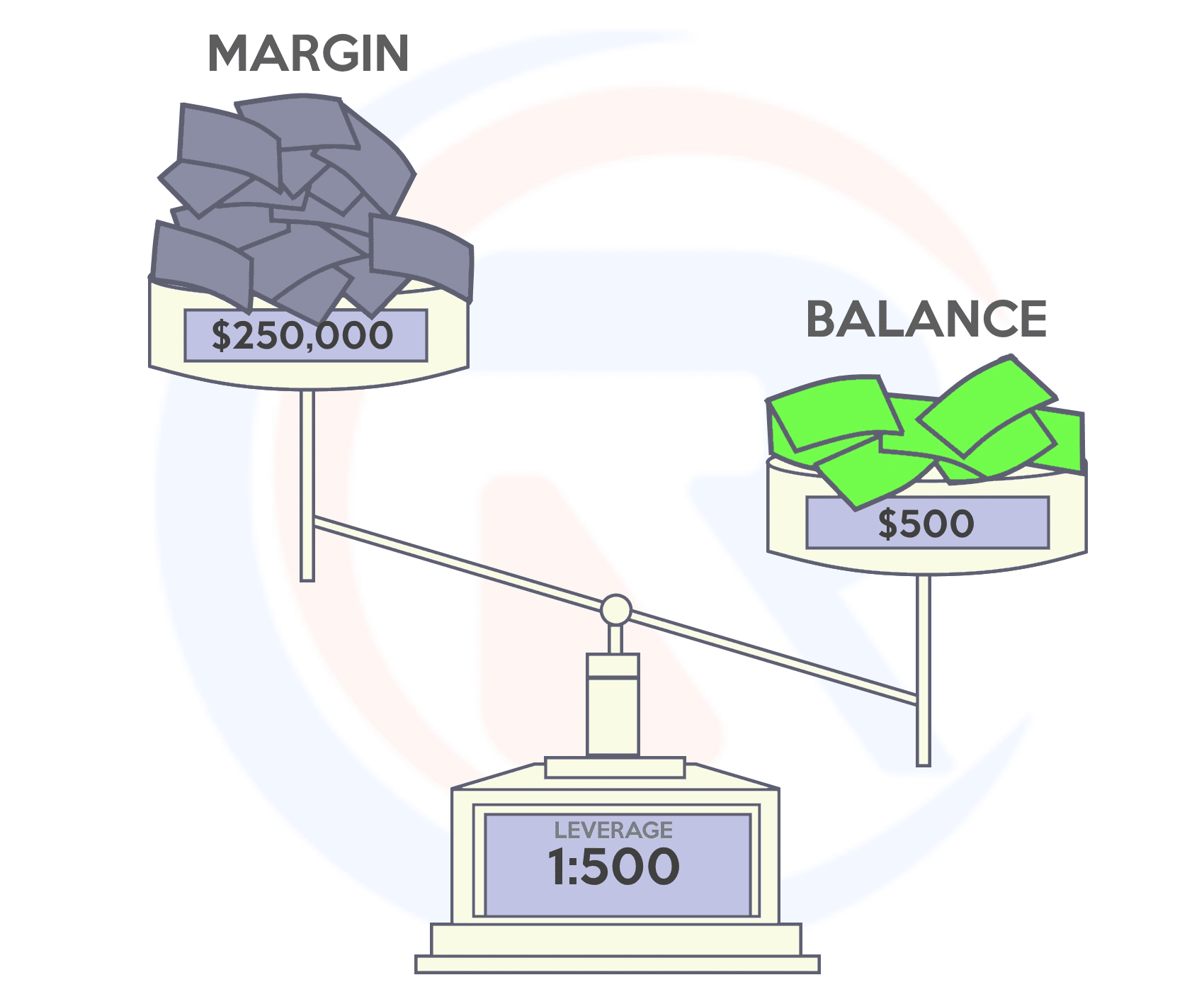

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which trading website is best for beginners

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

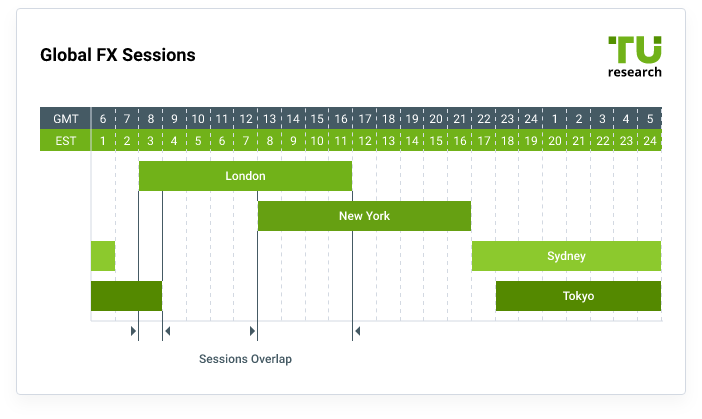

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

It is important to research both sides of the coin before you make any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important that you understand the different trading strategies available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is investing in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Online trading is possible if you're comfortable with the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Forex and Cryptocurrencies are great investments.

You can make a fortune trading forex and crypto if you take a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Safety is a must when it comes to online investment accounts. It's essential to protect your data and assets from any unwanted intrusion.

You want to ensure that the platform you use is secure. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

Secondly, always choose strong passwords for account access and limit your log in sessions on public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

It is important to be familiar with the terms and conditions of any online investment platform. Make sure you are familiar with the fees associated with investing, as well as any restrictions or limitations on how you can use your account.

Fourth, be sure to research the company where you plan on investing. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, you should be aware of tax implications for investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.