It is dependent on the financial instrument and exchange that the commodity is traded, so the trading hours can vary. There are many commodities that can be traded, including crude oil as well as gold, silver and wheat. But other items such ETFs or commodities index contracts cannot be traded on weekends. The daylight savings time can affect trading hours.

Most commodities are traded in futures markets. This means that the prices of a particular commodity will be influenced by demand and supply, but other factors also play a part in the price of the commodity. Geopolitical or economic factors can also influence supply and demand, for example. Organization of Petroleum Exporting Countries (OPEC) is the main decision-maker in determining the price of oil. It has Saudi Arabia as its top decision maker. OPEC can also agree to reduce oil output, which will have an impact on the price.

You can trade commodities through options, stocks, futures and CFDs. Investing in commodities can help to reduce risk and could yield positive returns. However, it is important that you remember that commodities investments can be volatile and have high risk for beginners. It is also important to use a risk management system, such as stop loss orders. You can access a list containing all the commodities available for trading via the Internet at Trader's Resource Center.

Commodities can usually be traded between 10:00 AM and 5:00 PM. However, in winter months, trading hours can be extended up to 11:00 PM. On certain days, the morning session may be closed because of national and regional holidays. The evening session is typically also closed. These hours can bring more volatility to the price of a particular product.

The pre-opening session is at 9:00 a.m., and the open outcry will remain at 9:30 a.m. Until the evening session is closed at 11:55 p.m. During the afternoon, you may find some trading in energy-related commodities such as crude oil.

Trading during after-hours can be less active than regular trading sessions. Trading after-hours can provide greater liquidity and opportunities for strategic trading. Trading after-hours can bring you wider spreads and less liquidity. These factors can make it more difficult for you to place orders and transfer your money.

While the CME Group has increased its trading hours in recent years, many other exchanges have made plans to follow their lead. For example, the Kansas City Board of Trade is planning to extend its trading hours to the same time as IntercontinentalExchange Inc., and the Minneapolis Grain Exchange is planning to do the same.

Another major factor in the timing of commodity trading hours is the timing of the stock market. The stock market usually opens at the same time every day. If there are large volumes of activity during the opening bell, prices can shift quickly. It is crucial to know the support and resistance levels. Also, be aware of macroeconomic sentiments as well as publicly released output figures.

FAQ

Which trading platform is the best for beginners?

Your level of experience with online trading will determine your ability to trade. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Which forex or crypto trading strategy is best?

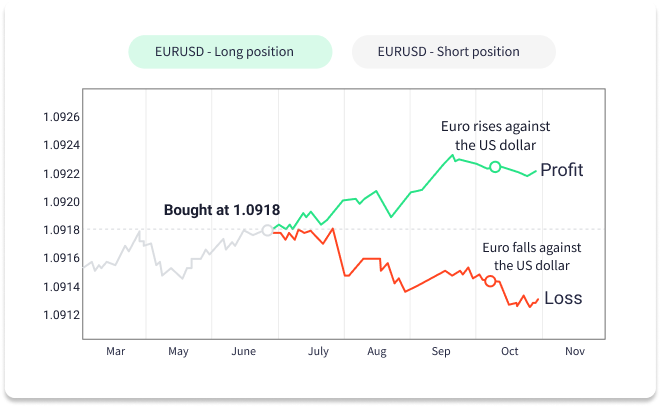

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

How can I invest Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. To get started, you only need to have the right knowledge and tools.

The first thing to understand is that there are different ways of investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Knowing how to spot price patterns can help you predict where the market will go. Also, you should only trade with money that is within your means.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protecting yourself starts with you. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Do not answer unsolicited emails and phone calls. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Don't forget to remember that "Scammers will attempt anything to get personal information." Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

Secure online investment platforms are also essential. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before you make any investment, read and understand the terms of any website or app that you use.