Stock trading apps that are free for investors can be a great tool. They allow you to trade stocks, options, ETFs and mutual funds, without having to pay any fees. These apps may not be as robust and reliable as desktop-based ones.

Commission Free Trades

Some of the top brokers, including TD Ameritrade and Charles Schwab, offer commission-free stock trading. They often offer other types of commission-free investing, as well, including mutual funds and exchange-traded funds (ETFs).

Despite this, some brokerages will charge you fees for certain services, such as margin lending or broker-assisted trades. Although these fees aren't prohibitively expensive they can add up very quickly.

Moomoo

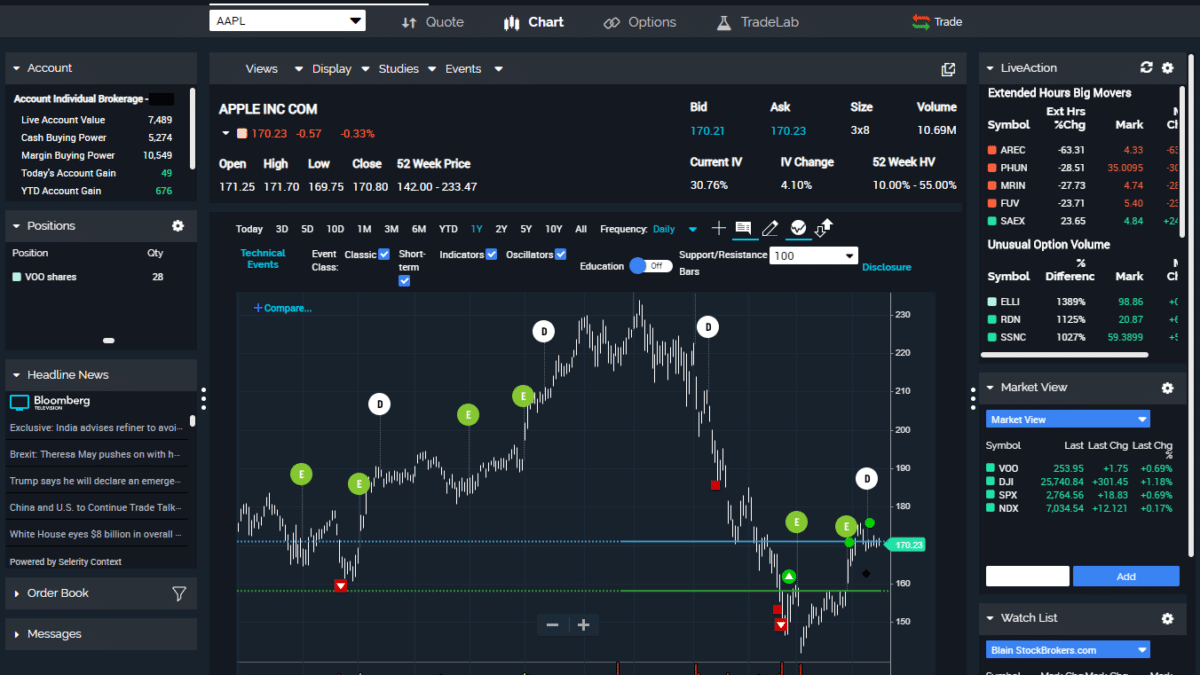

The all-in-one app for investing is popular among Asian investors. It recently launched in the US. It offers commission-free trading and robust charting tools for stocks, options, and ETFs.

It allows you to trade margin, which doubles your expected returns while eating into your principal. Moomoo gives away 15 stocks when you open a new account and make a qualifying payment.

Public

This app lets you trade in stocks, ETFs, cryptos, and more. It is also a great way to connect with other investors, and learn from them.

Yahoo Trading

If you are just beginning to learn about the stock market, you might consider signing up for a premium service. You will get access to portfolio tracking and real-time stock quote updates. Although these services can be a great deal, it is important to research the pros and cons of each service before you commit.

Webull

Webull is an affordable stock platform that can be used by both beginners and experienced investors. It offers commission-free trading and free Level 2 market data, which allows you to get more insight into the activity of the stock market than you'll find on many financial data sites.

You can also choose from a variety of trading tools including customizable stock screens or real-time alerts. To help you evaluate whether the app is suitable for your investment style, goals and objectives, they also offer a free stock trade demo.

Moomoo

This all-in one investment platform allows investors to track stocks, options, or ETFs through real-time market information. They have a powerful stock charting tool that allows you to see historical trends and analyze current events.

It also has a robust portfolio manager that can help you create a customized investment portfolio to meet your specific needs.

A portfolio that includes equities, bonds and mutual funds can be diversified.

Investors seeking to grow their knowledge and improve portfolio management skills should also consider other free resources. Stock investment newsletters, educational articles, and other resources can be helpful in making informed decisions about your portfolio.

You can also use a stock trading app in your classroom if you are a teacher to teach students about investing and stock markets. This app can be used to teach financial concepts and economics without the need for traditional textbooks.

FAQ

Which forex or crypto trading strategy is best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

It is important to research both sides of the coin before you make any investment. Diversification of assets and managing your risk will make trading easier.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. To help manage their investments, traders may use automated trading systems or bots. Before you invest, make sure to understand the risks associated with each strategy.

Which is harder forex or crypto?

Each currency and crypto are different in their difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Are forex traders able to make a living?

Forex traders can make a lot of money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which trading site is best suited for beginners?

It all depends on how comfortable you are with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many offer interactive tools to help you understand how trades work.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

What is the best trading platform for you?

Many traders may find it challenging to choose the best trading platform. It can be confusing to choose the right one, with so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. The interface should be intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. This information will help you narrow down your search and find the best trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protecting yourself starts with you. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Do not respond to unsolicited emails or phone calls. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Never forget that scammers will try any means to steal your personal data. Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

It's also important to use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before you make any investment, read and understand the terms of any website or app that you use.