Commodity currency pairs are used for describing currency pairings of countries that export raw substances. Not only does the US Dollar count, but so does the Canadian Dollar.

In general, commodity currencies are highly correlated to the country's import-export trade. This is particularly true for emerging economies that heavily rely on pricing local raw materials. However, there are other factors that can influence currency values. The economy's GDP plays a role as well. People may not have as many resources to purchase goods if the economy slows down.

Futures contracts is one of the most commonly used ways to trade commodities. Futures contracts are an agreement between buyer and seller that the commodity will eventually be purchased at a specific price.

A forex commodity is a basic good, such as oil, which is traded for other goods or currencies. They are usually used for daily purposes but can also be traded on speculative market. Many strategies can be used by forex traders to trade commodities. Some traders are focused on analyzing the demand and supply for major commodities. Some trade more directly, like buying stocks in corporations related to commodities.

You need to be prepared because commodity markets can be unpredictable and abrupt. Check with government departments or private research firms to find out about the demand and supply of commodities. Another option is to search for index funds and mutual fund that are invested in companies in the commodities industries.

A step-by-step trading plan is essential for traders who want to make a profit from the commodity forex pairs. They must be disciplined and stay on top of the market. They should also devise an exit strategy.

Profitable commodity currency pairs are possible, but it's important to stay focused and understand all the variables that can affect them. Inflation, deflations, tariffs and armed conflict can have an effect on commodity prices. Oil prices have dropped 30% over the last month, for example. As such, it is important to know how oil affects your own currency.

Other factors that could influence commodity prices include economic protectionionism, subsidized manufacturing, and environmental preservation. There are also industrial regulations that could affect the production of commodities. It is important that you consider the country’s economic performance, as well the price of raw material.

Even though commodity currencies tend to have low liquidity they can be manipulated by traders. Speculators can move derivatives prices by purchasing assets, hedging them, and then buying them back at a later point. Hedging is not for everyone.

Traders should be aware that there are differences between major commodity currencies and minor commodities. Minor currencies can be correlated with a country’s natural resources but have not shown the same degree sensitivity to raw matter pricing.

FAQ

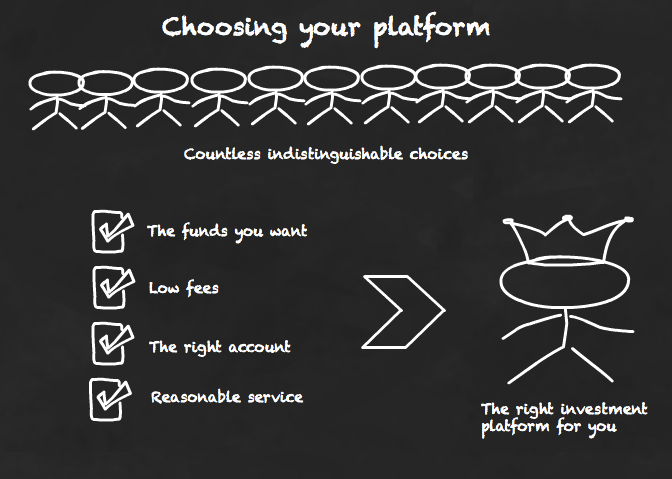

Which trading platform is best?

Many traders find it difficult to choose the right trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. The interface should be intuitive and user-friendly.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down the search for the right platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

How do forex traders make their money?

Yes, forex traders can make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Which is safe crypto or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which trading site is best suited for beginners?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Is Cryptocurrency Good for Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protect yourself. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Do not answer unsolicited emails and phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Don't forget to remember that "Scammers will attempt anything to get personal information." Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

Secure online investment platforms are also essential. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before you make any investment, read and understand the terms of any website or app that you use.