Day trading is a great way to make extra money but it can also be very risky. Day traders trade stocks in the hopes that stock prices will fall in their favor. This is called momentum trade. This is how you maximize your profits.

The main reason for success in day trading is timing. You can identify the best times in which to buy and/or sell stocks by using a variety strategy. You can also leverage your gains to make more.

You need to have patience in order for your business to be successful. It takes time learning the ropes of the markets. If you're willing to practice and put in the effort, you can become an effective day trader.

Make sure you have enough capital to turn a profit. You should determine how much money you can afford to invest in your day trading account before you begin. To start, you will need at least $10,000. You can borrow money to open a day trading account. This is only possible if you know your risk tolerance. You will most likely end up in financial trouble.

An online brokerage that provides comprehensive and detailed trading tools may be a good option. A company that allows stock trading without commissions is also a good option.

The first thing you should do is to get educated. This means reading as much information as possible about the market. You will find many tutorials online that can help you get started.

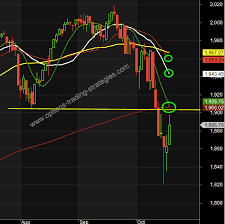

Another tip is technical analysis. Technical analysis can be used to identify patterns in stock price and volume. If you are lucky you may find a pattern that predicts changes in the market.

Day traders should take their time and have a clear strategy. It is best to avoid borrowing money. Many traders lose the initial investment and end-up in debt.

The other important lesson is to pick a reliable broker that offers a variety of tools and services. You should look for one that permits you to invest in stocks and ETFs as well as Forex. Some brokers provide commission-free trading; others charge a fee each time.

Trading in the early morning is the best time. This is the best time to trade. In a matter of seconds, prices can change by fractions of cents. This is why it is important to control your emotions when trading.

The right strategies should be implemented. You should also know how to read charts. If you don't have an in-depth understanding of the market, a chart can be misleading. Learning how to trade your stock when you believe it is going up is one of the best strategies.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

It is important to research both sides of the coin before you make any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it is important that you understand the risks as well as the rewards.

Trading forex or Cryptocurrencies can make you rich.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. It is important to trade only with money you can afford to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Understanding the different currency conditions is crucial.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Which trading platform is the best for beginners?

Your level of experience with online trading will determine your ability to trade. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Are forex traders able to make a living?

Yes, forex traders can make money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protecting yourself starts with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Do not respond to unsolicited emails or phone calls. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Don't forget to remember that "Scammers will attempt anything to get personal information." You can protect yourself against identity theft by paying attention to suspicious links and phishing emails, as well as the many types of online phishing schemes.

Secure online investment platforms are also essential. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.