Micro futures are an excellent way to trade even if you have a small account. This contract lets you trade stocks, metals, and currencies without spending a lot. This contract is ideal for people who are just starting out in the market. It can be very volatile, however, so there are some downsides to micro futures trading. Margin calls can also be issued if there are not enough funds to cover a losing trade.

There are many strategies available when it comes to micro futures trading. You can either use the same broker for eminis as you do for micro futures, or choose to go with another broker. You will need to have a minimum margin in order to trade through futures brokers. These amounts are typically between 5 and 7 percent of what the contracts have in real value.

On the Chicago Mercantile Exchange, micro futures are offered. They have products for experienced and novice traders. S&P 500 is the most popular micro-futures contract. E-mini S&P 500 futures contracts are $50 less than the S&P 500 Index. A micro S&P500 contract futures contract averages about 50 points per hour.

A micro emini futures can be traded 24 hours a day. You can profit from new opportunities whenever they occur. You can also move in and out of positions as required. If you want to hold a long position, you can purchase a contract for a target price. If the stock's price rises, you can either sell it or buy another contract.

You can also trade Micro E-mini futures in order to manage your risk. Additionally, professional investors can also trade in the futures market simultaneously. Futures trading can be very exciting and rewarding, but it can also become very volatile. By using a proven strategy, you can manage your risk and build a larger, more profitable trading account.

One of the best indicators of a fundamentally healthy company is its Price to Earnings ratio and Free Cash flow. Although the latter can be a bit more complex than the former, it's much easier to grasp. It is important to keep track of major announcements, reports and other information in order measure a company's performance.

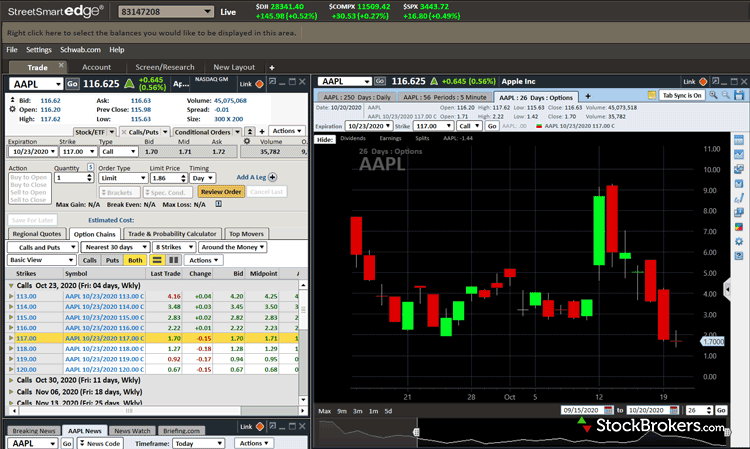

Trading micro futures requires a fully functional trading platform. Also, consider taking a training course in order to fully understand the market. Although it's not an exact science to trade micro futures, it can be done. These services are available from many reliable brokers. Look out for a broker who offers a free guide to trading.

Micro futures offer a great opportunity to maximize your returns and minimize the risk. These futures are rapidly becoming a commodity in the futures business. Trade micro futures with as little as $500 can be made by traders.

FAQ

Which is harder, forex or crypto.

Both forex and crypto have their own levels of complexity and difficulty. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Frequently Asked Question

Which are the 4 types that you should invest in?

Investing can be a great way to build your finances and earn long-term income. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be broken down into common stock or preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Is Cryptocurrency a Good Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which trading site is best suited for beginners?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

You can also trade independently if your knowledge is good enough. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

How can I invest Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need are the right tools and knowledge to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, gather any additional information to help you feel confident about your investment decision. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. Keep an eye on market developments and news to stay current with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

What is the best trading platform for you?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Demo accounts and free trials are a great way to test virtual money before investing any real money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? This information will help you narrow down your search and find the best trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

Research is critical when investing online. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

You should understand the investment risk profile and be familiar with the terms. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.