The crypto market is an extremely volatile and fast-moving asset that can experience extreme volatility. There have been some heart-breaking drawdowns and wild volatility. It is important to understand that this market is still very risky, and it is important to use smart trading techniques when investing in these assets.

There are several types of crypto you can invest, including bond crypto or gold-backed cryptocurrency. Each type of cryptocurrency has its own set risks and rewards. When investing in any cryptocurrency asset, it is important that you consider those risks.

M1 Finance - Crypto

M1 is a personal financial platform that provides a variety of products and services to clients in order to manage their money. Its motto "Yours is to Build" is what it stands for, and its goal is to help users build wealth how they want. It also has a blog and an extensive help center to assist with operating its platform.

Makara Crypto

Seattle-based Makara is a robo-advisor that makes it easy to diversify your investments by combining several crypto assets into thematic baskets. It uses a unique algorithm that matches your portfolio with the crypto assets that best suit your needs and goals. This algorithm was initially developed by Strix Leviathan, a crypto hedge fund company. However, it has been spun off into its own company.

B21 (crypto)

Cryptos are a fun addition to your portfolio. Your crypto portfolio can be built and tracked using B21. Trade with advanced tools, such as limit orders, market orders, and market orders, on multiple markets and with your favourite coin pairs. Access favourable prices as low as 0.1% maker fees and 0.25% taker fees.

Acorns Crypto

Acorns can help you invest your spare change in your day to make it more worthwhile. Acorns' Round-Ups feature adds up all your purchases and invests any money you don’t use. This allows you to accumulate small amounts.

Acorns also allows you to set up recurring deposits from your bank account that automatically enhance your investment balances. This is an excellent tool for anyone who doesn't know where to start investing or needs extra guidance.

M1 Finance - Crypto

M1 offers a complimentary consultation, where they will show you how the platform works and what it can do for your financial goals. They also offer a wide variety of investment products, including stocks, bonds and ETFs.

These experts will assist you in determining how much to give to each asset, and how to manage your risk. It's simple and tailored to your unique financial situation.

B21

B21 was founded with the aim of introducing the next 100 million people into cryptos. We accept crypto withdrawals and deposits worldwide. Our goal is provide cryptos with a safe, secure, and convenient environment for them to grow. With decades of experience in developing regulated payments products, we are supported by fintech professionals.

FAQ

How do I invest in Bitcoin

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You just need the right knowledge, tools, and resources to get started.

You need to be aware that there are many investment options. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. Keep an eye on market developments and news to stay current with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Can one get rich trading Cryptocurrencies or forex?

Yes, you can get rich trading crypto and forex if you use a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Knowing how to spot price patterns can help you predict where the market will go. You should also trade with only the money you have the ability to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

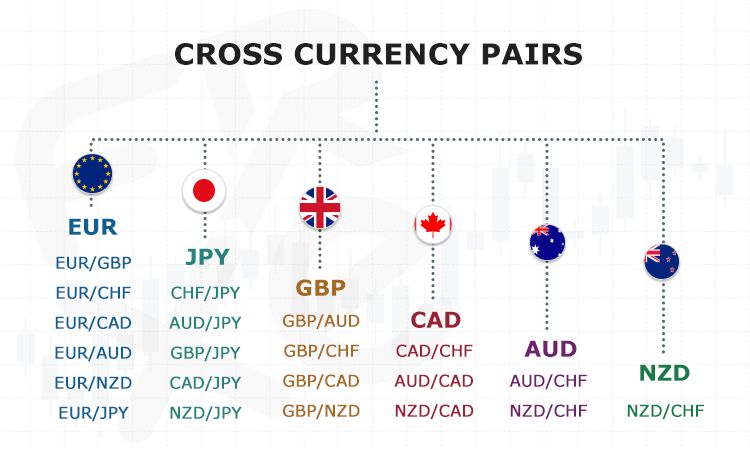

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Frequently Asked Question

What are the four types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into preferred and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Which is better forex trading or crypto trading.

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading is easier than investing in foreign currencies upfront.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. Before you invest, make sure to understand the risks associated with each strategy.

Where can I earn daily and invest my money?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to invest in real property. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. Online investing allows you to manage your investments anywhere with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many choices: stocks, bonds or mutual funds. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

It is easy to lose your money, but it can also be difficult to decide where to keep it. There are many options to protect your valuable assets.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. Yet, there are risks involved when using a digital option since electronic breaches may occur.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?