These stocks are best to trade because they can generate significant daily price movement. They have sufficient volume for large-scale trading.

Top day trading stocks

A stock that is considered one of the top stocks to trade must be strong in volume, high volatility and have a solid long term fundamental analysis. This will make sure that the stock is capable to generate large profits in the long-term.

It must also be liquid and low-impact, with the ability to react quickly to news flow. Finally, the company should be transparent about their operations and provide important information to the general public.

The best intraday stocks in 2022

Volatility is a key factor when you are choosing stocks for intraday trading. Volatility is a measure of the amount of risk/unpredictability associated with a stock's value. The higher the volatility, the larger the potential for significant price changes.

Trend is another aspect to look at in an intraday good stock. Trending stocks will move in an upward direction. It will follow a clear pattern, which is easy to explain and extrapolate.

This means that a stock with a strong trend will tend to remain within a range and will not move beyond this range as fast as a stock with a weaker trend. This is a great way for you to maximize your return and minimize your risk.

Nike is an example of a top-trending stock. It is a leader in innovation and is dedicated to connecting with customers. Its Nike Direct business has been performing well and international growth is strong.

Tesla, an American multinational electric vehicle (EV), company, makes a variety products including batteries for your home. It is valued at more than $950 billion and is rapidly growing as the world moves to clean energy.

Its perpetual media coverage and the eccentric persona of its CEO, Elon Musk, have made it a popular topic for speculation. The stock can be easily triggered by one news event, whether it is positive or not.

It doesn't really matter if your goal is to trade for a livelihood or to make side income. What matters is that you choose the best stocks to trade, which will suit your investment style as well as your risk appetite. These are some tips to help guide you in your decision making about which stocks would be the best for you.

FAQ

How do forex traders make their money?

Yes, forex traders can make money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

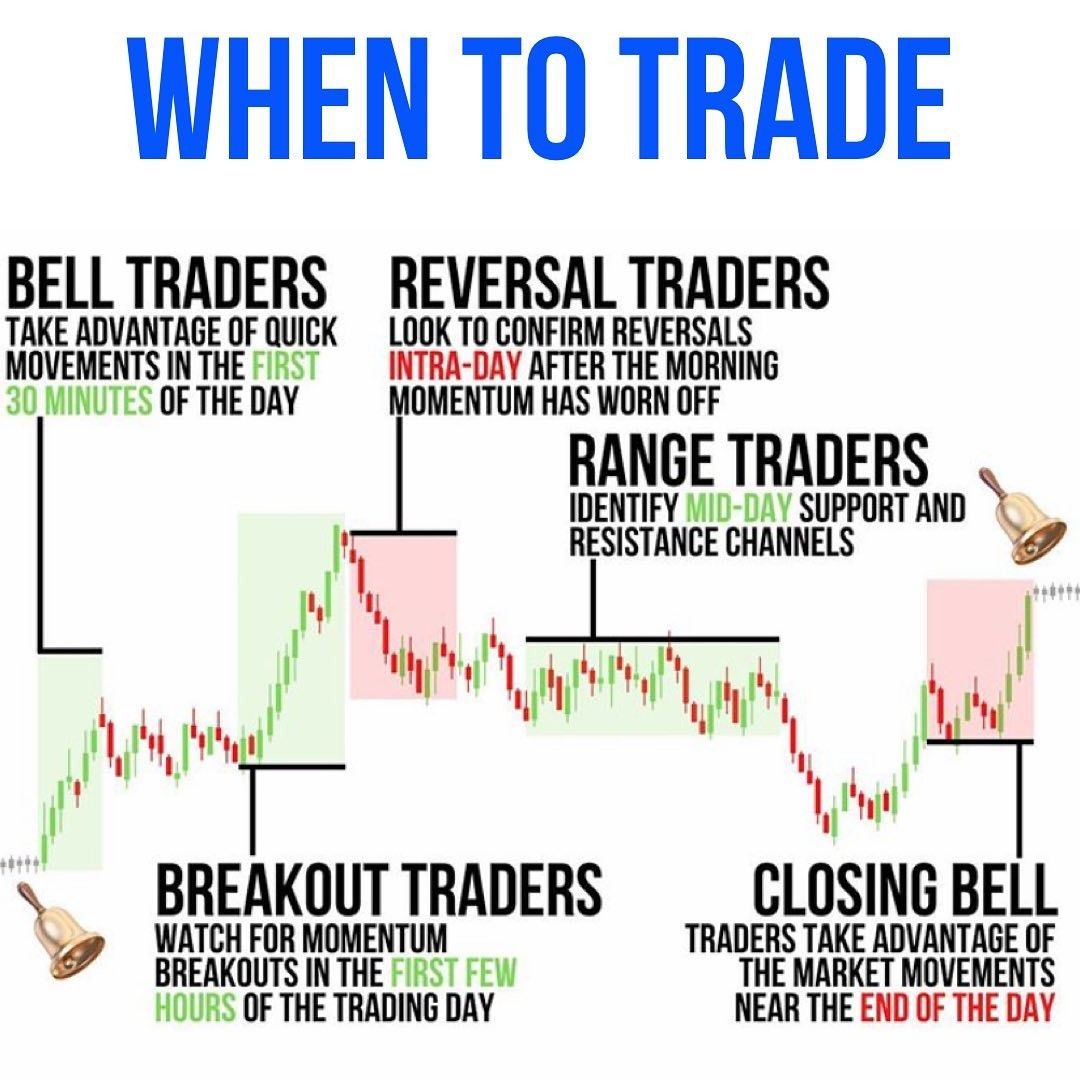

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Which is more difficult, forex or crypto?

Each currency and crypto are different in their difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

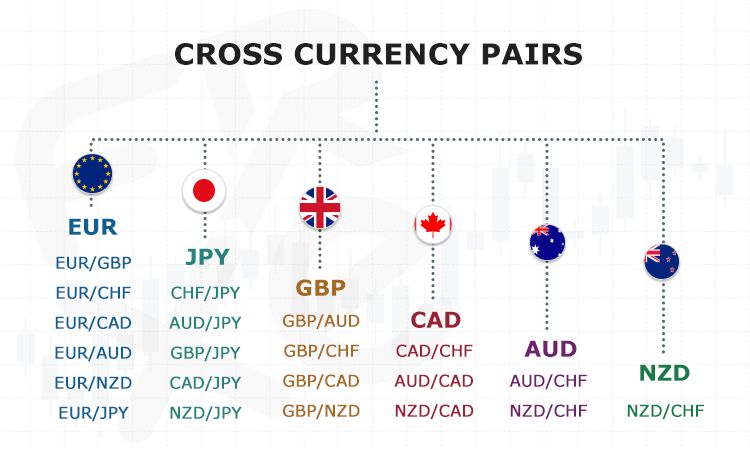

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Cryptocurrency: Is it a good investment?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

Understanding the various trading strategies for different types of trading is important. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which trading site is best suited for beginners?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

What are the advantages and disadvantages of online investing?

Online investing is convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading is a great way to get real-time market data. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, online investing does have its downsides. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There may be restrictions on investments such as minimum deposits or other requirements.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection begins with you. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Do not respond to unsolicited emails or phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Never forget that scammers will try any means to steal your personal data. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

It is also important that you use secure online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.