Alpari forex brokers are some of the most renowned in the world. The company has been in business for more than 20 years and offers many trading instruments. You can also choose to trade crypto currencies using a trading service.

Alpari is licensed in the UK and Russia. The company is also a member of the Financial Commission, which is based in Hong Kong. These regulatory bodies don't require brokers to have capital buffers, or register with any government agency. However, investors must ensure that they are dealing with a broker who is genuine and safe.

Alpari also offers Forex trading. The company's leverage ratio ranks among the best in the industry. This allows traders the freedom to trade without having to set aside a lot to open an account. Traders can earn points to trade, which can be used to receive money back on a swap and for a commission.

The company's trading platforms include MT4 and MT5. They have been designed to work with any device. An optional demo account lets new users try out the platform before creating an actual account.

Alpari's customer service is available 24/7. The team can be reached via email, chat, or phone. Agents respond quickly and offer helpful information. Customers also have the option of using dispute resolution tools.

Alpari offers a variety of assets including stocks, futures and options. It's easy to navigate the website and you can access all of its main functions. When you log on, the site automatically takes you to the trading page. You can then choose the type of account you would like to open. Alpari offers a variety deposit and withdraw methods, including credit or debit cards, bank transfer, and other digital payments systems.

Alpari has a good reputation for offering a reliable service. The company has established solid relationships with banks to facilitate the swift transfer of funds. There are many protections available for clients, such as the use of segregated assets. Sign up for a premium account to receive commission-free deposits. Alpari's services can be accessed in more than 10 languages.

Alpari requires visitors to complete a form. This information includes their financial background, employment details, and details about their personal and financial accounts. Alpari will need a copy to prove residency during the registration process. Traders will be notified by email that their account has been created.

The website of Alpari is simple to use and the live chat button is easily visible. All queries are answered within 30 seconds. Alpari clients can contact them via email and phone. Alpari has been recognized for its customer service and has received a double AA support rating.

FAQ

Can forex traders make any money?

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

How do I invest in Bitcoin

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

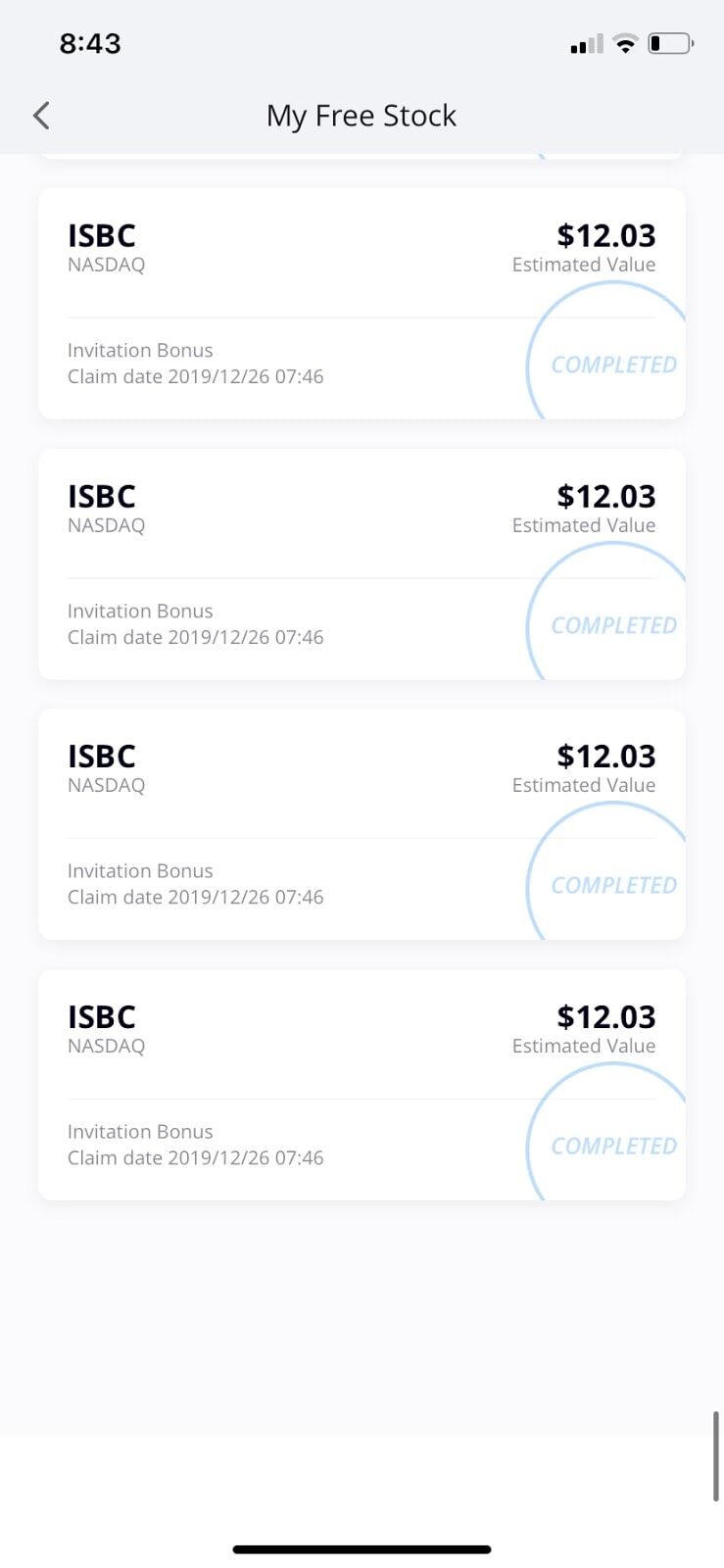

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, research any additional information you may need to feel confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

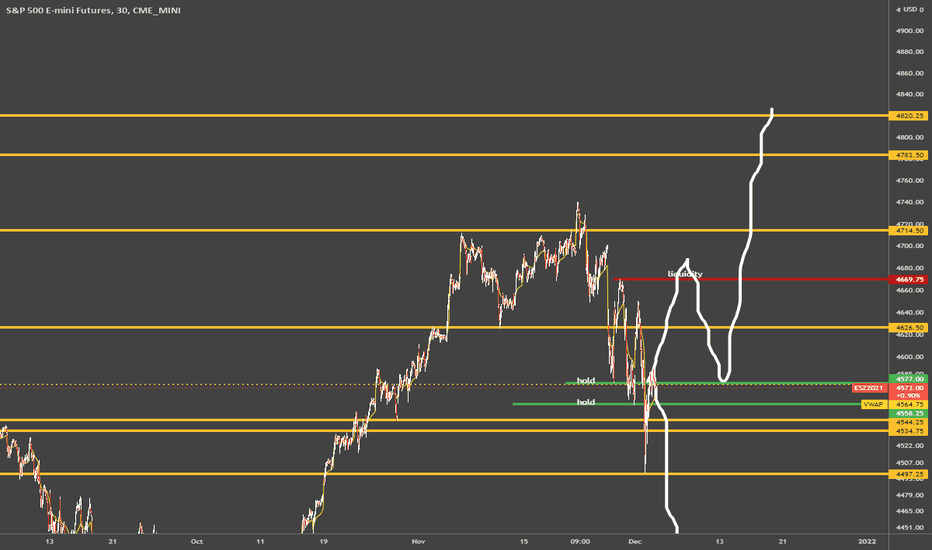

Which trading platform is best?

Choosing the best trading platform can be a daunting task for many traders. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Frequently Asked Question

Which are the 4 types that you should invest in?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

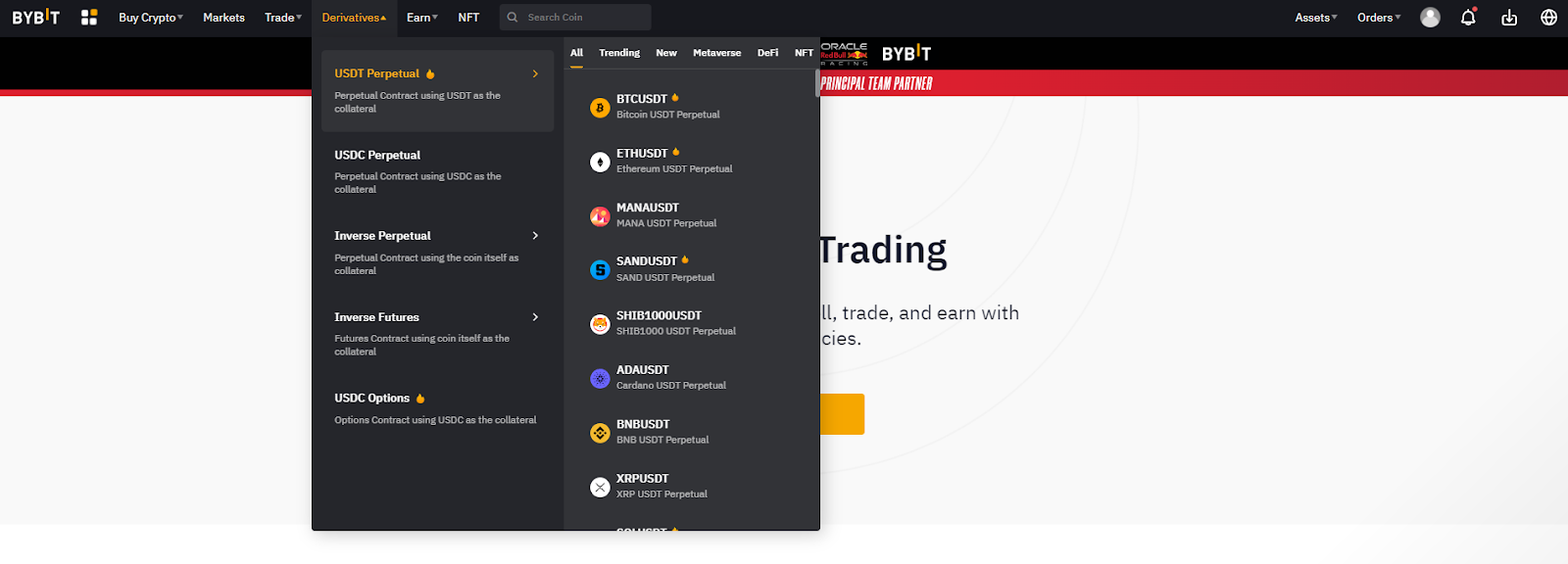

Which forex or crypto trading strategy is best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading is easier than investing in foreign currencies upfront.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

It is important to be familiar with the various types of trading strategies that are available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it's important to understand both the risks and the benefits.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I protect my personal and financial information when investing online?

When investing online, security is crucial. Online investments are a risky way to protect your financial and personal information.

Begin by paying attention to who you are dealing on investment platforms and apps. Make sure you're working with a reputable company that has good customer reviews and ratings. Research the background of any companies or individuals you work with before transferring funds or providing any personal data.

For all accounts, use strong passwords with two-factor authentication. You should also regularly test for viruses. To ensure your account security, disable auto-login on all devices. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. To prevent a breach of one account, it's smart to have different passwords for each account. Last but not least, make sure to use VPNs when investing online. They're often free and easy!