Agricultural commodities are essential for human living, and they are traded worldwide. The demand for these commodities is constantly increasing, and they are expected to continue growing in the future. Due to many factors, including economic and political disruptions, it is possible that these commodities' prices can fluctuate greatly.

Hence, it is important to understand the agricultural commodities and how to trade them effectively. Agri trading can be a great way for you to diversify and invest in your portfolio. Moreover, it also allows you to earn a higher income.

Many trading companies are licensed to trade agricultural commodities. These trading companies are licensed and regulated by relevant authorities. These companies offer many services to traders. They can provide technical support, trading strategies, and other tools to help you make informed decisions.

Some trading companies also have research teams. They can provide reports and data regarding the various factors that affect agricultural product prices.

These companies will give you information and tips about the best time to sell and buy different products. These companies will help you determine the correct amount of margin to place on each transaction.

Understanding how the agricultural commodities market works is crucial. It is also important to be aware of the various trading platforms and brokers that are available in the industry.

One of the most popular ways to trade agricultural commodities is through futures contracts. They can be traded on a variety markets, so they are suitable for both novice and seasoned traders.

A number of companies are based here and specialize in trading agricultural commodities. They have extensive experience in this area and are known for being reliable and transparent.

Global trade in agrifood is increasing. Many technological innovations have been applied to this process. These include electronic sanitary and phytosanitary (SPS) certification, which can save costs and time for producers and consumers.

Grain is a crucial crop for the global economic system. The supply of grain is high. Grain is used for animal feed and is the main ingredient in food such as corn and wheat.

The price of grain depends on many factors. These include supply, demand, production and availability. There are also trade regulations that can affect the price.

Among the top agricultural commodity trading companies are Archer-Daniels-Midland Company, Wilmar International, and Bunge Limited.

A number of Swiss-based traders have entered the agriculture industry in recent times. They are now focusing their attention on global values chains and mergers, acquisitions, and other areas.

Traders need to be able adapt quickly to meet changing demands for agricultural commodities. They need to be able and willing to guarantee the quality of the products that they trade.

Agricultural commodities play an integral part in our lives. Since the beginning of time, they have traded on global markets. These commodities are crucial to our lives, but they can also prove unpredictable. It is vital to keep abreast of the latest developments in agriculture.

FAQ

Which trading platform is best?

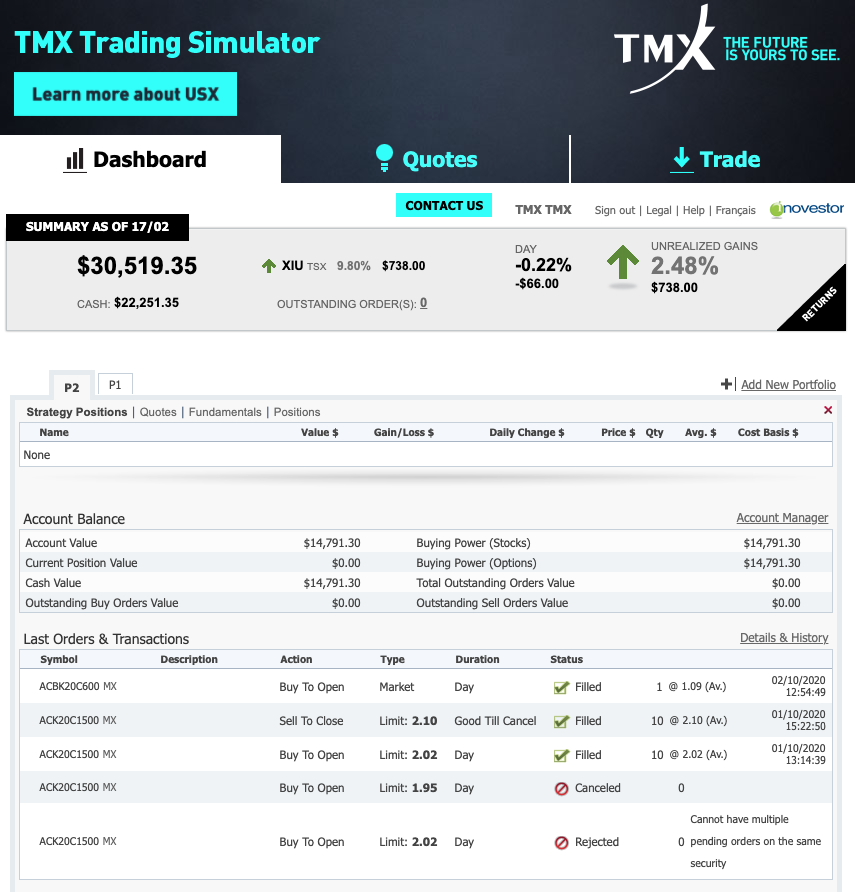

Many traders may find it challenging to choose the best trading platform. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This will help you narrow your search for the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Where can I find ways to earn daily, and invest?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Online trading is possible if you're comfortable with the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Which trading site for beginners is the best?

It all depends on how comfortable you are with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

What are the advantages and drawbacks to online investing?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. There may be restrictions on investments such as minimum deposits or other requirements.

Which is harder, forex or crypto.

Different levels of difficulty and complexity exist for forex and crypto. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

When you invest online, it is crucial to do your homework. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

Learn about the investment's risk profile and review the terms and condition. Before you open an account, check what fees and commissions might be taxed. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.