Futures or derivatives are contracts that allow buyers to purchase or dispose of a commodity, stock or index at a specified price in the future. Contrary to stock options which allow the buyer to purchase or sell an asset, a buyer of a futures contract has to either buy or sell the commodity or stock at a fixed price. This price is calculated using a comparison of the offers and the bids. It is based on the expectations of the prices at the maturity date. These contracts are highly leveraged and offer low transaction costs and high liquidity. They are also used to hedge.

To gain an advantage in the market, many speculators make use of derivatives and futures. The benefits of these instruments include high liquidity, risk hedging, and easy pricing. However, they can be complex. Understanding them is key before you trade.

There are many types of derivatives and futures. These include financial derivatives such as stock and interest futures and index futures. A futures contract might be entered into by a foreign trade organization to lock in a currency's exchange rate and hedge against the possibility of it fluctuating. An individual might purchase futures for a foreign currency, such as the United States dollar, to protect against currency appreciation.

Many individuals use derivatives to speculate on the movement of an underlying asset, such as grapes, oilseed, or cotton. The value of the contract is determined by the price of the underlying commodity, which can be based on both fundamental and technical analysis. Before entering into a deal, traders need to be able evaluate the market's size and direction.

A standard corn contract covers 5,000 bushels. A participant will also need to invest a margin in addition to the price for the underlying corn. Margin will be returned upon expiration or delivery. Margin is also called "variation margin" and "maintenance margin."

A futures agreement is similar to a forward, but the buyer has the right to purchase or sell an underlying commodity at certain prices in the future. These instruments can be used by those with large amounts of cash. Even those with a small amount of cash can still make use of these tools to reduce their exposure.

Futures are known for their transparency. Participants have access basic demand and supply information that is vital in determining the price of a contract. It is also important to understand that futures are not traded on a central exchange. Instead, they can be traded over-the counter. Participants must therefore be able determine if they can meet their margin requirements. The margin requirements can vary depending on the market. This can lead to huge losses.

Derivatives are legally binding contracts. These instruments are often blamed for the 2008 financial crises.

FAQ

Which trading site is best suited for beginners?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many offer interactive tools to help you understand how trades work.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

How can I invest bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. To get started, you only need to have the right knowledge and tools.

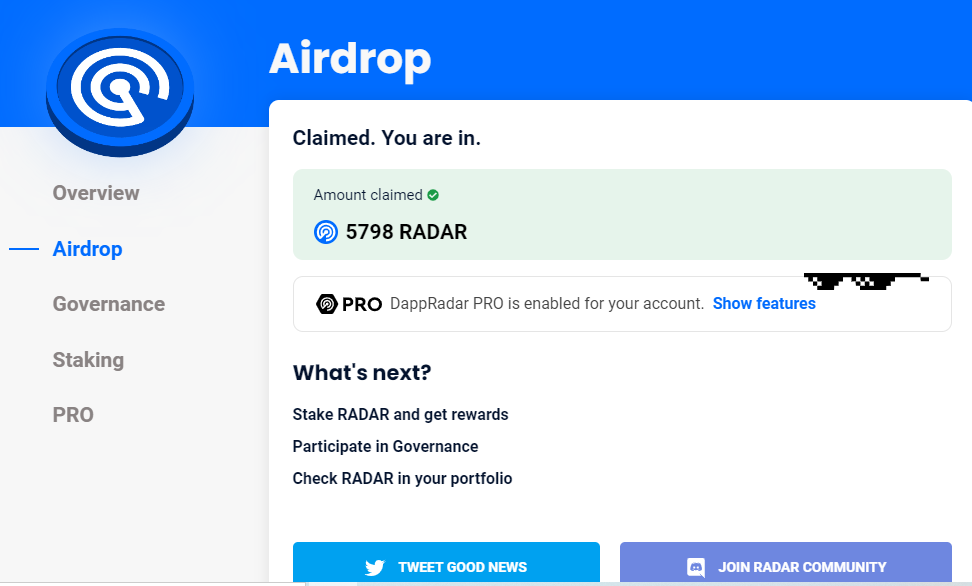

The first thing to understand is that there are different ways of investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. You may choose one option or another depending on your goals and risk appetite.

The next step is to research additional information you might need in order to be confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Are forex traders able to make a living?

Forex traders can make good money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

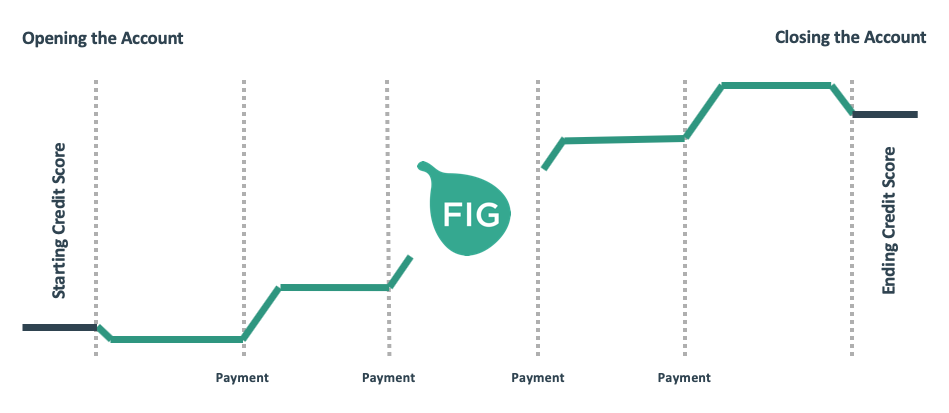

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Cryptocurrency: Is it a good investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Frequently Asked questions

Which are the 4 types that you should invest in?

Investing can help you grow your wealth and make money long-term. There are four main types of investing: stocks, bonds and mutual funds.

There are two kinds of stock: common stock and preferred stocks. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

What is the best forex trading system or crypto trading system?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading is easier than investing in foreign currencies upfront.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

What precautions can I take to avoid investment scams online?

Protection begins with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Do not respond to unsolicited emails or phone calls. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Don't forget to remember that "Scammers will attempt anything to get personal information." Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

Secure online investment platforms are also essential. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.