XM is an online broker that offers a wide range of trading options to customers. CFDs are offered on currencies and indices as well as precious metals, energy, and other commodities. CFDs on stocks and exchange traded funds are also available. With over a million users, XM is one of the world's most popular brokers.

XM registered brokers in 10 European regulatory organizations. It is licensed by the International Financial Services Commission (IFC) and the Cyprus Securities and Exchange Commission (CySEC). XM Global Limited is also a licensed subsidiary of the Australian Securities and Investments Commission. XM is present in more than 190 countries around the world.

XM offers a variety of account types that can be tailored to meet your trading needs. These accounts include Standard and Micro accounts. These accounts offer leverage and low minimum deposits. In addition, XM provides a demo account. XM also offers a complimentary virtual private server service. This can be used anywhere in the globe.

Traders can withdraw money from their XM account using MasterCard, Visa, Skrill or Neteller. XM also accepts Payoneer. It is essential to give accurate information to XM in order to open an account. This includes proofs of identity and addresses. XM's websites provide multi-factor authentication to protect customer data.

XM offers a wide range of educational resources on its website. You can also watch webinars about various topics. XM also provides market analysis and trading signal daily. Several tutorials are available to learn more about the broker's platforms. XM offers a manual signal tool for trading, with information on the most commonly traded instruments.

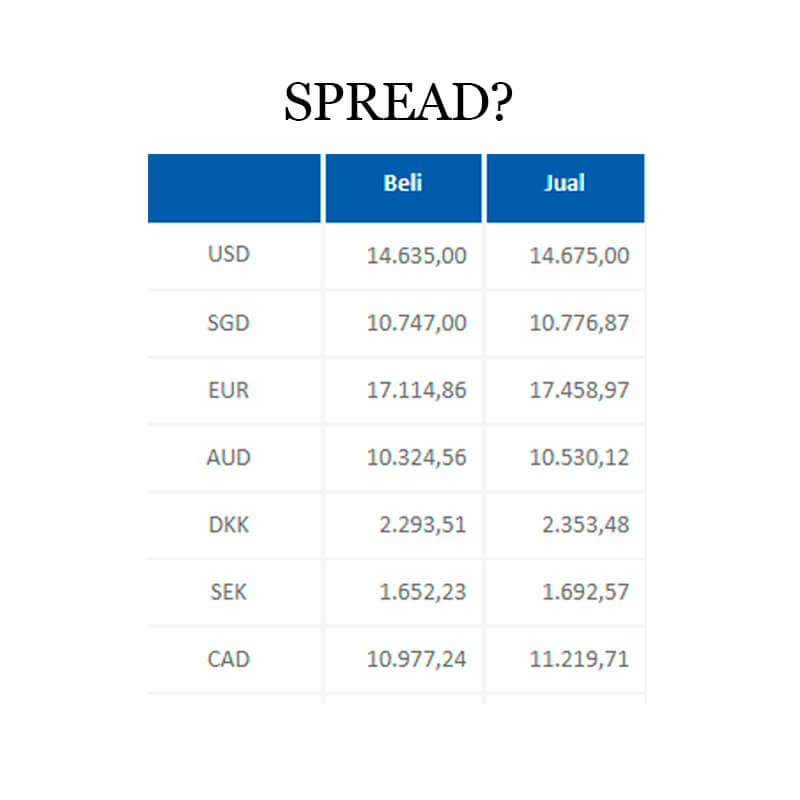

XM's spreads are competitive compared to other brokers in the industry. The spread on major currency pairs averages 0.1 pips. Spreads may vary according to account. Floating spreads enable clients to avoid high spreads and ensure that they receive the lowest prices.

Unlike many other brokers, XM does not have a commission policy. You may be able to find a more competitive broker that charges a deposit fee. Be aware that broker fees can vary depending on your payment method. In the end, the cost of transferring money will be balanced against the overall cost.

XM offers a micro account with a low minimum deposit of $5. You can trade up 300 positions simultaneously with the micro account and you have leverage of up to 1:888. XM also provides negative balance protection.

XM has more than 1.5 million clients across 190 countries. It has access to a wide range of financial markets worldwide. XM also offers its services in multiple languages. Apart from its website, XM offers a mobile app which can be downloaded to both Android and Apple smartphones.

XM is a very popular broker with traders in the United States, Japan, Canada, and other nations. Anyone who resides in these countries should consult the relevant regulations before opening an Account. Some countries require identification proof before opening an account.

FAQ

What are the advantages and drawbacks to online investing?

Online investing has one major advantage: convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing comes with its own set of disadvantages. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important to understand the different types of investments available when considering online investing. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Some investments may also require a minimum investment or other restrictions.

Can forex traders make any money?

Yes, forex traders can make money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Where can I earn daily and invest my money?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to invest in real property. Investing in property can provide steady returns with long-term appreciation and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which is more difficult forex or crypto currency?

Each currency and crypto are different in their difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which trading site is best for beginners?

All depends on your comfort level with online trades. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many offer interactive tools to help you understand how trades work.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

When you invest online, it is crucial to do your homework. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Do your due diligence and make sure you get what you pay for. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.