Robinhood Crypto is a cryptocurrency platform that's available in 46 of 50 US states. It's not available for New Hampshire or Hawaii. It means that if one of these states is your home, you will need to use a new platform to buy crypto.

There are a lot of crypto brokers out there. You can buy crypto from Robinhood, Coinbase, and more. Some exchanges offer extra features, including automated trading and wallets. It is important that you consider your needs before you sign up for a new service.

For a start, there are some big differences between the various crypto exchanges. Aside from fees and the sheer number of coins, you'll want to consider customer support and security. Consider whether you are willing to take responsibility for the storage of your crypto, which could lead to total loss if it is lost or hacked.

Robinhood is the first brokerage to offer trading with zero commissions. While there are many other platforms that offer similar services, Robinhood's user-friendly interface and mobile app have made it particularly popular among younger investors. You might find it helpful to review some instructional texts about investing before you make your first investment.

Coinbase allows you to send your crypto to its digital wallet using an easy-to-use interface. Like Robinhood, you must verify your identity before you can use the service. To store your coins, you'll need to create a separate cryptocurrency-wallet. You'll need your private keys to access a secure recovery phase of 12 words.

Coinbase doesn't charge commissions like Robinhood. The trade-off is that you'll pay a slightly higher market rate. This is largely dependent on the currency that you use.

No matter what platform or platform you choose crypto is not a secure investment. Cryptocurrencies should be considered only if you can tolerate the risk and are fully aware of the potential consequences.

Remember that not all crypto platforms accept bank accounts. You might have to be creative in order for your crypto to move. The process will be easier if you have a creditcard. However, it is worth checking the policies of your credit company to determine if funds can be transferred.

Robinhood's crypto services are available in the US, Canada. The platform supports seven cryptos currently, including Ether and Dogecoin. You should also consider Ether Classic (ETC) and Bitcoin SV(BSV).

Compared to traditional exchanges, Robinhood's Crypto is a well-capitalized service that offers a seamless experience for buying crypto. The business model is also well thought out. The quality of your customer service speaks volumes about a company.

Robinhood's cryptocurrency service is not available in every state, but it's a great option for many people. Their mobile apps are simple to use and provide access to a variety of assets.

FAQ

Frequently Asked questions

What are the four types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Are forex traders able to make a living?

Forex traders can make good money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

What is the best trading platform for you?

Many traders find it difficult to choose the right trading platform. It can be confusing to choose the right one, with so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This information will help you narrow down your search and find the best trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Which trading platform is the best for beginners?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. You don't need to invest all of your savings in the stock exchange - there are many other options.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which forex trading platform or crypto trading platform is the best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading is easier than investing in foreign currencies upfront.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

It is important to research both sides of the coin before you make any investment. Diversification of assets and managing your risk will make trading easier.

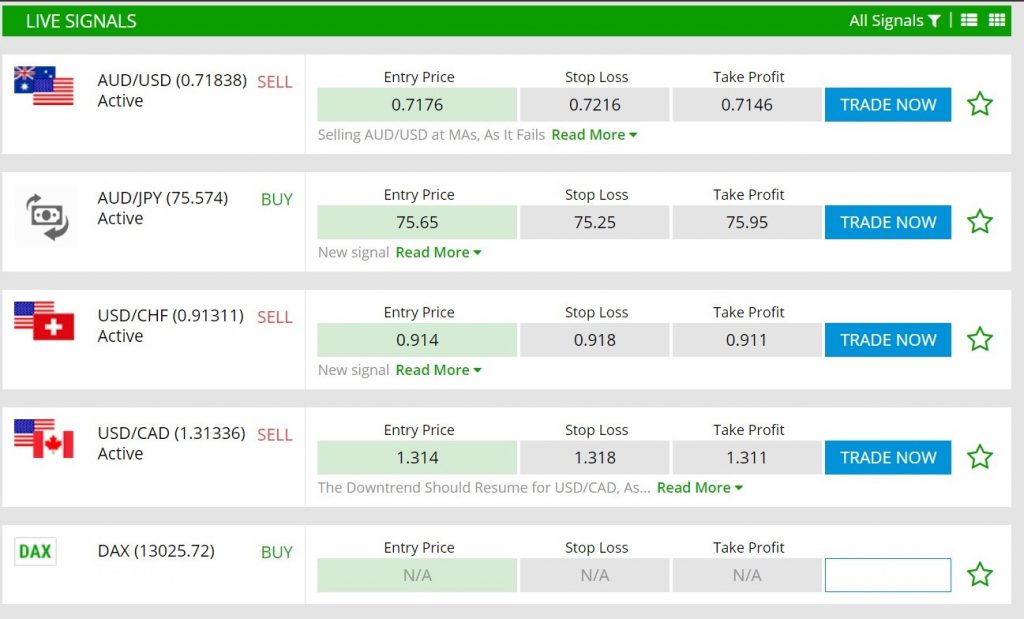

It is important to be familiar with the various types of trading strategies that are available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. To help manage their investments, traders may use automated trading systems or bots. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

When investing online, research is essential. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. You should also be alert for industry restrictions and regulations that might apply to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Learn about the investment's risk profile and review the terms and condition. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Conduct due diligence checks to make sure that you're receiving what you paid for. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.