Bitcoin is a decentralized digital cryptocurrency that is not backed or controlled by any central authority. Instead, it is based upon a highly secure public record called the Blockchain, which is shared by many people. It makes it difficult to reverse transactions and is also very hard to fake. The blockchain acts as a trusted account book for all transactions, since it is not centralised. It also prevents the use of coins that were already spent.

Simply send the amount to be transferred from one person's digital wallet to your other. Your transaction is then made public to the network. If you are using an internet platform such as a centralized trading platform, your transaction is completed immediately. If you're using a peer to peer service, however, the transaction will be recorded in a few minutes.

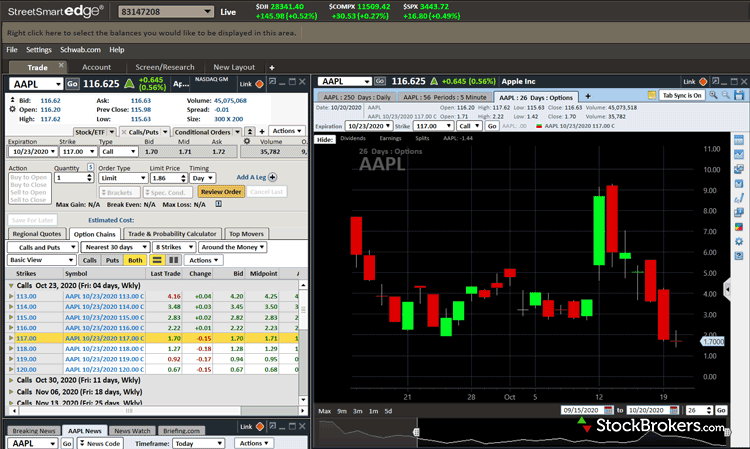

A bitcoin's current price is $30,200. The value of one bitcoin can fluctuate greatly, especially in volatile markets. You might want to search for a platform that allows limit orders. These platforms usually require you to have an ID or social security number, a bank account, and proof of income. Some platforms allow you to keep your investment in the account till you're ready to sell.

Transactions can either be conducted in person or on any of the communication platforms. Bitcoin transactions are more secure than any other digital currency. Because of this, it is recommended that you store your crypto safely. You should also keep your private key separate from any other information. Multiple passwords are a good way to protect your account.

Although the cryptocurrency market has been volatile, some investors have placed bets on its long-term success. Although crypto can have many benefits, it also has potential dangers. For example, some experts are concerned that it could be used as an instrument of crime. Some other cryptocurrencies have been linked in fraud and illegal activities, and some companies worry that they may become more popular among criminals.

Some experts believe that cryptos should only be part a portfolio with a high level of volatility. Although there is some risk involved, investing crypto is more affordable than traditional assets. Large investors have begun to use crypto as an option to protect themselves against inflation.

You can't withdraw your crypto from the bank, unlike traditional investments. Additionally, it is not possible to physically withdraw your crypto. Crypto volatility can be high. If you are just beginning, investing in crypto can be a good idea. You should understand the basics of crypto before making any purchase.

Bitcoin is a great starting point if your goal is to invest crypto. The market is growing, however, and there is plenty of room for more volatility. Before making a purchase, beginners should ensure they find a platform that is user-friendly and can calculate the current rate of crypto.

FAQ

Is Cryptocurrency an Investment Worth It?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which is harder forex or crypto?

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Frequently Asked questions

What are the 4 types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four main types of investing: stocks, bonds and mutual funds.

There are two types of stock: preferred stock and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

What are the advantages and drawbacks to online investing?

The main advantage of online investing is convenience. You can access your investments online from any location with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing comes with its own set of disadvantages. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

What is the best forex trading system or crypto trading system?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. You can cash out your tokens quickly because crypto trades are highly liquid.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, make sure to understand the risks associated with each strategy.

Where can I invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are many other investment options available.

One option is investing in real estate. Investing property can bring steady returns as well as long-term appreciation. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I ensure security for my online investment accounts?

Online investment accounts must be secure. Protecting your assets and data from unwanted intrusion is essential.

You must first ensure that the platform you're using has security. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Check your account activities regularly to be alert of any unusual activity.

Thirdly, it's important to understand the terms and conditions of your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, make sure you do thorough research about the company before investing. Review and rate the platform and see what other users think. Make sure to understand the tax implications of investing online.

Follow these steps to ensure your online account is protected from potential threats.