Webull is not like other brokers who limit the hours you can trade. The extended trading hours policy allows you to trade during weekends, too. This can be done via the app or on the desktop platform.

This may sound like an obvious convenience, but this is a time when trading can be more volatile. The bid-ask spreads are therefore usually wider. This is why It's important that you pay attention to Webull's rules about trading during this time.

To trade, you will first need to open an account. After you've selected the type of brokerage account you want, you'll be asked to enter your name, email address, and password. Next, you'll be asked to deposit a certain amount of money. After that, you will receive a verification code. If you have difficulty completing the steps contact customer support.

Once you create an account, you can access real-time technical charts as well as candlestick charts, line charts and fundamental analyses. In addition, you can get analyst recommendations and share earnings data. Sign up to an account and you'll get a stock for free.

Webull provides a variety of options for anyone looking to purchase ETFs, stocks or cryptocurrency. You don't pay commissions when you trade or buy these securities. A Webull account also allows you to sell your own crypto investments. Your funds can also be withdrawn. There is a $25 charge to withdraw funds by domestic wire transfer.

When trading takes place during regular market hours you can use the same account to place orders as when you deposit funds. But, all orders will require you to set limits. A limit order provides the best protection to your investments, as there is often volatility during these hours.

Webull's mobile app as well as desktop trading platforms allow you to trade during extended hours. The app displays pre-market extended hours prices, and the desktop platform allows you to access your account in full screen mode. The chart settings window allows you to trade even after-hours.

Webull's many features make it easy to see why so much people have opened accounts with us. The brokerage's interface is extremely simple and is ideal for intermediate to experienced investors. The site's inability to provide customer support for beginners might prove problematic.

Customers reported that they received lengthy delays when answering emailed questions. Customers report difficulty getting a response to complex questions. Other customers have complained that the phone support is slow. Webull says that it offers a 24-hour customer support.

Webull does not require a minimum deposit. You can choose to open an account with a credit card, debit card, or personal bank account. To verify your identity, you will need to provide a photo of your passport and driver's permit.

FAQ

How can I invest Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. To get started, you only need to have the right knowledge and tools.

You need to be aware that there are many investment options. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. Keep an eye on market developments and news to stay current with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which trading site for beginners is the best?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Can one get rich trading Cryptocurrencies or forex?

You can make a fortune trading forex and crypto if you take a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Also, you should only trade with money that is within your means.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is harder, forex or crypto.

Each currency and crypto are different in their difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

What is the best forex trading system or crypto trading system?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading is easier than investing in foreign currencies upfront.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

Both cases require that you do extensive research before investing. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

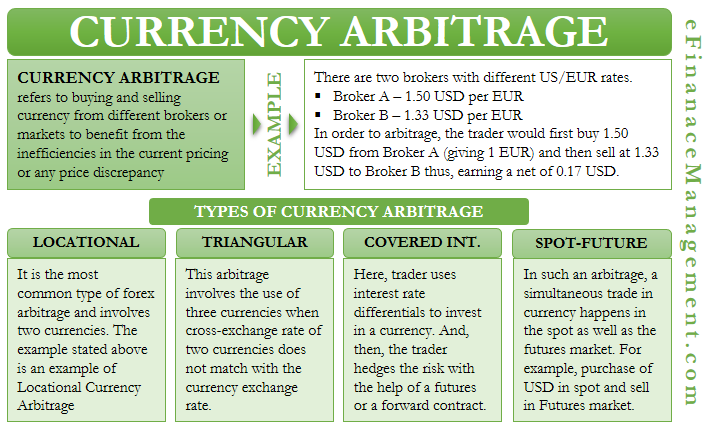

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Where can I find ways to earn daily, and invest?

Investing can be a great way to make some money, but it's important to know what your options are. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can my online account be secured?

Online investment accounts should be safe. It is vital to secure your assets and data against any unwelcome intrusions.

First, ensure the platform you are using is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Check your account activities regularly to be alert of any unusual activity.

It is important to be familiar with the terms and conditions of any online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. Review and rate the platform and see what other users think. Finally, make sure you are aware of any tax implications associated with investing online.

Follow these steps to ensure your online account is protected from potential threats.