Webtrader allows traders to trade online from any device. Traders don't have to install any software on their devices, which makes this platform a great choice for those who want to make transactions without taking up a lot of space.

MT4 Webtrader

MetaTrader4 is a very popular online trading platform. The platform has many easy-to-use features. One of the greatest features of MT4’s interface is its simplicity and ease-of-use. It offers many indicators and tools that will help traders make better market analysis and more informed decisions.

MT5 Webtrader

MetaTrader 5 is another popular online trading platform that can be used on desktops and mobile devices. It offers all the same features as MT4 but in an online format, making it an excellent choice for those who have multiple devices and need to be able to trade on the go.

Plus500 Webtrader

Plus500 is an online forex and CFD broker that offers an excellent trading experience for both new and experienced traders. The demo account can be used to learn more about the company and practice your trading techniques before you decide to invest real money. Even $40,000 of fictitious cash can be traded.

Plus500's free demo account offers many features that will improve your trading strategy, increase profits, and make it easier for you to trade. You have the option to set either a Close at Profit' (or Close at Loss) rate for your positions. This allows you to preserve your gains while minimizing your losses.

There are many other tools available to help manage your risk so that you don't lose more than you can pay. These include the option to set your orders to close when prices reach certain levels, and the ability for you to analyze your position in real time.

Interactive Brokers Webtrader

Interactive Brokers offers investors the opportunity to trade forex stocks and CFDs worldwide through a range of platforms. WebTrader is most popular. It has an intuitive user interface that makes accessing your account easy.

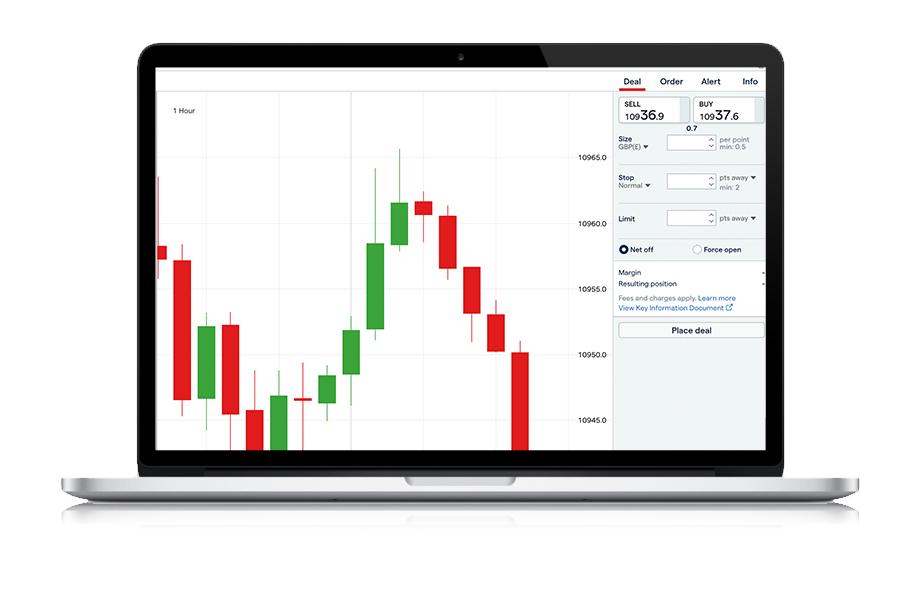

IG Webtrader

The IGwebtrader is an internet trading platform that can be used on any browser. It offers an intuitive interface and is easy to use. A number of technical indicators are included that can be extremely useful to traders. These indicators can be used to help you understand trends and predict the future.

IG also offers a wide range of addons that can be customized to your trading platform. These add-ons include stealth orders and mini terminal. They can be used to customize the IG Webtrader to suit your trading style.

IB Webtrader

Forex investing can be very risky. It is therefore important to find a forex broker online that provides a safe and reliable platform. You can do your research by visiting their website to discover the best broker.

FAQ

Which is the best trading platform?

Choosing the best trading platform can be a daunting task for many traders. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

What are the advantages and disadvantages of online investing?

The main advantage of online investing is convenience. You can manage your investments online, from anywhere you have an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing comes with its own set of disadvantages. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important for online investors to be aware of all the investment options. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Is Cryptocurrency a Good Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. Any type of trading can be managed by diversifying your assets.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. It is important to understand the risks and rewards associated with each strategy before investing.

How do I invest in Bitcoin

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You just need the right knowledge, tools, and resources to get started.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

The decision about where to store your money can be complicated. A strong security system is essential for your valuable assets. There are several options.

Online storage of your investment assets allows you to access them from anywhere and can be accessed quickly and easily. Yet, there are risks involved when using a digital option since electronic breaches may occur.

Alternately, you can keep your money in physical forms such as cash or gold. However, it is less secure and more difficult to track and requires more maintenance for storage and protection.

You can also keep your investments in traditional bank or investing accounts. There are also self-storage options that allow you safe storage of gold, silver, and other valuables, outside your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

You make the final decision.