Stock charts can be an invaluable tool for traders. These charts can provide traders with a wealth of market information including peak and trough levels, key entry/exit points, and much more. These charts can also be used to help you decide when to sell or buy. Stock charting software can be used to quickly analyze stocks and determine when they should be sold or bought. Learn more about the best stock charting software packages.

Sierra Chart offers a full range of charting and analysis tools. This is a versatile piece, which can be used to create a wide range visualizations. It can produce simple OHLC chart to complex mountain or candlestick charts. Additionally, Sierra Chart is capable of detecting trendlines, Fibonacci patterns, and even automated indicators. A variety of chart overlays are also available from the company, including charts for DOM execution windows. They can also be used in a variety chart layouts.

The Market screener is another piece that will assist you in trading. You can create a screening strategy using a variety of templates. This includes a simple screen or a more complex one. You can also personalize your view to highlight specific securities. The real strength of this product lies in its ability to scan and display important trading information in an easy-to-use and streamlined manner.

ChartNexus, which plots key stock price levels automatically, is another useful tool. Additionally, you can create your own templates or download up to five decades of historical fundamental data.

A Trading Magnet, an automated indicator is also available on this platform. The indicator helps you identify signals that are good candidates for a buy or sell. It can also scan through a number of symbols to determine the best ones for price triggers.

Other features include an advanced Scouting system, a customizable Interface, and an ad free experience. DXcharts is an excellent choice if you're looking for a powerful charting tool with premium features.

Interactive Brokers also offers the Multichart trading platform. This platform has 15 layouts you can configure to suit your trading style. One example is the ability to display four charts simultaneously and to synchronize crosshairs. You can also synchronize intervals as well as drawings and intervals. To use this feature, you must have the correct symbols downloaded onto your computer.

Finally, the YChart tool is a comprehensive and complete tool for communicating your investment strategy. It can also help your clients understand what your investment plans are. This software will allow you to generate visuals and market analysis, as well as educate your prospects. The software's powerful tools allow you to make informed decisions, create a portfolio and attract potential investors.

You have to ultimately choose the stock charting program you want to use. Your needs as well as your budget will influence the best stock charting software for you.

FAQ

How do I invest in Bitcoin

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

You need to be aware that there are many investment options. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Cryptocurrency: Is it a good investment?

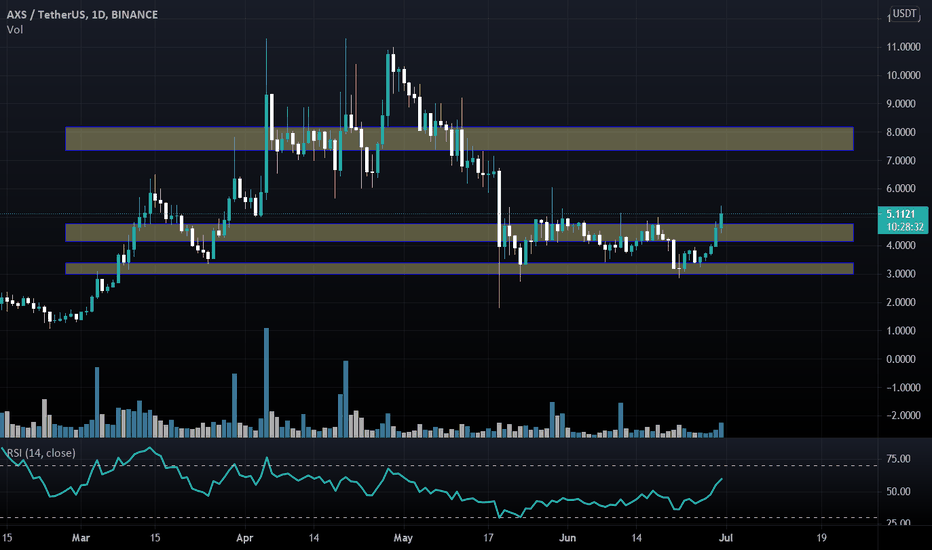

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which trading site is best suited for beginners?

It all depends upon your comfort level in online trading. You can start by going through an experienced broker with advisors if this is your first time.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

Both cases require that you do extensive research before investing. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

Understanding the various trading strategies for different types of trading is important. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Where can I find ways to earn daily, and invest?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is investing in real estate. Investing property can bring steady returns as well as long-term appreciation. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

It is important to do your research before investing online. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Know the risks associated with your investment and the terms and conditions. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!