Stock charts are a valuable tool for traders. They provide an abundance of information about the market, including peak levels and key entry and departure points. These charts can also be used to help you decide when to sell or buy. A reliable stock charting software program is essential if you want to efficiently analyze your stocks and make trades. You can read on to find out about the top choices.

Sierra Chart provides a wide range of analysis and charting tools. It is a versatile piece and can be used for a wide range visualisations. Sierra Chart can also detect trendlines and Fibonacci patterns. It even has automated indicators. It is also possible to use it in a variety DOM execution windows.

Another piece of software that can help you with your trading is the Market Screener. This allows you create a screening plan with multiple templates. You can also customize your own view to highlight specific securities. However, the real power of this product is its ability to scan the entire stock market and display critical trading information in a streamlined and user-friendly way.

ChartNexus' ChartNexus feature is another useful tool. It automatically plots key levels of stock prices. You can also download upto five years of historical foundation data and create your own templates.

The Trading Magnet is an automated indicator that can be used to help you identify potential buys and sells. This indicator will help you identify potential buy and sell signals. It can also scan through several symbols to determine which ones are the most price trigger-friendly.

Other features include an advanced search system, a customizable interface and an ad - free experience. DXcharts can be a great choice for anyone looking for robust charting solutions with premium features.

Interactive Brokers also offers the Multichart trade package. This platform has 15 layouts you can configure to suit your trading style. One example is the ability to display four charts simultaneously and to synchronize crosshairs. You can also synchronize intervals as well as drawings and intervals. You must have the right symbols on your computer in order to use this feature.

The YChart program is a comprehensive and comprehensive tool to help clients understand and communicate your investment strategies. Using this software, you can generate compelling visuals, analyze the market, and educate your prospects. This software offers powerful tools that can be customized to help you make informed investment decisions, build your portfolio, and draw in potential investors.

You'll ultimately need to decide what stock charting software you wish to use. The best choice for you will depend on your needs and your budget.

FAQ

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

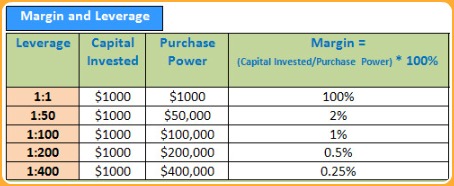

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which trading site for beginners is the best?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Forex and Cryptocurrencies are great investments.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

What is the best forex trading system or crypto trading system?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases, it's important to do your research before making any investments. With any type or trading, it is important to manage your risk with proper diversification.

It is also important to understand the different types of trading strategies available for each type of trading. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it's important to understand both the risks and the benefits.

Which is safe crypto or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What precautions can I take to avoid investment scams online?

Protect yourself. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Never respond to unsolicited phone calls or emails. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Remember that scammers will do anything to obtain your personal information. Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

You should also use safe online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.