TD Ameritrade offers several options for forex trader. The broker offers several trading tools, including a platform which allows you to trade currencies online via your computer or mobile phone.

Traders have easy access to a broad range of assets via the TD Ameritrade platform. These include stocks, mutual fund, ETFs, bonds, and many more. They also have access to the Thinkorswim trading platform, which is designed for desktop, web and mobile devices. No matter if you're an expert trader or a beginner, there's a strategy for you.

Forex leverage is a key factor you need to be aware of before you make a trade. However, it's crucial to use a risk management plan and limit your leverage to avoid incurring too much damage to your account.

The TD Ameritrade website features a large selection of investment options including stocks, bonds, and other financial products. It is simple to use and easy to navigate. There are a few free tools and platforms that can be used to trade, which is great for beginners.

TD Ameritrade offers a free program to help you learn how forex trading works. The company's educational videos and articles provide an overview of the basics of currency trading, as well as tips and strategies for successful forex investing.

Open a Trading Account With TD Ameritrade

To open a TD Ameritrade account, the first step is to complete an application. This can be done online, or you can call in to speak with a live person. After your application has been approved, you will receive a username, password, and a trading account number.

TD Ameritrade - A reputable, well-respected forex broker offering competitive rates as well as a robust platform for traders. Its thinkorswim trading platform is available in desktop, web and mobile versions and provides many of the same advanced features found on MetaTrader.

How to Trade FX With TD Ameritrade

Once you have an account opened, it is now time to start trading. You can trade and place orders using the TD Ameritrade trading system. This platform provides real-time information, including market data and news, to assist you in making informed decisions regarding your investments.

How to fund your Forex account at TD Ameritrade

After you've established your account, you can fund it with a deposit or withdrawal method of your choice. TD Ameritrade provides a variety of deposit- and withdrawal methods including wire transfers and check.

You can also replenish the account using electronic bank transfers. These are convenient and quick. Withdrawals from TD Ameritrade Thinkorswim can be processed within five mins, while wire transfers can take up 24-hours to process.

The TD Ameritrade trading platforms offers advanced features like expert advisors as well news and charts. There are also technical analysis tools. It is a great choice for anyone looking to add forex trading into their portfolio.

FAQ

What is the best trading platform for you?

Many traders may find it challenging to choose the best trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This information will help you narrow down your search and find the best trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

What are the benefits and drawbacks of investing online?

Online investing has one major advantage: convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, there are some drawbacks to online investing. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important to understand the different types of investments available when considering online investing. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There might be restrictions or a minimum deposit required for certain investments.

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. There are many options.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

What is the best forex trading system or crypto trading system?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Cryptocurrency: Is it a good investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is more difficult, forex or crypto?

Each currency and crypto are different in their difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

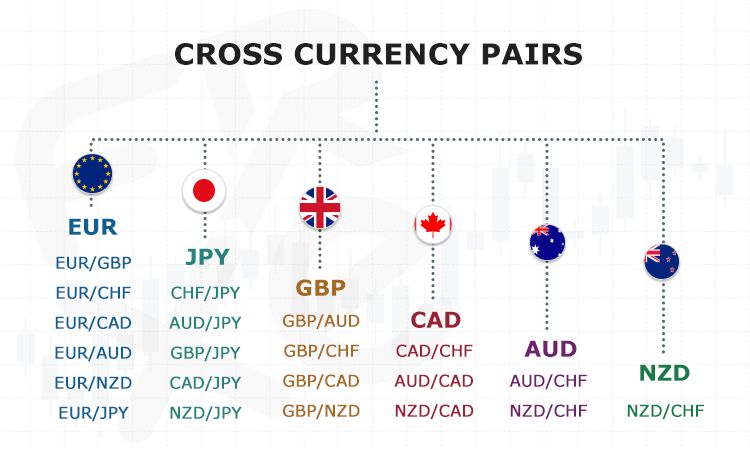

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

Online investing requires research. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.