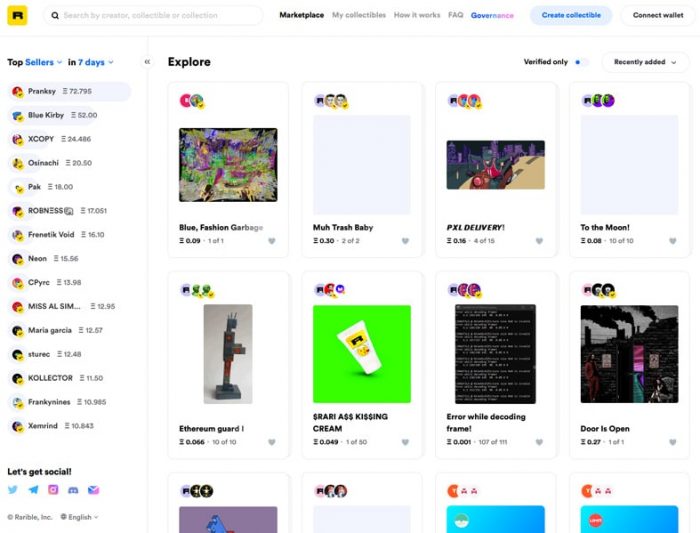

OpenSea was the company that made NFT platforms a household name. It announced plans to make Solana NFTs available on its platform several months back. Amongst other things, this is a way to bring more creative content to users. It also represents a significant leap forward for the industry.

In order to achieve this feat, the team at OpenSea developed an algorithm that is able to analyze billions of transactions to spot the best NFTs in a matter of seconds. Although the algorithm isn't perfect, it can provide high-level information. This is how it has been able find the NFT most recently in the spotlight. The algorithm, which was incorporated into OpenSea's platform in early 2017, is capable of identifying the NFT that is the most relevant to user's needs. OpenSea's X2Y2 performance has been attributed to this algorithm. The competition will heat up with the arrival of the latest entrant.

As for OpenSea's accomplishments, it is hard to ignore the fact that the company surpassed the other X2Y2 contenders in the short term, but has since re-enforced its position with a series B funding round. Just a glance at the company's recent press release will show that they intend to maintain the market leader in NFT. At the moment, a whopping 950,000 Solanas has been processed on the Solanart platform, which is roughly equal to US$149 million at the current market price.

OpenSea, despite having a small team, has managed to keep its core product at the forefront of its attention despite this. It generated a $5.8 billion profit in January. The company also has impressive features such as an open source code repository and smart contract library. Moreover, it has managed to fend off its more illustrious competitors and become the NFT ecosystem's premier X2Y2 player.

It is not surprising that the platform has not surpassed its predecessors in terms of volume. Although trading volume has been on a steady upwards trajectory for most of the year, the spikes have been tempered lately. In this context, Christmas is when the trading volume spikes most. Moreover, last minute Christmas shoppers are likely to push the needle even higher. It's important to stay on the pulse of gas prices. You could lose in the gas battles if you don't manage to grab a few DFTs.

OpenSea is also responsible for some of the most significant NFTs that have hit the market in recent history. These include the degenerate Apes. This was an amazing feat considering that they had never been a very active seller on Open Market.

FAQ

Frequently Asked questions

What are the 4 types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it is important that you understand the risks as well as the rewards.

Is Cryptocurrency an Investment Worth It?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which is more safe, crypto or forex

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

How do forex traders make their money?

Yes, forex traders can make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which trading site is best for beginners?

All depends on your comfort level with online trades. You can start by going through an experienced broker with advisors if this is your first time.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

When investing online, security is crucial. Online investments pose risks to your financial and personal data. Take steps to reduce them.

Be mindful of whom you are dealing with when using any investment app. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. You should also use different passwords to protect each account from being compromised. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!