The Commodity Futures Trading Commission ("CFTC") is amending its regulations. These amendments include modifications to the Real-Time Public Reporting Requirements. They also amend the Swap Data Recordkeeping and Reporting Requirements. This is to improve accuracy and consistency in the data that firms report.

The CFTC mandated reporting OTC derivatives after the financial crisis. However, the rules are not always clear. Many companies have been asking questions about the Technical Specification as well as other aspects of the Rules. The CFTC devised a "Rewrite", which included a number of new reporting fields as well as message types in an effort to fix the problem. It also incorporates suggestions from the industry.

The CFTC's transaction-reporting regulation is designed to make sure that firms provide correct and up-todate information. It includes a seven-day deadline for correcting errors. You must also notify the Commission in writing. Firms are also required by law to have procedures and controls in place to verify that data is correct.

The International Organization of Securities Commissions and Committee on Payments and Market Infrastructures reached an agreement on a range of key data elements. The International Organization of Securities Commissions and the Committee on Payments and Market Infrastructures have agreed to a number of key data elements. Firms are encouraged to submit all fields required by each jurisdiction. While this may take time, it will benefit firms and regulators alike.

The ReWrite has made one major change: the ReWrite reduced the number of schedules required for the Form CPO–PQR. For example, Schedule B requires more information about each pool. All reporting CPOs are now required to submit the Revised Form quarterly. Previously, only Schedules A and C were required.

Another change is the inclusion of a capital rule. This rule is designed to improve the CFTC's ability to monitor its operations. This is the first time that the Commission has changed its rules. It will be crucial to ensure that they don't depart from existing practices.

ReWrite also contains other changes including an extended reporting timeline, and different message type options. These changes had been in the making for some time. However, the CFTC waited to make them official. The Final Rule became effective on December 10, 2020. Officials with the CFTC explained that they will be working hard to ensure that the new rules are in "good condition" before they become law.

Other changes include the elimination of reporting threshold requirements. This is part a larger rewrite to the CFTC's regulations. Due to the financial crisis, the Dodd Frank Act also had to be revised.

The staff of the CFTC explained that the Commission was interested to see the activities and pools of CPOs. They were specifically interested in how CPOs interacted and the relationship between CPOs, intermediaries and other parts of the financial sector. Moreover, the Commission wanted to understand the population of the registrants and their interconnectedness with the financial system as a whole.

During the discussion Quintenz thanked her entire staff for all their hard work. She stressed that the Commission had adopted a principled approach when developing the rules and that all the commissioners had done their best to keep this in mind.

FAQ

Is Cryptocurrency Good for Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which is safe crypto or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

How do I invest in Bitcoin

Investing in Bitcoin can seem complicated, but it's not as hard as you think! To get started, you only need to have the right knowledge and tools.

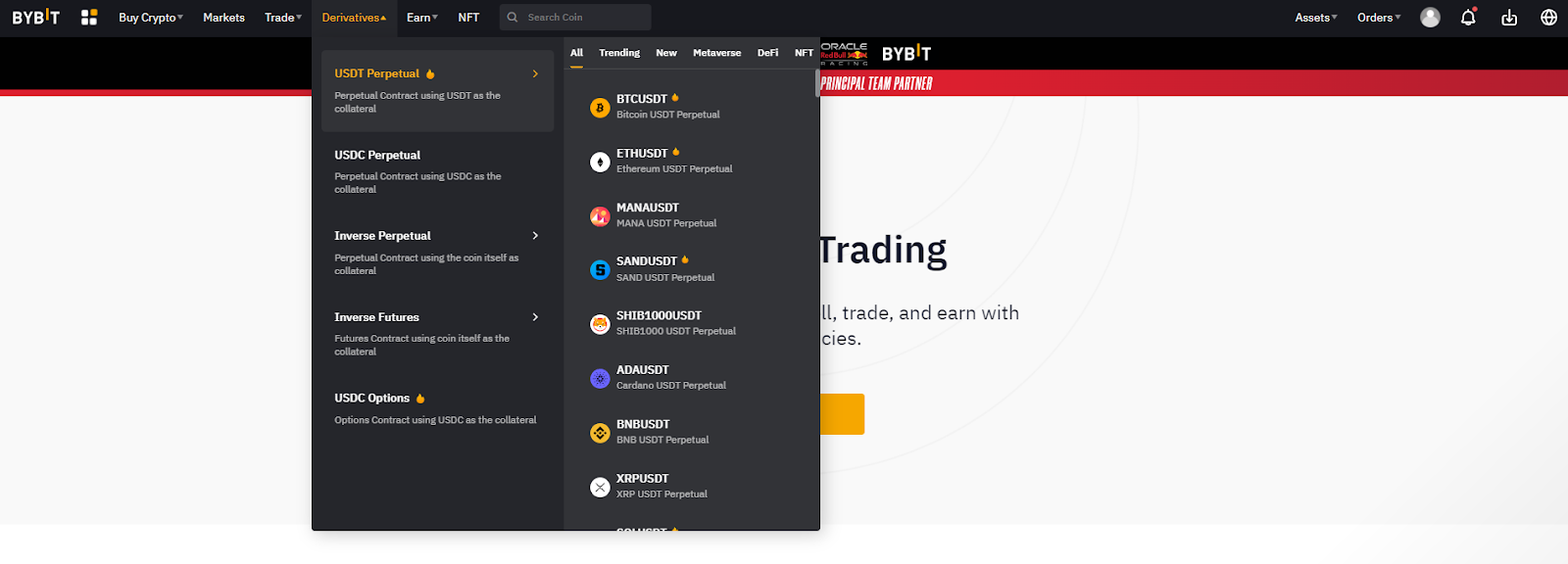

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Most Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four main types of investing: stocks, bonds and mutual funds.

There are two kinds of stock: common stock and preferred stocks. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Forex traders can make money

Forex traders can make good money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

What is the best forex trading system or crypto trading system?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is important to be familiar with the various types of trading strategies that are available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection starts with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Do not respond to unsolicited emails or phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Never forget that scammers will try any means to steal your personal data. You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

It's also important to use secure online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.