OpenSea enables users to trade non-fungible tokens online. This includes art, domain names as well as music, and many other items. The website is a hub for trading NFTs, and it is currently the largest NFT market on the Ethereum blockchain.

OpenSea began as a place to mint CryptoKitties. It has since evolved into an NFT exchange, which allows users to sell and buy digital assets. OpenSea offers a way for traders to trade NFTs with cryptocurrency. This greatly reduces transaction fees.

OpenSea's major advantage is that creators get NFT free of charge. This is significantly more than rivals like Rarible. OpenSea is subject to a 2.5% fee from the marketplace and creators must pay gas fees for Ethereum.

OpenSea can only be used if you have an ETH wallet. The Polygon chain is a sidechain solution that uses the ethereum blockchain to counter ethereum's high gas fees.

To buy an NFT on Polygon you first need to link your ETH wallet to the Polygon Chain. Once that is done, the wallet can be unlocked for Polygon trading. In order to complete your purchase you will need sign a transaction. After signing the transaction, you will be able to browse the NFTs available on Polygon and make your purchase.

Once you've chosen the NFT you want, you'll be able to see the price history. To narrow down your search, you can filter NFTs by price, type, and other criteria.

OpenSea makes it easy and quick to buy NFTs. Select the NFT you wish to purchase, then select the type and click "Buy".

You can view the NFT's price history and see transactions history. You can also purchase NFT with your preferred method.

OpenSea can allow you to list NFTs that you own with a Cmorq wallet. After signing in with your Cmorq card, you will see the NFTs you have in a folder named "Hidden". This is because the system thought the NFT was a private sale. Once you are ready for the sale of the NFT, the system will allow you to remove the NFT from the hidden folder and place it on the market.

NFTs should be listed on the OpenSea marketplace. Once you have created a profile on the OpenSea website, you will be able to list NFTs for sale and track their status and activity.

You will need to create an NFT listing. Also, specify the price at which you would like to sell them. You can also specify the sales method you wish to use, and choose whether or not you would like your NFTs to be visible on your profile page.

FAQ

Where can I invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are many other investment options available.

One option is investing in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

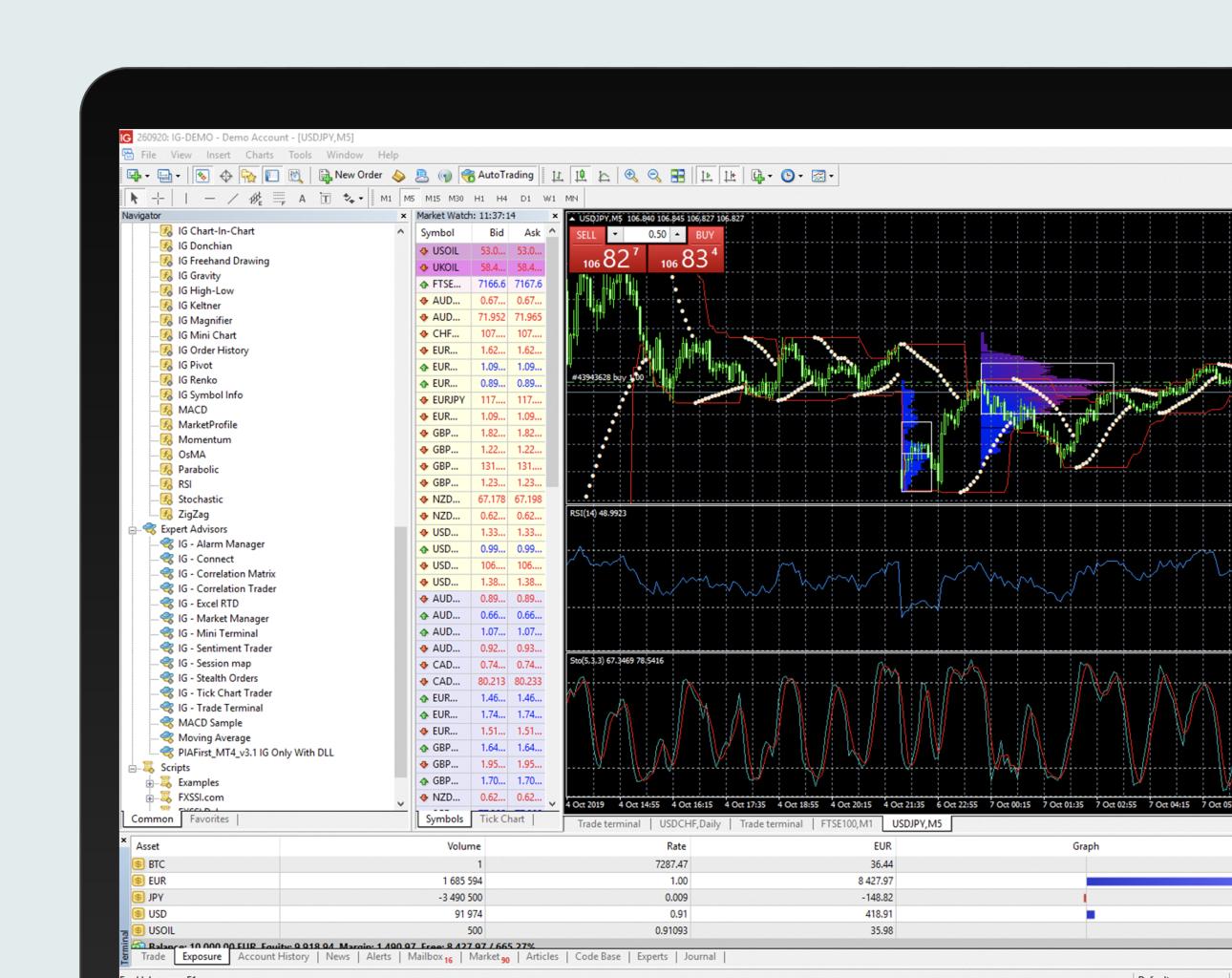

Forex traders can make money

Forex traders can make a lot of money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Frequently Asked Question

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into preferred and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Which is better forex trading or crypto trading.

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases, it's important to do your research before making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

Money can be complex but so can the decisions about how to store it. You have many options for protecting your valuable assets.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. Yet, there are risks involved when using a digital option since electronic breaches may occur.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.