These stocks are most active if they trade the most during a particular day. This is often referred to as a volume leader. It is compiled daily by stock exchanges such as the New York Stock Exchange (NYSE), and Nasdaq.

Most Active Stocks Today

Most active stock markets help investors identify which stocks they want to buy or hold. These lists can be analysed over several weeks or months to determine the direction of market.

They can also be used for short-term trading or long-term winners. They can be triggered by news and earnings reports that cause stock prices to move in any direction.

High average daily volume (or ADTV) stocks are some of the most actively traded on a daily base. Individual investors who trade intraday are interested in this metric.

These high volume stocks have large liquidity which allows traders quick entry and exit without adversely affecting the prices. It is also easier for market participants place orders with brokers.

A wide variety of factors can influence the most active stocks, including economic data, corporate news, and policy developments. A company's announcement of an acquisition or buyback can have a significant impact on the stock's movement.

Also, a stock with an upcoming earnings report that is expected cause the price of the stock to go up will be one among the most actively traded stocks on any given day. However, if the news is negative, it can cause the price to drop.

Most Active Stocks nyse

Each day, The New York Stock Exchange compiles an active stock list. Other categories include most active by share or dollar volume. These most active stock lists can be analyzed on a weekly, monthly, quarterly, or yearly basis to determine the best investment opportunities.

Most Active Stocks nyse tend to be the most traded stocks daily on NYSE and NASDAQ. You can access them with a free account.

Stock volume leaders can be a great option for day traders and investors looking to trade stocks that are high in liquidity and have strong momentum. They are also a good selection for long-term investors who want to invest in the future of a specific company.

Why are these stocks more active that others?

Stocks that are active are often fueled by economic or corporate news. This creates market pressure to either buy or sell the stock. Investors can be attracted to this type of price shift, which can result in a significant increase.

For example, if a company announces a big merger, it can create a surge in trading volume. The stock can see a spike in trading volume for several days, as other investors become entangled in the hype and rush to buy the stock.

Stock volume leaders also include those who have major announcements such as earnings reports. These announcements can cause the price to rise or fall in response to news that affects the company's profitability and growth potential.

FAQ

What are the pros and cons of investing online?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing comes with its own set of disadvantages. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There might be restrictions or a minimum deposit required for certain investments.

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. There are many other investment options available.

One option is to buy real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which is more difficult, forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

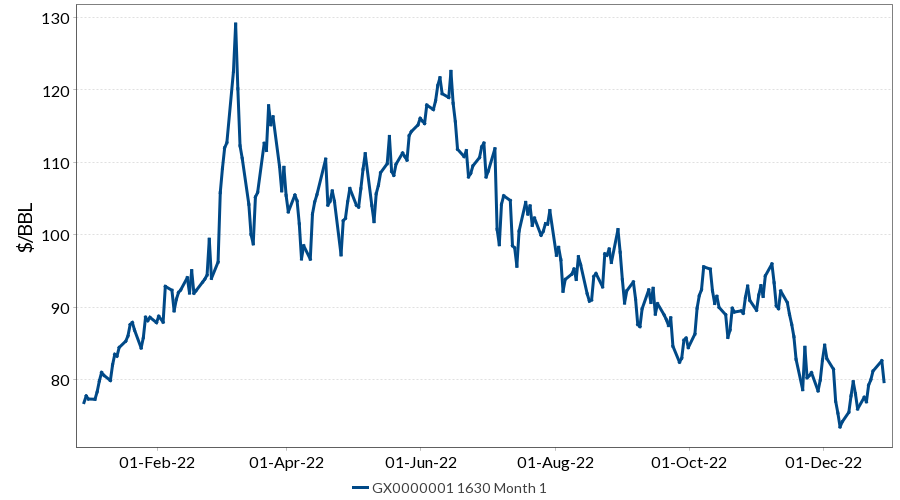

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

How can I invest bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need is the right knowledge and tools to get started.

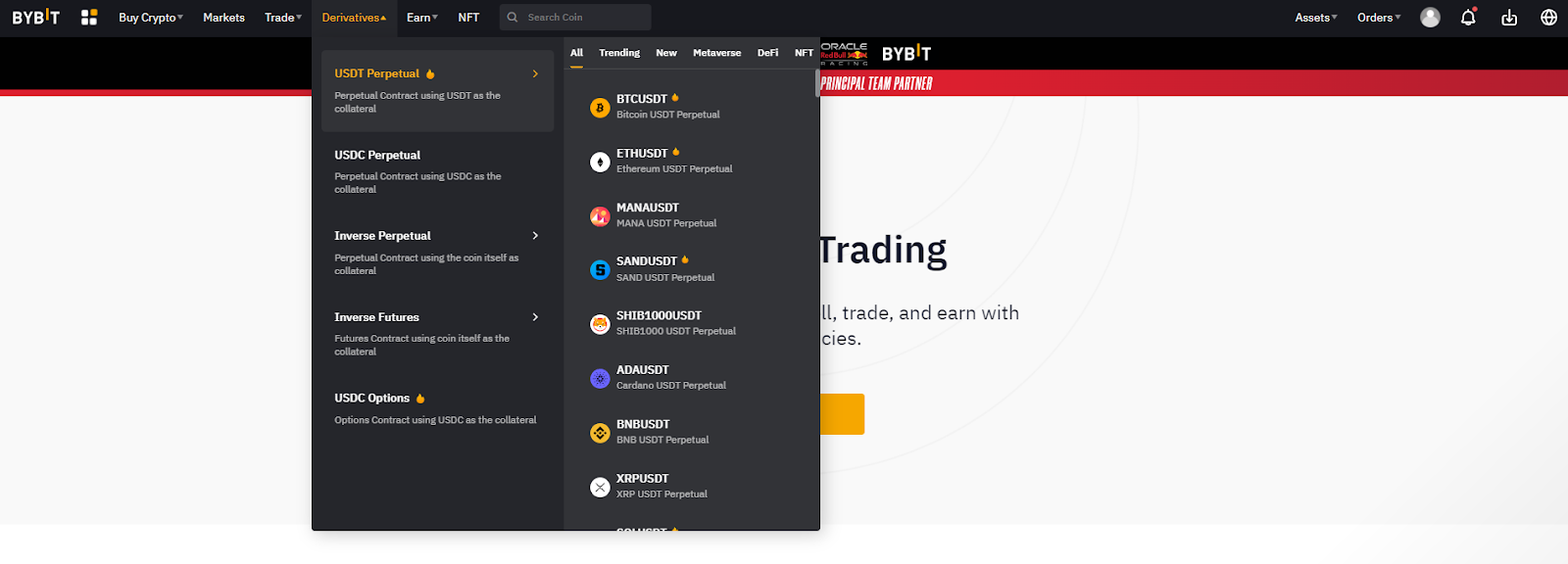

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, gather any additional information to help you feel confident about your investment decision. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which trading site is best for beginners?

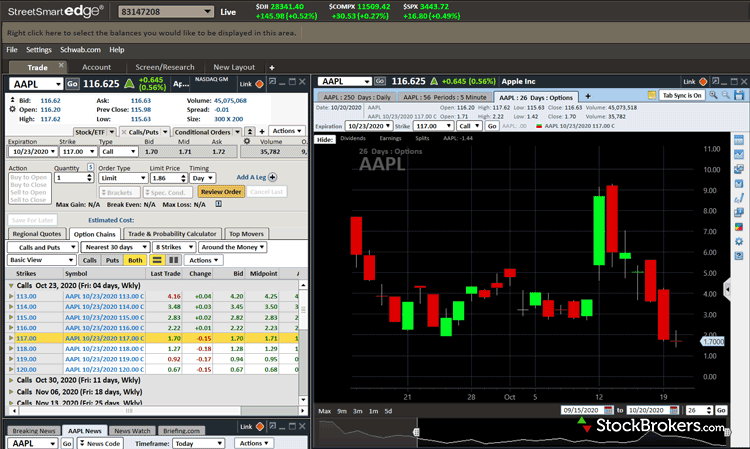

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

What is the best forex trading system or crypto trading system?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Online investments require security. Protecting your financial and personal information online is essential.

You must be mindful of who your investment platform or app is dealing with. Make sure you're working with a reputable company that has good customer reviews and ratings. Research the background of any companies or individuals you work with before transferring funds or providing any personal data.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Avoid phishing attacks by not clicking on links from unknown senders and never downloading attachments unless they are familiar to you. Also, ensure that you double-check the website's security certificate before you submit any personal information.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!