You need to be familiar with the companies you will be investing in if your goal is to invest in commodity penny stocks. Some of the risks involved include a high level of volatility, fraudulent activities, and a lack of financial disclosure. Some investors will still take on the risk.

A few penny stock have performed exceptionally well over the past 12 months. Harmony Gold Mining Co is one of them, and it specializes in gold. The company is headquartered in Canada and has properties in Chile, Argentina, and Brazil. The stock price hovers just above $5.

Talga, a pre-production firm with high-quality graphite projects located in northern Sweden, is another. It has permits underway to begin production in 2023. Although it is not a true play miner, the company does have a strong business model. The company may see significant upside as alternative energy demand increases. Additionally, the company is close to several lithium ion battery megafactories.

Denison Mines, an alternative energy company, has been one of the top performers. Although it was volatile in the past it has made solid gains.

A royalty company is a great way to diversify your portfolio. These companies specialize in acquiring interests in mining operations at different stages of the mining cycle. They usually pay higher dividends. These stocks are a great way to make money quickly without investing a lot. OTCBB (an online exchange for over-the–counter stocks) may have them.

Another great place to invest in penny stocks is the biotech industry. There may be breakthrough drugs being developed by companies. A variety of reliable screening services are available to help identify potential companies. The risks involved in investing in a new industry are high, but the rewards can be great.

Also, pump and dump stocks should be avoided. This scam involves paid marketers promoting stocks. They can promise you huge returns but you may be fooled if you don’t do your research.

For the most part, these penny stocks are speculative and have large fluctuations. Avoid penny stocks if you don't want to take on a large amount of risk. Rather, focus on a company where you have a solid understanding of the business. Also, don't trade in volume restrictions. In order to be ideal, only invest in penny stock in an OTC market.

Avoid penny stocks listed on Pink Sheets when you are looking for penny stocks. These companies are often manipulated. These companies are not always as transparent as the listed companies on the major exchanges.

Be aware that a newsletter editor may have endorsed a company. The newsletter might contain a disclaimer that indicates the editor has been paid to endorse the company. Don't believe any emails purporting to be from an official spokesperson of a company.

FAQ

Is Cryptocurrency a Good Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which is safer, cryptography or forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

What are the advantages and disadvantages of online investing?

Online investing has the main advantage of being convenient. You can access your investments online from any location with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, online investing does have its downsides. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. There might be restrictions or a minimum deposit required for certain investments.

Frequently Asked Fragen

What are the four types of investing?

Investing can help you grow your wealth and make money long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

How Can I Invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. You only need the right information and tools to get started.

The first thing to understand is that there are different ways of investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. Keep an eye on market developments and news to stay current with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which forex trading platform or crypto trading platform is the best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases it's crucial to do your research before making any investment. Diversification of assets and managing your risk will make trading easier.

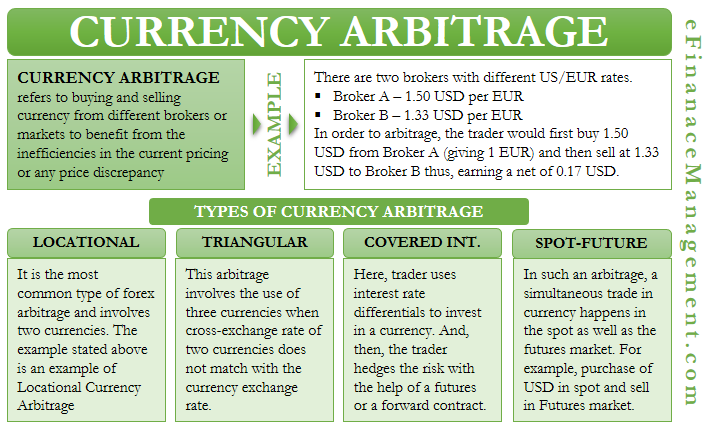

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. To help manage their investments, traders may use automated trading systems or bots. Before investing, it is important that you understand the risks as well as the rewards.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

When you invest online, it is crucial to do your homework. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Know the risks associated with your investment and the terms and conditions. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.