Commodities refer to commodities that are vital for daily life of both individuals and companies. The factors that influence commodities' price are supply and demand, exchange rates and inflation.

The best way to invest is to buy commodity ETFs. These ETFs can also be bought like stocks. They provide diversification and low expense ratios with no margin trades. They can also act as a hedge against inflation which makes them an excellent investment choice.

Choosing a good broker for commodities is important to success in the market. A broker that is reliable, efficient, and secure will help you trade in commodities. Additionally, you will find experienced and professional traders at the company who can answer any question you may have.

A commodities broker list can include brokers that specialize in a particular commodity or industry. Some of these brokers will also offer a wide range of other products such as Forex, cryptocurrencies, shares, and indices to meet the needs of all types of investors.

These commodity broker lists are easily accessible online. Using these lists can be a great way to find the best commodity broker for your personal circumstances.

Skilling is one of the most prominent commodity brokers on the Internet. CMC Markets (IG), Alpari, and IG are others. These brokers are well-known for their reliability, ease of use, as they can be used by both novice and experienced investors.

Excellent customer service and competitive fees are two of the hallmarks of top commodity brokers. These brokers offer both short-term trades and long-term options.

Investing with commodity stocks can be risky. It is best to do your research first before investing. If you are unsure about what type of investment is right for you, it would be best to consult an expert.

Agriculture Stocks

The best commodities stocks are those that are related to agriculture and agribusiness. These stocks offer high dividend payments and a strong track-record of increasing their payouts over time.

Archer-Daniels-Midland (NYSE:ADM) is an agribusiness that offers everything from animal nutrition to food processing and commodities trading. Its track record of reliability and resilience makes it one the best commodity stocks you can buy in 2023.

Nutrien, NYSE:NTR, is an international fertilizer/potash manufacturer that has seen some remarkable pricing and production results in recent years. The company enjoys exceptional profitability, cash flow margins and profits during this boom cycle.

BHP Group (NYSE NYSE :BHP), a mining- and resources company, specializes primarily on iron ore and copper. It is involved with several production and exploration projects across the globe. In the last few years, it has enjoyed steady profits.

Rio Tinto is an international multinational mineral company. It owns a quality portfolio of mines in Brazil, China and Australia.

FAQ

Which is harder, forex or crypto.

Both forex and crypto have their own levels of complexity and difficulty. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

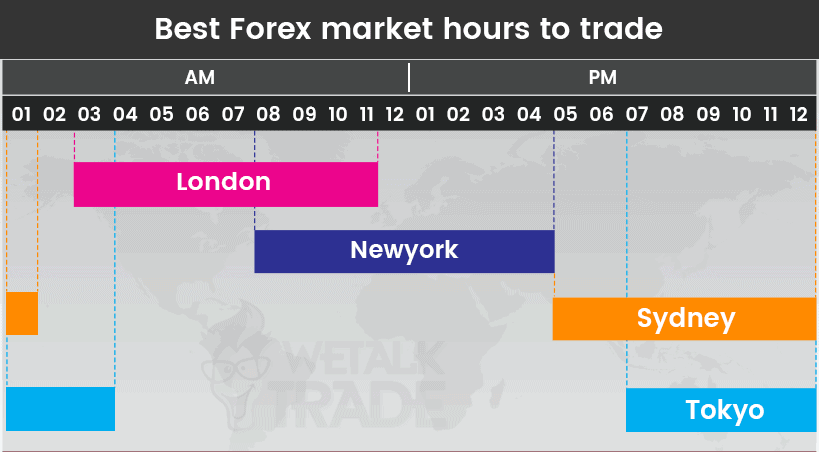

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Is Cryptocurrency Good for Investment?

It's complicated. It is complicated. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Where can I earn daily and invest my money?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

You can also invest in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

How can I invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need are the right tools and knowledge to get started.

First, you need to know that there are many ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, research any additional information you may need to feel confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. To stay on top of crypto trends, keep an eye out for market developments and news.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Frequently Asked questions

What are the four types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Which trading site is best for beginners?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What are the best options for storing my investment assets online?

The decision about where to store your money can be complicated. You have several options when it comes to protecting your valuable assets.

Online storage of investment assets is easy and convenient. You can access them easily from any device. There are some risks associated with using a digital option as electronic breaches could occur.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?