Commodities can be defined as commodities that are essential to daily life for individuals or companies. The factors that influence commodities' price are supply and demand, exchange rates and inflation.

The best way to invest in commodities is to purchase commodity ETFs. These ETFs can be purchased just like stocks, providing diversification, low expense ratios and no margin trades. They can also be used to protect against inflation making them an attractive investment option.

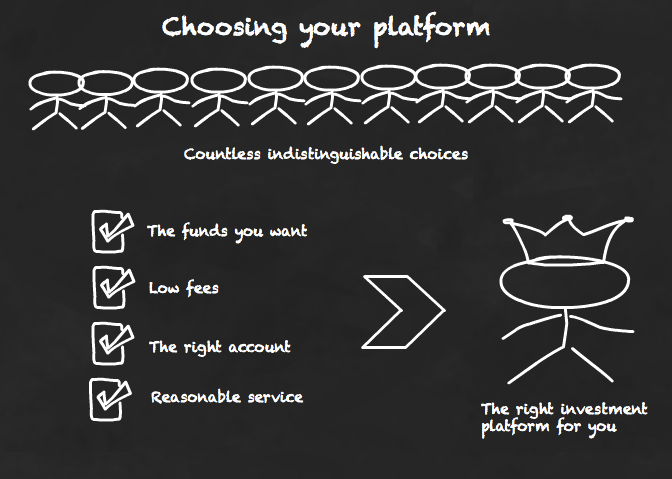

Choosing a good broker for commodities is important to success in the market. Trading with the right broker will guarantee that you have a safe, reliable, and efficient platform. A team of professional and experienced traders will be available to assist you with any queries you might have.

A commodities broker's list could include brokers who are experts in a particular industry or commodity. Many brokers also offer other products like Forex, cryptocurrencies or shares to suit the needs of all investors.

You can find many of these commodity broker lists online. These lists can be a good way to find the best broker for you.

Skilling and CMC Markets are just a few of the best commodity brokers you can find online. These brokers are known for their reliability and ease of use, and they can be used by both beginners and experienced investors alike.

A great reputation for excellent customer service, competitive fees, and high-quality brokers in commodity trading are some of the best. These brokers offer both short-term trades and long-term options.

Investing with commodity stocks can be risky. It is best to do your research first before investing. You should consult an expert if in doubt about which type of investment you should choose.

Agriculture Stocks

Agribusiness and agriculture are the best sectors for commodities stocks. These stocks have strong track records of increasing their dividends over the years and offer high dividend payouts.

Archer-Daniels-Midland (NYSE:ADM) is an agribusiness that offers everything from animal nutrition to food processing and commodities trading. Its resilience and dependable track record makes it one of the top commodity stocks to buy in 2023.

Nutrien (NYSE.NTR) is an internationally-recognized fertilizer and potash producer. It has enjoyed some of the most impressive pricing and production in recent years. This boom cycle has seen exceptional profitability and cash flows margins for the company.

BHP Group (NYSE :BHP) is a mining company that specializes primarily in copper, iron ore, and coal. It is involved with several production and exploration projects across the globe. Over the last few decades, its profits have been steady.

Rio Tinto (NYSE.RIO), is an international, diversified mineral corporation that operates several mines around the globe. It is home to a large portfolio of high-quality mines and projects throughout the United States, Canada, Australia, Brazil, China, Australia and Canada.

FAQ

Frequently Asked Fragen

What are the 4 types?

Investing can help you grow your wealth and make money long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be broken down into common stock or preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

How do I invest in Bitcoin

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. To get started, you only need to have the right knowledge and tools.

First, you need to know that there are many ways to invest. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, find any additional information that may be necessary to make confident investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Cryptocurrency: Is it a good investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

What are the disadvantages and advantages of online investing?

Online investing offers convenience as its main benefit. You can access your investments online from any location with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing comes with its own set of disadvantages. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There might be restrictions or a minimum deposit required for certain investments.

Can you make it big trading Forex or Cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. It is important to trade only with money you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

Money can be complex but so can the decisions about how to store it. You have many options for protecting your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

You make the final decision.